Past results do not guarantee future outcomes.

This boilerplate disclaimer is standard wording for almost any financial investment we might make. Still, it is frequently ignored when it comes to buying a home.

Homebuyers are often led to believe that because prices rose last year, they must rise again the following year.

The same is true for speculators, who believe that because house prices have been steadily rising, they will continue to grow in value

.Without knowing why prices rose the previous year, how can a buyer be confident that prices will continue to increase not only this year but also the following year?

Volatility and Predictability

The consensus in finance is that prices of assets, such as stocks or houses, shouldn’t be predictable. Because if people could foresee where prices would go, they could profit handsomely by making suitable market investments.

However, there is some validity to the predictability of house prices.

House prices, on the other hand, can be highly volatile.

We saw this during the 2007-2008 financial crisis, with the enormous boom and bust in US house prices.

Housing markets experience large cycles in which prices move faster than underlying indicators of how desirable it is to live in a specific area, such as rents or local incomes.

Understanding the forces responsible for these patterns in house prices necessitates considering how market participants form their beliefs about where prices will go in the future.

Price increases could be caused by one of two factors.

One possibility is that the fundamentals have improved.

These could include the desire to live in the area, the productivity of the industries, improved amenities, lower crime rates, and so on.

Price increases may be caused by the fact that these underlying elements have improved and made the area live desirably.

The other possibility is that people’s expectations of how much prices will rise have increased and that this shift has caused prices to rise.

Simply put, prices are increasing simply because more people are becoming more optimistic about prices.

The difficulty is that how a buyer should respond to recent price increases in a neighborhood dramatically depends on which of these two scenarios is true.

Suppose you believe that prices are rising because the region is becoming livable. In that case, you may think the area will continue improving.

Because you believe that the fundamental factors driving up prices will continue to improve, you want to keep driving up prices. You would like to buy today and pay a little more to do so.

A wise buyer will not want to drive up prices simply because others predicted it and paid more because the area hasn’t fundamentally improved.

How to Identify a Bubble

Bubbles form when the process of initial price increases gives people hope for future price increases, causing them to push up prices and becomes amplified.

Then, as they raise prices, other buyers become even more optimistic, which raises prices even more, and prices begin to grow exponentially.

When this takes hold, and market prices continue to rise, people begin to predict this will continue. Short-term buyers are drawn into the market, accelerating price inflation.

Suppose you are a long-term buyer who intends to reside in a home for many years. In that case, you won’t care as much about predicting the direction in which house prices will go. Because you will buy the home and keep it for a long time, you will have heavily discounted that future informing your initial plan of how much you want to pay for a home.

Whereas someone buying to sell in a year or two cares a lot about where prices are going.

A core tenet of the “fix-and-flipper” business model, which caters to short-term buyers, is that since prices increased last year, they will likely increase again this year.

As prices rise and there are both long-term and short-term buyers in the market, the short-term buyers will outnumber the long-term buyers and take control of the market.

Therefore, evaluating a local market and comprehending what is causing price increases presents a challenge for any buyer.

A wise buyer must determine whether rising home prices are due to local speculative activity, fundamental advancements, and increased demand from residents who are similar to themselves.

One useful metric is to compare how many current buyers sell after a short period versus how many recent buyers are in it for the long haul.

Indicator of Sales Volume

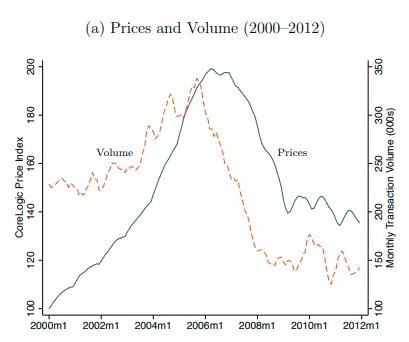

The truly remarkable fact is that transaction volume often declines noticeably before prices and thus serves as an excellent indicator that a bubble has burst.

Although volume and price increase together, transaction volume—the total number of units sold—begins to decline much earlier than prices.

As previously stated, many short-term buyers are drawn into the market

when prices rise.

They will sell much faster than the average buyer. It boosts transaction volume, resulting in many sales where volume and prices rise simultaneously.

However, price growth eventually begins to slow.

Prices continue to rise, but they are approaching their peak.

People become less optimistic as price growth slows, and they expect less price growth in the future.

Fewer short-term buyers are as enthusiastic about buying and flipping houses as they once were because they no longer expect prices to rise as quickly as they did.

When this occurs, numerous short-term buyers attempt to sell the homes they purchased perhaps a year or two prior. Still, they cannot find any buyers due to the market’s slowing price growth and the consequent decrease in the number of prospective new short-term buyers.

Prices continue to rise, but the number of transactions on the market is decreasing.

It’s known as “The Quiet” when prices are rising but beginning to level off, and transaction volume is declining because it seems like the market is a little less giddy than usual.

Since the previous short-term buyers cannot sell, much-unsold inventory is starting to build up on the market, and people expect less price growth. Transactions are also declining.

The bubble then bursts, prices fall, and the market enters a recessionary period.

The chart below shows how this works:

The graph demonstrates that ‘Wile E. The ‘Coyote’ moment occurs when prices continue to rise even after the market’s bottom has been reached. Sales volume falls precipitously, but buyers continue to pay, unaware there is nothing left to support pricing.

The Conclusion

To understand what is causing recent house price increases, we must first understand what prior buyers believed when they purchased their homes.

They might have made an irrational decision if they bought with the expectation that prices would rise, which could have caused costs to multiply than the market’s underlying trends.

One way to assess this is to determine how much of the increase was driven by speculators.

If such activity is abundant, it could indicate that you are nearing the end of a cycle.

Pricing can be predicted based solely on transaction volume.

If volume begins to decline, it may be the first sign that prices are about to stop rising and begin to fall.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.