Finding the ideal balance of risk and return is necessary for maintaining an investing portfolio. Higher returns may be found in private equity real estate and public real estate investment trusts (REITs), which may also decrease the total volatility of a portfolio. Both will improve a standard stock and bond portfolio. So, which is the better investment option: public REITs or private real estate? In an investing portfolio, a new study demonstrates that they work best when combined.

There are many similarities between private real estate and REITs as indirect forms of property ownership. Both can provide investors a cushion against the highs and lows of other stocks while also generating passive income. In a recent analysis of the revenue and diversification potential of real estate, Nuveen discovered that since 2013, real estate yields in the US have surpassed inflation and have subsequently gotten considerably farther ahead. Private real estate has generated lower absolute returns over the past twenty years (9.2% vs. 9.6% for public REITs), but both assets’ values have tracked the general real estate market.

But compared to direct investments or private real estate funds, public REITs are a better leading indicator of the larger real estate market. Public REIT asset prices will be the first to reflect current market circumstances when they occur, such as when increased competition makes it more difficult to raise rents. A broader range of price fluctuations might result from the ease with which shares can be purchased and sold, frequently based only on investor opinion. In other words, a REIT’s stock price may be significantly higher or lower than the value of the underlying real estate depending on market conditions, even while the dividends it delivers to investors as passive income are constant.

A change in capitalization rates, on the other hand, will not be instantly represented in property valuations since structures must first be promoted, evaluated, underwritten, and sold before market circumstances are reflected in the price. Due to the lag with which net asset values are frequently and sporadically priced to current market circumstances, private real estate returns exhibit this tempering impact.

Spread Your Portfolios Among Both for Safety in Numbers

A portfolio of stocks and bonds may perform better if either type of real estate is included. Using a ratio of 55% equities, 35% bonds, and 10% real estate, the Nuveen research computed 20-year returns. In comparison to a 60% stock, and 40% bond split, greater returns were obtained by 10% public REITs or 10% private real estate.

Notably, the valuations of both public REITs and private real estate have little connection with stock and bond prices when the real estate has contractual lease income and the opportunity to raise rents over time. In reality, Nuveen discovered that bonds and private real estate values had a negative connection, which meant that their pricing tend to move oppositely.

Public REITs often generate better overall returns than direct real estate investments, but with greater market volatility—a wider range between good and poor outcomes, and consequently a larger potential loss. Private real estate generates greater risk-adjusted returns due to its reduced volatility.

However, there is a happy middle. Nuveen tracked a third portfolio of the same real estate allocations, but with 80% allocated to private real estate and 20% dedicated to public REITs, or 8% and 2% of the overall portfolio, respectively. The risk-adjusted returns were higher with this distribution than with the all-REIT or all-private choices.

Is this a good combination of assets?

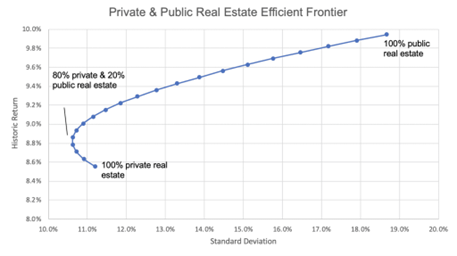

We used the same process to sketch the whole range of risk vs. reward allocations, from 100 percent listed REITs to 100 percent private real estate funds, and estimated the Sharpe ratio (which gauges the profitability of an asset as opposed to a risk-free asset like a Treasury bond or equivalent low-risk choice) for each. 21% public REITs and 79% private real estate made up the combination with the highest Sharpe Ratio. Because of this, 80/20 was not the optimum allocation; rather, it delivered a great risk-adjusted return.

Individualize Your Real Estate Portfolio Using REITs

The line on this graph might move in either direction depending on future returns, but the historical averages somewhere along the “efficient frontier” point to the stabilizing effect that both public and private real estate can have on a portfolio. Potentially equal profits to those of private real estate alone, but with reduced risk, might be obtained through a mix of public and private real estate. But increasing the proportion of REITs might increase predicted returns, although at the cost of more market volatility. The decision is influenced by the investor’s desired return rate and risk tolerance.

However, there are additional benefits to holding public REITs alongside private real estate funds.

Liquidity is a key advantage of buying REITs because they are publicly traded. They can be kept for short or extended periods and often offer dividend returns that are greater than those of money market rates. Selling shares will make money instantly accessible for any anticipated expenditures, such as future capital demands for private equity commitments, home purchases, college tuition, and other such things. Public real estate investment trusts (REITs) can also be utilized to improve industry distributions within a larger real estate portfolio. A real estate investor with significant exposure to multifamily in a private real estate fund can consider REITs that control several kinds of properties. And to achieve a specific asset mix, it could be necessary to combine REITs.

Public REITs move more like daily up-and-down stock market shares than private real estate values in the near term, which are slow-moving and stubborn. But there’s no reason to pick between the two. Like peanut butter and chocolate, privacy and public are best when they coexist. Both are excellent individually, but together they make a whole that is superior to the sum of its parts.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.