The amount of money you keep after charges and taxes are deducted is the only factor that matters when assessing an investment. A common misconception among investors is that only when investing non-taxable funds does it make sense to compare investments on a pre-tax basis. Considering a hedge fund that seeks 20% returns may seem quite alluring, so when the government takes 37% of your earnings, such rewards don’t seem nearly as enticing. Additionally, once taxes are paid, a solid debt investment with an 8% return performs comparably to a municipal bond. When assessing different investment options, individual investors must take taxes into account. They should also search for cost-effective assets.

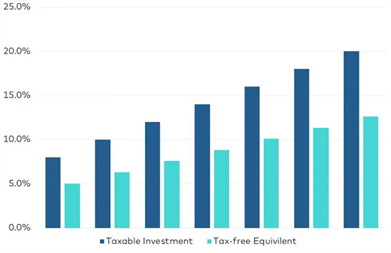

It’s fantastic to have an investment that yields 8% in cash, but on an after-tax basis, a more effective investment with a 6% yield could be preferable. The graph below depicts the after-tax return on investments with a 37% tax rate. Only roughly 5% after taxes result from an 8% pre-tax return.

With the opportunity to return money tax-free via refinancing, delay investment returns forever through 1031 exchange sales, and hide profits by depreciation, private real estate has long been acknowledged among the most tax-efficient assets. Due to their acquire, fix, and then sell business model, most private equity real estate companies, do not benefit from these tax advantages. Each sale results in a taxable event, and the short asset holding periods prevent businesses from utilizing depreciation and refinancing.

The “buy, fix, and keep” approach enables investors to make the most of the advantages of long-term real estate ownership, including tax shelters, tax-free refinancing, and continuously postponing gains. We may incur less risk and build greater wealth over time by investing in this way.

The truth is that a venture that is tax-efficient and yields 10% yearly will lead you to the same location as an investment that is unproductive and yields 14% annually. This is seen in the graph below.

A $1 million investment that generated a 14% annualized return over three years is represented by the light blue line. As you search for another chance to redeploy the capital, the fund isn’t generating anything, thus the decrease on the light blue line reflects the conservative effect of taxes and 6 months of cash drag. An investment dividend that goes into one’s bank account frequently never makes it to another. The same $1 million is represented by the dark blue line, which shows it invested tax effectively and generated 10% yearly. Regardless of whether the time frame is five, ten, or fifty years, the outcome is essentially the same in both scenarios. The risk associated with an investment that yields a 10% yield should be significantly lower than the risk associated with an investment that yields a 14% return, provided you believe in the efficacy of the market.

The example above utilizes a 30% tax rate, but the difference starts to increase when considering assets like debt and hedge funds, which are taxed at about 37%, as the case below demonstrates.

There are tax-efficient and tax-inefficient ventures, but none produce an annual return of 10% or more tax-free. Your whole investing plan must take the friction of transferring money into and out of assets into account. We aim to offer the same amount of value as our prior funds, but with reduced risk, through our tax-efficient Fund, which was created to eliminate the friction of distributions and capital calls. The renowned investor Warren Buffett maintains assets indefinitely for a reason. He wants to save money on taxes.Until you sell an item or stock, there is no tax liability on it.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.