Buying a home is a big undertaking, as anyone who has done it knows: searching for properties, figuring out your spending limit and financing options, going on countless house tours to determine which ones meet your criteria, securing an inspection from a third party, figuring out utility costs, looking over the land survey, and the like. As difficult as it is, the procedure becomes even more difficult when it involves a large-scale commercial real estate project with a massive financial stake. Even if you’re a seasoned real estate investor, it is paramount to treat this process seriously to avoid buying a “lemon.”

“Lemons,” as economist George Akerlof coined the phrase, are terrible investments that look plausible due to asymmetry in the way that information is available to investors. Private real estate markets are full of lemons for that reason, the party with the best and most complete knowledge of the real estate asset and the local market usually wins. Consequently, a thorough and strict underwriting procedure is a major aspect of de-risk a purchase, uncovering trigger points in good value-add chances, and minimizing the possibilities of asset underperforming expectations.

About Real Estate Underwriting

An investment’s potential and viability are determined through an underwriting procedure. It is the simplest definition. For investors, poor underwriting can result in significant losses. As a result, unlike many of our competitors, we have adopted a proactive, holistic approach that takes into account a wide range of quantitative and qualitative data sources, including market sentiment and technical expertise, when assessing each potential investment.

Deals in the Making and Preliminary Verification

We do not take a one-size-fits-all strategy when reviewing potential acquisitions. Investing in a wide range of real estate asset classes and throughout the capital stack gives us the freedom to select the investments that we feel will provide the best risk-adjusted returns.

As a result, our due diligence procedure must be highly customized and tailored to the specifics of each investment opportunity that we are considering. On the other hand, while looking to acquire senior debt in ground-up development, we may give more weight to an equity investment’s history of vacant units, while focusing on the creditworthiness of the sponsor’s development and construction experience.

The “jockey” and the “horse” are equally vital to us, no matter how senior we are, what stage of development we are in, or what kind of asset we’re managing. Consequently, each investment deal undergoes a thorough vetting and underwriting procedure that examines both property that is being purchased and the company that owns it.

As a rule, we start by checking out the qualifications of the sponsor. As part of our due diligence, we examine their credit history, as well as their overall financial situation. We may not accept a sponsor with less than $100 million in multifamily property development experience. This includes principals who have not recently completed more than five projects of the same type and value structure. We only engage with sponsors who show a secure financial foundation and a track record of success in competitive U.S. marketplaces.

Before final approval, the sponsor’s project undergoes a preliminary evaluation to ensure that it adheres to our policies. It’s not uncommon for project sponsors to be overly confident in the feasibility of their endeavor. As a result, our examination of their suggestions is very cautious. In many cases, their worst-case scenarios serve as our benchmarks. We discount and stress test our pro forma predictions, for example, even though a sponsor may present enticing projections for a prospective investment.

Underwriting Extensive Analysis

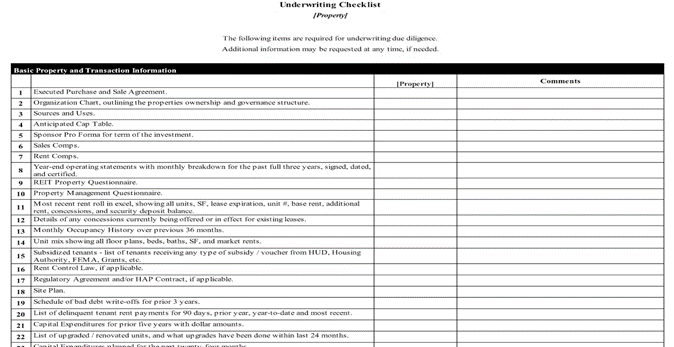

Once a project’s sponsor and early facts have been thoroughly vetted, a lead underwriter is selected. At this point, the underwriter conducts a thorough risk-return analysis to ensure that a project is a serious investment. Additionally, this stage includes site inspection, a comparison of the property’s value to other comparable properties, an extensive budget analysis, and the creation of an organizational structure, along with other things. The underwriter conducts this examination to ensure that the proposed project satisfies our exhaustive underwriting checklist, which includes more than 350 contrasting data points.

Furthermore, the project is presented to our Investment Committee by the head underwriter, who has a combined transactional experience of over $10 billion and 100 years. As part of our Transaction Committee’s due diligence, we stress testing any potential unfavorable effects of the investment. As the “devil’s advocate” stage of the process, we aim to account for the project’s hazards, determine if these risks are worth taking, and devise ways to mitigate or eliminate them whenever necessary.

At the end of this rigorous procedure, the investment is determined to be suitable for us, afterwards, the project receives approval from our Investment Committee. The following steps include conducting final negotiations and concluding the deal.

To safeguard our investment, we may try to negotiate additional crucial legal rights at this time. Ultimately, we want to guarantee that our downside risk is maintained to a minimum. You may be able to force the transfer of ownership or take possession of the building by evicting the manager if you have specific rights. Like the capacity to foreclose, personal guarantees, and springing guarantees (effective upon specified conditions, such as the sponsor’s bankruptcy filing or fraud).

Even though we’ve put in a lot of time and effort, we are not scared to pull the plug on a potential investment. Especially if there is a change in the fundamentals or if we obtain new facts that contradict our initial findings.

Key Point

Even in a market world filled with lemons, only those willing to go the extra mile to gather and objectively assess information can expect higher returns on their investments, even when risk is taken into account. Since being founded, we remain focused on locating high-quality investments in key cities around the U.S. and making it easy for everybody to invest at a low price. Investment on our platform is backed by an experienced team of industry experts that have properly evaluated every transaction. We believe in a proactive, holistic, and objective method to deal with sourcing and underwriting.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.