However, value-added and opportunistic juicing increases risk. Therefore, allocation at the optimal moment is essential.

In Part 1, we discussed the core and core+ strategies that serve as the foundation of a diversified real estate portfolio.

In the second part, we will examine value-added and opportunistic tactics that boost returns. Finally, we will cover the percentage of your portfolio that should be allocated to each of the four strategies and when this allocation should occur.

Valuation

- The historical rate of return: 10 to 15%

- Leverage: 40-70 percent

- Moderate to great danger

Added-value strategies include:

- Buying property at a discount is significantly distressed in some aspects (rundown, poor management, etc.)

- Obtaining a loan to enhance it.

- Selling it for a price that (ideally) exceeds the cost and generates a profit.

For instance, you may invest in and refurbish a rundown strip mall with few tenants. Once it has many renters, you may sell the property for a substantial profit. Or you might acquire a dilapidated house. After repairing it, it might be “flipped” for a profit.

In addition to investing in the investment’s stock, you may also participate in its debt (finance the loan). (See “what is the difference between debt and equity?”)

Much of the risk associated with value-added solutions stems from their execution requiring moderate to high leverage (40 to 70 percent). Power enhances the profit and the risk and the investment’s susceptibility to loss during a downturn in the real estate cycle.

Before investing, it is essential to understand the real estate cycle and timeliness.

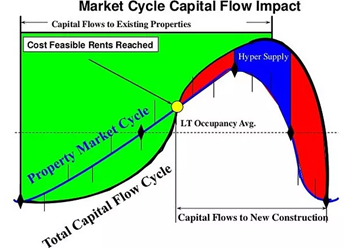

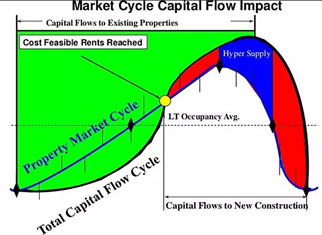

The green region denotes the cycle phases during which value-added methods are frequently used. The sooner an investment is made, the bigger the number of favorable possibilities and the smaller the risk. As the cycle advances, there are fewer and fewer chances that are advantageous. After the green section, it is a terrible moment to invest. And in areas of the revolution where there is no green, investing conditions are so poor that there are often no investments available.

Numerous academic studies have indicated that most of the return from effective value-added (and opportunistic) tactics was attributable to timing rather than operator competence (assuming they are at least competent). If properties are not sufficiently distressed and/or debt is not inexpensive enough, it is doubtful that the investment would be successful (see Depaul University study).

Also, the approach must be implemented as intended. If it is more complex or costly, you may not get the anticipated return or incur a loss.

Primary sites for value-added strategy assets are safer than secondary locations, which are riskier.

Residential Versus Commercial Value-Added

The asset type for commercial investments might be any of the “Big Four” or a specialty asset (self-storage, entertainment, medical offices, student housing). The profit is derived from income (40 to 70%) and price appreciation (30 to 60 percent). Since the approach might take years to implement, some investors only buy when prices fall (when assets are significantly distressed, allowing for selling in the next up cycle). Others use it later in the process, which may also be effective but is riskier.

Typically, residential real estate investment properties cannot be leased during renovations. Therefore, the real reward must come from price appreciation, making it riskier than commercial.

The fact that the approach may be deployed in as little as a few months mitigates this drawback. Consequently, home investments may be launched and renewed several times during the upcycle.

Unscrupulous

- Historically, returns have exceeded 12 percent.

- Leverage: 50-80 percent

- Risk: high

Opportunity-based tactics target distressed homes requiring extensive improvements. Also included is the transformation of undeveloped land into residential or commercial buildings.

This technique entails using high leverage (50 to 80 percent), and the improvement plan is far more complex and subject to unforeseen events than “value-added.” In addition, there are often lengthy periods during construction when no revenue may be earned. Often, it is only possible to gradually increase income after the term expires, and it may never be possible to do so.

As a result, the property appreciation rather than the income generates 70-100 percent of the return on an opportunistic strategy.

As described in the section entitled “added value,” research has shown that the timing of an opportunistic investment is critical for avoiding losses.

In the red and blue domains of the graph below, opportunities for opportunistic investing exist. Initially, they are safer and less risky, but they become progressively hazardous as they advance. In parts of the cycle that are neither red nor blue, it is not cost-effective to construct an opportunistic approach, and investments in these sectors should be avoided entirely.

Opportunities may be exploited in primary, secondary, and tertiary markets. It may include the conservative “Big Four” asset classes and the riskier specialist asset types.

You may invest in either debt or opportunistic equity options.

Debt may be either senior or mezzanine.

The interest on senior debt is generally paid first, making it more secure, and has moderate interest rates. However, when the asset is sufficiently distressed, the interest rate increases to a level that the method may use.

Interest on mezzanine debt is paid after interest on senior debt and has longer maturity durations of 5 to 10 years. (It also has a greater probability of principle loss since it lacks the physical property as security and instead has the opportunity to convert to stock in the parent firm.) Therefore, it pays a greater interest rate but is also riskier.

What Allocation Should I Make for Each Strategy?

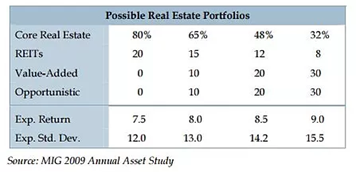

Meketa Group examined the returns of various allocation strategies and how to design the most effective and secure portfolio.

They observed:

- The most secure portfolios had eighty percent core assets (core and core+).

- It is feasible to get up to 1.5 percentage points more by boosting value-added and opportunistic to 60 percent. However, doing so also increases the danger.

However, these findings may be somewhat deceptive and not as beneficial as they first seem.

Maketa analyzed the risk associated with a “dumb portfolio” that invested evenly over the whole real estate cycle.

However, a wise investor may not invest in this manner. Intelligent investors (ideally) invest exclusively in value-added and opportunistic properties at the optimal time in the real estate cycle. Furthermore, they avoid them at inappropriate times. This might significantly lower the danger below what was mentioned before.

Allocation Based on Risk Aversion

Numerous real estate investing gurus take an entirely different approach. Instead, they advise you to evaluate your risk tolerance.

You should devote more to conservative strategies if your risk tolerances conservative or you are income focused. And you dedicate more resources to aggressive methods if the contrary is true. Here is a very common recommendation:

- Conservative/return-oriented investor:

- Core: 80% (+/- 20%)

- Value-added: 15 percent (+/- 10 percent)

- Opportunistic: 5 percent (+/- 5 percent)

- Moderate/balanced investor focus:

- Core: 50 percent (+/- 20 percent)

- Value-added: 30 percent (+/- 10 percent)

- Opportunistic: 20 percent (+/- 10 percent)

- Active/appreciation-oriented investor:

- Core: 10 percent (+/-10 percent)

- Value-added: 50 percent (+/- 10 percent)

- Opportunistic: 40 percent (+/- 10 percent)

Follow the Flow

It might be challenging to get a precise number depending on where you are in the cycle. For instance, during the recovery phase of the real estate cycle, new development is not economically viable. Regardless of how much you would want to commit to opportunistic investments, you will be unable to do so (not good ones, anyway).

If you are in the last stages of the hyper-supply phase of the cycle, there are no longer any viable prospects for value-added investments. Again, you are unlikely to locate any, and if you do, you should likely avoid them.

Therefore, the astute investor is less concerned with the ratio and more with using the appropriate strategy type at the right moment.

In addition, Meketa Group suggests diversification by strategy, geographic region, property type, employment base, management, vehicle, individual investment, and vintage year. Therefore, investing over numerous years may not be such a terrible idea.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.