The Internal Rate of Return (IRR) is the average yearly return on investment throughout its lifespan. The calculation of IRR might seem complicated and scary to the typical investor.

Modern tools and software make the procedure straightforward if you know how to utilize them. However, it is essential to comprehend the formula’s underlying components since even little modifications in assumptions may significantly affect the outcomes.

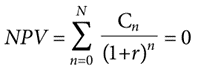

Here’s How to Calculate the Internal Rate of Return:

The formula may seem complicated, but its components are rather essential.

- NPV: NPV (Present Net Value) is the sum of the present values of future cash inflows and outflows.

- N is the total number of intervals within the time range being examined. This is usually the total number of years.

- Cn: Cash flow for the current period at this algorithm phase.

- r: Represents IRR. This is the value for which you are solving.

- n: The current period at that formula step.

A Real-World Illustration of IRR

In a situation in which an investment consists of a single outgoing cash flow event (such as the purchase of an apartment building) followed by several incoming cash flow events (such as monthly rent payments), the extended formula might look like this:

Solving the equation manually takes trial and error, inputting multiple values for r until a weight is found that makes the equation equal to zero. Fortunately, Excel and Google Sheets provide a straightforward tool for computing the equation, providing you have the other required inputs – cash flow into and out of the investment – to complete the solution.

To solve for IRR, insert the series of cash flow events into successive cells (e.g., A1, A2, A3,…) and then enter =IRR(A1:A3) in the next available cell, where the range inside the parenthesis encompasses the whole series of cells representing cash flow events.

Conclusion

Although the calculation may first sound difficult, contemporary software makes computing IRR simple and rapid. The problem is identifying all the integers needed to complete the equation. Cash flow forecasting necessitates several assumptions about future events about investment and the surrounding market. The resultant IRR computation is only as accurate as the underlying assumptions. Therefore, investors need to comprehend the basics of the IRR formula and the significance of establishing reasonable assumptions.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.