Volatility, lack of diversification protection, and the “liquidity premium” make publicly listed REITs difficult for investors to recommend as a core holding.

As we tackled in Part 1 of this post (“Why Not a REIT?”), Institutional Private REITs and traditional non-listed REITs have significant drawbacks that make them inaccessible or inappropriate for most investors.

A publicly traded REIT is a different form of REIT. In contrast to the other types, a publicly-traded REIT may play a part in your real estate portfolio. However, it is critical to understand the shortcomings and why it may not be a primary function.

Public traded REITs are listed in the U.S. Securities, Exchange Commission, and National Stock Exchange. Shares can be purchased using a standard brokerage account (such as SoFi Invest) or through tax-sheltered accounts such as an IRA.

As a result, they are exceedingly simple and transparent to acquire and trade. Limit and stop-loss orders can be placed while trading REIT shares, much like stocks. It also means immediate liquidity, as you can buy and sell shares anytime.

However, this liquidity is not free. Volatility, loss of diversification protection, and the liquidity premium are all present.

Volatility – Knowing “Mr. Market”

For many people, real estate is the ultimate investment. It has a long track record of producing both passive income and capital appreciation.

One joint study by the German central bank and several U.S. institutions compared real estate returns with asset classes like equities and bonds over 150 years. They found real estate had the highest returns with minimal fluctuation.

However, there are various disadvantages to direct real estate investment, including large down payments, financing issues, the necessary cash reserves for upkeep and repairs, and the need for extensive expertise, among others.

Unfortunately, Public REITs have more tough years than private direct real estate. Can you believe that?

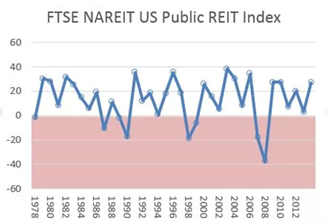

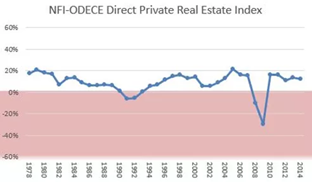

From 1978 to 2014, publicly-traded REITs lost twice as much money as direct real estate. The up-and-down gyrations are also more heartbreaking.

So, why are public REITs so much riskier?

The reason is that public REITs are traded on a public stock exchange, and everything that is sold on the market is pulled into periods of overvaluation and undervaluation.

The graph above shows that public REITs also fall when the stock market falls (every five years or so). With that, direct real estate is far more stable, only going negative during financial crises.

Benjamin Graham is known as the “Father of Value Investing” and was the mentor of the world’s most significant investor Warren Buffett. Graham used a metaphor to explain the stock market’s behavior, which he dubbed “Mr. Market.”

Many people assume that the stock market always represents the ideal price for a stock, but it’s not. Mr. Market is frequently carried up in irrational exuberance ( refers to investor excitement that pulls asset prices higher than assets warrant) and extreme pessimism. Because of this up-and-down nature, anything traded on the public stock market is more unstable than ever.

In reality, stability plays a significant part in determining whether an investment is a solid choice or entails much too much risk to be effective. A high-risk investment has a lesser level of stability, but it also has the potential for more considerable earnings.

Loss of diversification protection

One of the primary benefits of real estate investing is that it is unrelated to the stock market, which secures your portfolio from setbacks and enhances your overall profits. However, public REITs fluctuate in tandem with the stock market. Public REITs do not diversify or ensure your portfolio in the same way that direct real estate does.

The liquidity of public REITs is their most significant advantage because you can enter and exit whenever you choose. However, nothing is entirely free, and this flexibility is a double-edged sword that will lead to a “liquidity premium.”

A liquidity premium is an additional compensation needed to promote investment in assets that cannot be rapidly and effectively converted to cash at fair market value. Pro-tip you should consider: don’t put your emergency funds at risk. Divide your emergency funds into portions and use them when it’s necessary.

Do you know what I would do to deal with the liquidity premium?

Everyone believes that real estate is not a good investment in the short run. It would be best if you only funded it with long-term funds you don’t need immediately.

If my real estate money is long-term, it seems silly to pay a liquidity premium of up to 20% only to know that I “could” take it whenever. It is far preferable to put money aside for emergency savings rather than investing it in real estate.

Advanced investors: public REIT diversification

Despite the disadvantages described above, you should consider public REITs for their two advantages.

For starters, they tend to do better than direct real estate over time. Second, they do not exactly connect with the stock market (they are close, but not exact) or with direct real estate.

In my opinion, a seasoned investor may choose to add public REITs to their entire real estate portfolio to reduce correlation and danger. If that is the case, the diversification effect may outweigh the drawbacks of public REITs, as depicted in BNY Mellon’s study.

Although the study does not provide specifics, I can picture an advanced investor investing up to 10-20% of their real estate portfolio in public REITs and the rest in direct real estate. However, I would not do this with a shorter hold term due to public REIT volatility.

Overall, I believe that the benefits of diversification exceed the severe drawbacks.

Direct real estate investing may be a superior option if you desire cash flow, tax incentives to offset that income, and a high potential for gain. It’s also an excellent option if you want more control over your money and prefers a hands-on approach.

REITs are suited for investors who do not wish to operate and manage real estate and those who do not have the funds or cannot obtain financing to purchase real estate.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.