Rising interest rates: The Federal Reserve has the awkward position of having to play catch-up and try to contain the inflation genie by rising rates quickly enough to stop it while avoiding a recession. Meanwhile, decades of ultralow interest rates have encouraged some corporations

Introduction:

One investor’s portfolio strategy, allocations, deal-by-deal performance, tax concerns, and long-term plan. Read to discover some insights.

My defensive portfolio had a fantastic year (returning 41.32 percent, including 7.37 percent in income). In contrast, the stock market’s value fell by 3.35 percent, that of bonds by 10 percent, and that of bitcoin by 33.87 percent. The following provides a detailed analysis of my portfolio strategy, allocations, deal-by-deal performance, tax concerns, and long-term plan.

(As is customary, I’m an investor wanting to express my personal opinion and am not an attorney, accountant, or financial advisor. Seek advice from your financial professionals before making any financial decisions.)

So here’s the most recent update. This article discusses:

1) Personal information (so you can put my portfolio choices into perspective)

2) Overview of the current portfolio and approach (and changes from last time)

3) Benchmarking against other alternatives (stocks, bonds, real estate indices, as well as the performance of my last update)

4) Portfolio management

5) Investment-by-investment analysis

6) My long-term strategy

Additional features include:

7) How I Handle Money

8) Investment through investment tax breaks

So, to explain my portfolio decisions, let me tell you a little about myself and my position.

My background

I’m a former serial entrepreneur who relies on my investments to support my family and myself. As a result, my risk tolerance for loss is limited (particularly when compared to someone who works and does not rely on their investments to survive). And I’m much more concerned with conserving my cash (rather than losing money) and am generally uninterested in pursuing the best-expected returns. As a result, I am a cautious investor.

Alternatively, someone with a different financial status, other financial objectives, and additional risk tolerance may most likely disagree with some or all of my decisions. That’s okay because (in my opinion) everyone is unique, and there is no such thing as a single sponsor or investment that is beneficial to everyone.

My wife and I jointly make financial decisions and have diverse portfolios. This approach includes $7 million in “alternative investments,” products beyond the standard box (of public shares, bonds, and cash investments) that most investors are familiar with and typically obtain through a retail broker. Many solutions are only available to wealthy individuals and institutions. And they’re usually only discovered by word of mouth, crowdfunding, or an investment club.

To mitigate risks, my alternative investment portfolio employs the core-satellite method of portfolio design. This strategy means that the bulk of it is concentrated in a massive, conservative core. And this allows me to be more daring with smaller satellite pieces.

The portfolio is mainly comprised of real estate, with additional investments in various difficult-to-find asset classes that are not immediately related to the business cycle (like G.P. stakes, litigation finance, music royalties, and life settlements). More information is provided in the following section.

As of May, the portfolio had returned around 41.32 percent (for the trailing 12 months). The income component was 7.37 percent.

So this was a fantastic year that well exceeded my expectations. And I don’t expect to perform this well every time.

This year, it outperformed most other benchmarks (stock, bonds, cyber currency, commercial real estate, and core real estate). I also do not anticipate this happening every year. That is why I maintain a diverse portfolio first (and alternatives are just one part of it).

Here’s how those other investments fared in the previous year.

For the previous 12 months, these were the total returns (including dividends/income and price appreciation) for the following benchmarks:

Stock market: -3.35 percent for the Standard & Poor’s 500 indexes of significant firms (S&P 500). (with a lot of volatility)

Bond market: -10% drop in the S& P 500 bond index for large corporate grade bonds.

Cryptocurrencies: Bitcoin fell -33.87 percent.

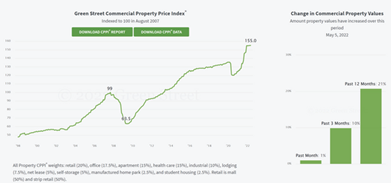

Commercial property: the Greenstreet Real Estate “All Sector” CPPI index increased by 21%.

This index is made up of a variety of sectors, including the following:

- Rretail (20%)

- Office (17.5%)

- Apartment (15%),

- Health care (15%)

- Industrial (10%)

- Lodging (7.5%)

- Self-storage (5%)

- Net lease (5%)

- Manufactured home park (2.5%)

- Student housing (2.5 percent )

The NCREIF ODCE core real-estate index increased 28.47 percent (the highest in history).

So this year was fantastic for my alternatives. I don’t expect them to break so many records every year (which is why I have a diversified portfolio). But if that does happen, I’m not going to complain. As well as a comparison to my previous update.

How did my portfolio fare since my last update in the second quarter? The overall return was 11.58 percent at the time (including a decent 6.77 percent in income)

This year was great; I don’t anticipate blowing it out of the water yearly.

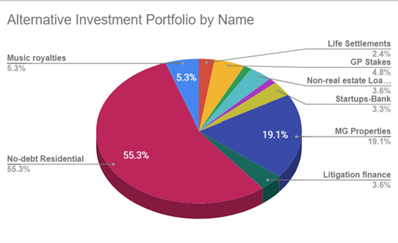

Here’s a high-level overview of my portfolio allocation.

As previously stated, I use the core-satellite method to risk management. As a result, the conservative core consists of basic no-debt residential properties, which account for 55.3 percent of the portfolio (versus 49 percent last time). (More on this below).

The remainder is the satellite section. I put money aside for the following investments. (Note: additional cash isn’t always simple to discern from raw numbers because more money is also being put into other areas, which can lower the percentage because it’s a relative metric.)

- Litigation financing (non-correlated asset) is currently 3.6 percent, up from 3.5 percent.

- M.G. Properties (real estate): now 19.1 percent, up from 14.8 percent.

I also made fresh investments in:

- 4.8 percent for G.P. Stakes (non-correlated asset).

In a moment, I’ll go into detail on each of these.

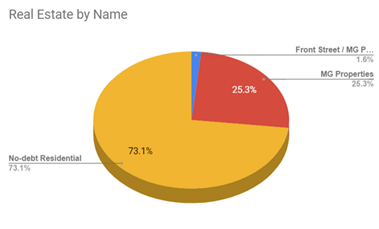

Real-estate Portfolio Allocation in My Portfolio

But first, for those interested in real estate, here’s how the portfolio is divided between real estate and non-real estate investments.

At 75.6 percent, real estate remained the most significant element of my portfolio. This percentage is slightly lower than the 83.2 percent in the second quarter. Non-real estate increased from 16.8 percent to 24.4 percent.

How is the 75.6 percent real estate allotment divided? Here’s how it appears (with all of them adding up to 100%):

Again, you can see my core-satellite strategy, with most of it concentrated on boring no-debt residential homes. (The “mixed” refers to Front Street, which consists primarily of office, healthcare, mixed-use, and industrial development.)

Please remember that I did not include my residential residence in these graphs or calculations. It is, technically, a real estate investment. And for many people, it is the most significant investment they will ever make (which is not the case for us). On the other hand, my house provides shelter, which is an uncompromising value to quantify. My family views our home as more than just an investment. We adore it and spend far more money on it than we would on a pure investment.

As a result, I do not include it here.

So, returning to the graph. Here’s what has changed since the last time we spoke:

- Hard money loans and equity NNN have been decreased to 0%. (versus 10 percent and 12 percent respectively, last time). Both of these IPOed, moving them from my alternative portfolio to my public market holdings.

- No-debt residential homes have risen to 73.7 percent (versus 58.9 percent last time).

- Multifamily housing climbed to approximately 26.9 percent (versus 19.1 percent last time).

And for those who are interested, here is a breakdown of my current real-estate portfolio by real estate investment:

Those as mentioned above will be discussed in depth in the following sections.

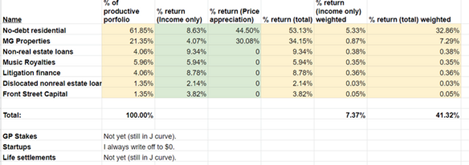

Returns for the Previous 12 Months

What was the outcome of each investment? The following are the trailing 12-month returns:

And here’s how they were arrived at:

J-curve: Alternative investments have an initial investment period (usually a year or two) during which money is deployed but not fully distributed. As a result, I have not yet included these in the total return estimates (G.P. stakes and life settlements).

J-curve partial: A few are partially in the J-curve (parts of litigation finance, parts of M.G. Properties, parts of music royalties). It would have been too much work to separate things, so I included them for convenience. As a result, my reported return was reduced slightly (versus what it would be if it were fully split out). But I figured “near enough.”

The income from the no-debt properties was significantly higher than shown (probably a couple of percentage points higher). However, because that portion has yet to be fully calculated by my accountant, it was not included.

Real estate price appreciation might be difficult to predict without an expensive appraisal (which is impractical). And they are also valued when properties are sold. However, in most cases, the sale does not occur until 5-7 years after the initial investment (to maximize the return). I used Zillow’s home price estimator, the Zestimate, as a proxy to calculate residential property appreciation. Many people believe that this undervalues prices. If this is the case, the actual return would be higher than represented.

Investment-by-investment Analysis

Here’s a closer look at what’s going on with each investment (from most significant to most minor holdings):

1) Residential rental properties (same as in #1)

This is the most significant component of my alternative portfolio. Once again, I take a core-satellite view of risk. And having such a sizeable conservative core allows me to take more significant risks on smaller satellite pieces.

I prefer residential tenants over multifamily/apartment renters since they are more stable and long-term. I look for working-class neighborhoods with low-cost homes (to broaden the pool of potential renters and align myself with the long-term trend of an increasing scarcity of secure housing). In addition, I choose neighborhoods with low crime (avoiding class C) and properties that fulfill my yield and other minimums.

These were bought with no debt, which I believe makes them exceptionally resistant to a significant downturn. Most real estate investors consider this an overly cautious strategy that leaves too much money on the table. And they would choose more significant expected returns via leveraging instead. On the other side, the system serves my needs.

This yielded a return of 53.13 percent. That’s certainly out of the park and not what I’d expect from a conservative investment.

5.33 percent was in income (a few percentage points higher, but I didn’t mention it because my accountant hasn’t correctly computed it yet). Due to a heated real estate market, the price increased by 32.86 percent. This kind of price increase is unlikely to occur every year. But when it happens, it’s like getting extra gravy at a meal: a welcome addition.

I frequently purge this portfolio when a property fails to meet my minimum criterion (for example, if the neighborhood appears to decline or there is excessive turnover). There were no sales this time.

My goal is to invest more money in this asset class. But it will depend on pricing and other factors, so we’ll see what happens.

Also, I’m not willing to purchase rentals in a faraway city through a turnkey operator since I assume there are too many financial incentives and ways for them to conceal severe flaws that I’ll never see. So, if I can’t redeploy it here, I’ll either keep it in cash or find another use for it.

2) M.G. Properties Group (increased from #2 the previous time)

The last time I saw this sponsor, I was in ten separate properties across numerous funds. I’ve contributed more money since then and am currently fourteen.

M.G. Properties looks to be one of the very few sponsors that have gone through numerous cycles without losing any investor money. They perform multifamily value-added transactions with moderate leverage and significant skin in the game (10 to 33 percent ). They are also the few firms implementing a full-featured TIC 2.0 1031 exchange pipeline, allowing taxpayers to defer all taxes indefinitely.

This is a long-term hold for 7 to 10 years, and when I exit, I want to 1031 exchange into a succeeding investment with M.G. (to defer capital gains). Ideally, I would like to work for them indefinitely and pass it down to our son after my wife and I die (who would inherit it on a stepped-up basis and also not pay any capital gains). This is all part of the previously mentioned “defer, defer, and die” tax avoidance plan.

M.G.’s rental collections have been solid since last time, and income has increased slightly. (Last time, it had dropped to 5.29 percent owing to covid-19 lockdowns.)

Please remember that my percent income figure includes recent M.G. investments still in the J curve (meaning they are not entirely deployed and are not producing total dividends). As a result, the overall percentage appears slightly lower than what occurred (had I correctly split it out). But it was too much labor to change that, so I just kept it the way it was for these purposes.

3) Music Royalties: (up from #10 the previous time)

Historically, music royalties have been recession-resistant and uncorrelated with traditional and real estate asset classes. As a result, non-correlation might give portfolio diversification during a downturn. The industry’s target IRRs might be as high as 14-15 percent net IRR.

The sponsor has asked that his identity be kept private in this article.

4) Grand Prix Stakes (new this time)

G.P. stakes are a specialist asset class that is not well-known (beyond institutional investors who keep it closely held). The heart of its profitability is unrelated to economic cycles, the stock market, and so forth (which can provide valuable diversification to a portfolio and cash flow).

This is how it works. The G.P. stakes fund invests in a private equity firm by purchasing an equity share (stake) (the G.P.). This entitles it to a portion of G.P. management fees, promotions (profit splits), and balance sheet income (co-investments) for all present funds (and any new ones that are created).

Furthermore, the cash flow and downside protection from management fees are reliable and predictable (even without growth). The other revenue factors (promotions, balance sheet income) allow for additional upside return.

Not all general practitioners are created equal, and the top tier is far more trustworthy and less volatile than the others. As a result, I’m not comfortable bottom-fishing in this asset class. I’m also particular about which funds I invest in and require a team with a strong track record of success and experience.

So I was delighted to discover not one but two funds that fulfilled my criterion over the last year. These sponsors have asked that their identities not be revealed in this article.

5) Litigation Finance: (up from #6 the previous time)

Litigation funding is money given to legal firms that need it to pursue cases with a higher than average chance of winning. It is not directly tied to the business cycle/recessions, which can provide excellent portfolio protection and diversification during a downturn/recession.

The asset class is gaining popularity among institutional endowments and wealthy family offices, but it is complicated for average investors to access. IRR net returns of 18 to 20% are possible.

The sponsor with whom I invested has the industry’s longest track record. It pioneered the asset class in 2007 and has received multiple industry accolades. This asset class has a “J curve,” meaning it will take a few years to break even and make a profit. Distributions are also not expected in the first year. So it’s true for long-term money (5 years or more).

6) Non-Real Estate Loans (up from #5 the previous time)

This debt fund is not connected to real estate and has one of the best recession track records I’ve observed. Employees and family members have around $500 million invested in the company, which has earned numerous industry honors. It’s also the most popular investment for Tiger 21 members (an investment club that needs a minimum of $10 million in assets and a $30,000 annual membership fee).

During the Covid-19 crisis, I was pleased by the sponsor’s devotion and skill. I appreciate how they are cautious and prepare in case the worst is not yet gone. I’m delighted I chose a sponsor who has been through a severe recession in the past.

7) New businesses

A startup is a company that is in its early phases of operation. Startups are created by one or more entrepreneurs who desire to create a product or service that they feel will be in demand. These businesses typically begin with high costs and low revenue, which is why they seek money from several sources, including venture capitalists.

Startups are businesses or initiatives focused on bringing a single product or service to market. These businesses often lack a completely formed business model and, more importantly, the finance to continue to the next stage of development. Their founders initially supported the majority of these businesses.

Many entrepreneurs seek additional money from outsiders, including family, friends, and venture investors. Silicon Valley is well-known for its robust venture capitalist community and as a popular startup destination, but it is also commonly regarded as the most demanding arena.

Startups might use seed funding to fund the research and development of their company strategies. A complete business plan covers the company’s mission statement, vision, goals, management, and marketing strategies. In contrast, market research helps evaluate the demand for a product or service.

Most startups fail, and the handful that does are frequently roller-coaster rides. And it used to be my duty as a serial entrepreneur to ride that roller coaster. But now that I’m a passive investor.

So, when I invest in a business, I deduct the total amount from my portfolio and budget and assume the money is gone. That way, if they fall to zero (statistically the most likely scenario), I won’t lose a night over it. And if they do well, it’s a terrific way to celebrate (but not something I was counting on). And I have no desire to be disappointed if and when success does not occur.

Also, if I don’t feel entirely comfortable writing it off, that tells me I shouldn’t be investing (which I don’t).

By the way, I see a lot of other investors who don’t do this, which can generate a lot of pointless worries (over something they can’t control anyhow). And in my opinion, this might lead to excessively positive or excessively negative emotional states, leading to poor investing judgments.

Now, for this post, I’ve included the figures. But I wouldn’t be doing this stuff if I wasn’t writing this piece.

7a) New bank establishment:

This was an investment towards forming a new (startup) community bank. Community banks are small, local banks that specialize in financing small businesses. Large banks typically do not make these loans because they do not know the local firms well and are ready to underwrite them, and the amounts included are too little to appeal to the larger institutions. As a result, tiny banks play an essential role in local economies. However, larger banks have taken up many of them over the last few decades.

I liked this venture since the principals owned a 28 percent stake. The CEO had an excellent underwriting record throughout the Great Recession while working for another Community Bank (which eventually was bought out). That bank’s charge-off/default rate was 4x-9.6x smaller than the standard community bank (much lower than the average big bank).

This has been performing well before Covid-19 (hitting or ahead of projections on expenses and asset growth). Then came Covid-19, which drove the Federal Reserve to cut interest rates to rock bottom. In general, this places a strain on bank profits. So, when that happened, I became concerned about this investment. I didn’t expect them to have a new opportunity to write Paycheck Protection Program (PPP) loans. And they still managed to meet several of their net profit estimates (which was a pleasant surprise).

However, the PPP program is coming to an end. Furthermore, the economic environment may become more difficult for debtors (see my concerns about the future below). We’ll see how they fare.

I’m rooting for them. At the same time, I’ve calmly written it off to $0 (so if they don’t hit it big, it won’t be the end of the world).

7b) Startups-Personal Protective Equipment (Covid-19 “insurance”):

Initially, the Covid-19 problem resulted in a severe shortage of crucial PPE (personal protective equipment, such as n95 masks) for U.S. healthcare professionals. Part of the difficulty is that supply chains were based on Chinese manufacturing, and during the pandemic, China shifted them to its own needs rather than those of the United States. And the Chinese manufacturers who ship to the United States are frequently insufficient due to forged certifications and poor quality control.

As a result, I invested in a PPE manufacturing company. This struck me as a type of Covid-19 insurance. If the epidemic lasted longer rather than shorter, and many other investments suffered, this one would do better. And if the epidemic is over sooner, I’d be content to accept a total loss on this (because it would mean all my remaining investments would be skyrocketing).

The federal certification process for N95 masks eventually became extremely clogged and dysfunctional (due to massive levels of fraud), and the N95 market has transformed, with a surplus of specific types of masks and other issues. I’m not authorized to discuss any specifics regarding this investment, so I’ll just remark that any firm would have hurdles in such an environment. I’ll just add that, like all of my startup investments, I hope they can overcome any obstacles. And if they can’t do it, I’ve already written it off to zero (so I’m not losing sleep over it).

8) Life Settlements: (up from #8 the previous time)

Life settlement funds buy life insurance policies from people who decide they don’t want to pay for them (the price has risen too high, they don’t believe they need it, they prefer quick cash, and so on). The fund provides payments until the person dies, at which point the fund collects the life settlement.

The asset class is uncorrelated with the stock market/business cycle and can provide valuable diversification to a portfolio during a recession/downturn. Net returns might range from 7.2 percent to 10%.

The sponsor has asked that his identity be kept private in this article.

9) Non-real estate loans relocated (up from #12 last time)

As I said in my previous thorough report, I have saved a substantial sum. The goal is to be able to capitalize on the next recession’s displaced and distressed possibilities (and when cash becomes king). There is no 100% certainty that there will be an opportunity or that it will be profitable.

However, this is how many tiny fortunes were established following the Great Recession.

This fund was created to capitalize on displaced, non-real estate debt caused by the Covid-19 crisis (and after-shocks). Because it is not a distressed fund, they are not seeking troubled deals. Instead, they’re hunting for robust, cash-flowing loans that can be acquired at a significant discount due to market disruptions and distressed sellers. As a result, this approach is less risky than a distressed fund strategy.

The sponsor has a strong recession track record and has successfully managed many funds comparable to this one in the past.

The sponsor has asked that his identity be kept private in this article. Club members can acquire comprehensive information, including their names, detailed due diligence, and so on, right here. (Membership is free, but applicants must demonstrate that they are genuine investors with no corporate ties to the sponsors.)

Front Street Capital is number ten. Return: (as opposed to #13 before)

Front Street is a unique corporation with over 30 years of expertise, $100 million in cash, and no investor losses across numerous cycles. They build and purchase office, healthcare mixed-use, and industrial properties with a conservative LTV target of 65 percent.

At this point in the cycle, I usually avoid starting from scratch. Front Street, on the other hand, eliminates the ordinarily significant refinance and interest rate concerns by securing the permanent loan in advance. Furthermore, by putting the renter in advance, they minimize most or all of the tenant lease-up risk. So I felt pretty at ease making an exception for them on this occasion (especially with their track record).

This one was intended to pay a quarterly dividend immediately, and it did. And, like most real estate syndications, it will generate much higher profits if it can eventually sell assets at a profit.

Please remember that I invested in this through a vehicle that also invested in M.G. Front Street remains in the J curve and is not yet completely operational. As a result, the income percentage shown is lower than it would have been (if I had split things out).

What comes next? (My long-term approach)

So, what will I do next?

My strategy has evolved significantly since my last update in the second quarter. (which feels like a lifetime ago). Back in the day:

We were on lockdown due to the coronavirus outbreak. Never in a million years did I expect that entire sectors of the economy would be shut down, millions of occupations would be lost, and we would see the most severe GDP loss on record.

But I was lucky to be already on the defense since I had been worried about cracks appearing in the business cycle. As a result, I avoided several riskier asset groups that got slammed (like hotels, business-cycle sensitive retail, certain types of offices, etc.).

There has been a lot of fantastic news and a lot of bad news since then.

The great news is:

Successful vaccines and less lethal variants: Following the solid success of mRNA vaccines and the decrease in severe sickness caused by newer variants, many areas of the economy reopened (like Omicron and now BA2).

Rapid economic recovery: We rebounded quickly from a brief and unexpected recession.

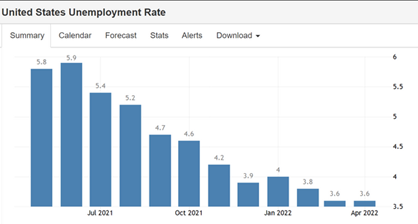

Strong labor market: The labor market is in the most muscular shape it has been in a long time (with unemployment decreasing to just 3.6 percent and the best since February 2020).

On the other hand, there’s a lot of bad news and uncertainty out there right now:

Inflation: Due to supply chain issues, a shortage of semiconductors, a scarcity of workers, the battle in Ukraine, and China’s covid-zero policy, inflation is at unprecedented levels (causing shutdowns of manufacturing plants on by many U.S. companies). This is generating a lot of misery for both consumers and businesses. And, thus far, it has resisted forecasts that it would vanish fast.

Inflation is the price increase that results in a loss of buying power over time. The average price increase of a basket of selected goods and services can show the rate at which buying power declines. The increase in pricing, frequently stated as a percentage, signifies that a unit of currency buys less than it did previously. Inflation is distinguished from deflation, which happens when prices fall but buying power rises.

While specific product price increases are easy to track over time, human needs extend beyond just one or two things. Individuals require a wide range of items and services to live comfortably. Commodities such as food grains, metals, and fuel, utilities such as power and transportation, and services such as health care, fun/entertainment, and labor are examples.

Inflation seeks to assess the overall impact of price fluctuations on a wide range of goods and services. It enables a single value description of an economy’s increase in the price level of goods and services over time.

to incur record levels of debt, which may not be sustainable if interest rates continue to climb.

Economic advantages from globalization are being reversed. The war in Ukraine hastened the world’s division into two competing domains, calling into question the post-International War II global world order that has enabled extraordinary economic success over the last several decades. Furthermore, the escalating confrontation with China is hastening the divide and is likely to undo many financial gains from globalization.

Will there be more covid? Finally, there is still the possibility that the next Covid 19 mutation will be more severe, causing further economic devastation. With the global rollout of pandemic vaccines and treatments moving slowly, the virus will have plenty of time to shake things up.

So it’s no wonder that the two and ten-year treasuries just inverted (which has historically been associated with an impending recession):

There is no ideal recession predictor (and no one factor can accurately predict every recession). At the same time, I feel this warning symbol appropriately reflects the high level of uncertainty (and potential risk).

The economy then startled many economists and commentators by declining 1.4 percent in the first quarter (Q1).

So rates have only recently begun to rise, inflation is unacceptably high, and we are already one quarter away from a technical recession.

For those who think the Fed will effectively thread the needle and arrange a “soft landing,” this is hardly a promising start (raise rates and conquer inflation without causing a downturn).

I hope everything works out well and that we escape a recession. However, many individuals and some investors may suffer if rough seas are ahead. Furthermore, some business-cycle-associated investments (including some real estate classes) may face significant stress (or even default and lose everything). If that occurs, I would instead not be engaged in them.

Furthermore, some previous recessions provided once-in-a-decade or once-in-a-lifetime opportunities for patient, discerning investors with funds to purchase dislocated/distressed assets at rock-bottom prices. So I’m keeping everything in mind as well.

So, my strategy is as follows:

Invest in asset types not affected by the business cycle (G.P. stakes, litigation finance, music royalties, life settlements, etc.).

Only invest in real estate and business cycle sensitive investments if they are extraordinary and have strong downside protection.

Real estate transactions must have whole cycle experience, a high level of co-investment, no floating rate loans, and no unusual hazards (i.e., no junk-rated securities, and everything needs to be high quality).

Keep cash on hand and be alert to take advantage of distressed vendors.

And my thoughts and tactics will shift whether we receive good or bad news.

I don’t keep my money in a savings or money market account because the returns are usually pitiful (much less than 1 percent ). Instead, I put it into five-year C.D.s with a modest penalty for early withdrawal, which are currently yielding roughly 2%-2.75 percent. To avoid penalty fees, I divide the money into little C.D.s and only liquidate what I require (so I only get penalized for that amount).

For example, if I had $100,000 in cash, I would divide it into five C.D.s of $20,000 each. Then, if I need $20,000 in cash, I’d break only one of them, pay a couple of months’ interest penalty on it alone, and keep drawing genuine interest on the others. (Update April 22, 2022: Here’s a webpage that lists the liabilities for various C.D.s.)

In addition, I max out on what I believe to be the best risk/reward trade in the market: U.S. Treasury I bonds. They have an inflation-adjusted component, now yield 9.62 percent, and are guaranteed by the U.S. government’s full faith and credit.

The major drawback is a tight $10,000 restriction per investor. However, there are ways to save more than the $10,000 limit, such as spouse accounts, children, trusts, etc.

Bonus: Investment via Investment Tax Analysis

Another common question is how the various goods in my portfolio are taxed. Because this can sometimes be complicated, many individuals avoid thinking about it. However, doing so can result in costly errors. So, while considering an investment, a wise investor should always consider the after-tax return.

At the same time, lowering taxes isn’t my primary priority. Yes, I spent a lot of effort and thinking into minimizing my tax burden as much as feasible. But, if forced to choose between lowering taxes and capital preservation/risk reduction, I’ll take the latter every time. Someone with different risk tolerance and financial circumstances may have completely different feelings.

To put it another way, I’m usually okay with losing a few percentage points of expected after-tax return if it means additional safety and principle protection. So you won’t see me putting all my money into the most tax-efficient investments.

My circumstance

I live in Tampa, Florida, and I am fortunate that there is no state income tax. (We have a sales tax, but it only applies to purchases, not income.) In addition, I keep a modest portion of my portfolio in a tax-sheltered self-directed IRA. As a result, I’ve set money aside for other assets with far worse tax treatment than real estate. However, if your circumstances differ, your self-directed IRA or solo 401(k) can be a fantastic option to save on taxes.

My tax breakdown for my portfolio:

Residential rental properties include:

This is taxed at the same rates as passive income. Last year, dividends were tax-free by 35% due to depreciation. Furthermore, new tax regulations went into effect last year, providing me with an additional 20% deduction (for Qualified Business Income or QBI).

Group of M.G. properties:

Taxes are completely avoided on distributions. Furthermore, they usually give their investors the option to conduct a 1031 exchange into a new property at the end of the period. This postpones paying back depreciation and capital gains.

An investor can do this repeatedly and effectively postpone paying taxes indefinitely. Even if the investor dies, their heirs inherit it on a stepped-up basis and are not required to pay taxes

Main Street:

Taxes are only levied on 50% of distributions. Again, the new tax law should provide me an additional 20% in QBI tax sheltering this year.

Litigation funding:

I’ve seen other funds formed and classified differently. A typical structure is an income classified as capital gains (which can be very tax advantageous over time) and ordinary gains (which are taxed at regular income rates and thus not any tax benefit).

Settlements for life:

I’ve also seen these arranged and classified in various ways. I prefer it when it is set up with tax treatment (such as all gains projected to be qualified dividends and taxed at just 20 percent ).

Non-real estate commercial loans:

Like most others in this asset class, this fund has no unique tax benefits and is just taxed at conventional income rates.

Grand Prix Stakes:

I’ve also seen these arranged and classified in various ways. One configuration is capital gains on hold (tax-deductible) and regular income on management fees (taxed at ordinary income rates and thus not any tax benefit).

The sponsor has asked that its identity and other information be kept private in this article.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.