Introduction:

Real estate investments have the unique opportunity to generate income and appreciation. Here’s how:

How Real Estate Investing Makes Money

There are hundreds of advantages to investing in real estate, one of which is the unique opportunity to make returns through income and appreciation.

In some cases, real estate investments can generate income while also increasing value. The methods by which real estate investments can produce these returns – and by which investors can receive them – vary depending on the investment.

Let’s take a look at the foundations of how real estate investments can profit from various investment firms.

Equity vs Debt in Real Estate Investing

Real estate investments are classified into two types: debt and equity. Let’s first examine the distinction between these two forms of investments to grasp how returns are organized in income or appreciation.

Debt investment is an investment in a company or project that involves acquiring a considerable amount of debt with the expectation of repayment and interest.

Unsecuritized debt is similar to a bank loan or credit card payment in that it can be for any amount agreed upon by the lender and borrower. While investors trade bonds on exchanges regularly, they also deal with loans, but these transactions are typically between private parties.

Mortgages are secured by real estate. Almost every bond has some form of underlying collateral, such as real estate or something else. An unsecured bond is referred to as a debenture.

A debt investment is usually less dangerous than equity investment, but as explained below, various factors influence how difficult each asset can be.

An equity investment provides an investor with ownership of tangible property. Capital gains are often realized as a one-time payout in the form of appreciation returns.

An equity investment also allows an investor to obtain consistent income via rental payments for the duration of the investment, often monthly. While stock investments provide investors with income and capital appreciation, they are frequently riskier than debt investments, as we will see later.

With this knowledge, let’s look at how real estate investments can generate income through loan and equity investments.

How Real Estate Investments Make Money

As previously stated, both debt and equity investments can generate regular income. Earning income is only possible while an investor owns their investment.

Unlike appreciation, payment does not require the sale of an investment. Ownership gives an investor the right to collect revenue from their income-producing assets.

Let us first look at how income is often generated for real estate loan investments.

A real estate loan investment is a transaction in which an investor lends money to a buyer or developer, who then charges fees on the principal borrowed. While the loan is being returned, an investor obtains a return in interest payments. Payments are frequently made regularly, making them an enticing investment option for people looking for “passive” or “residual” income.

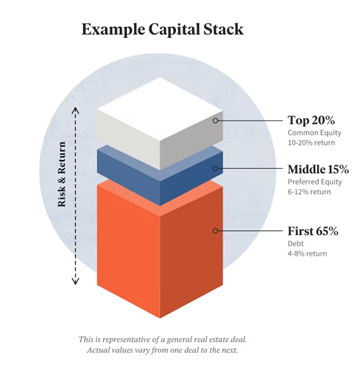

Debt investments can only generate income but have a lower risk profile than equity investments due to their lower position in the capital stack.

Debt is the most senior position in the capital stack called the “base,” which implies it has the top repayment priority. Before an equity investor can see any profits, debt investors receive their money plus interest (apart from rental income potential). For example, whoever decides to sell their property while there is debt must pay back the loan to the lender before they may keep any appreciation profits.

There is a further distinction of seniority among the forms of debt inside the debt tranche of the capital stack, which defines loan repayment priority. Predictably, senior debt is the oldest and has the highest repayment priority. The capital stack’s equity element is followed by junior and mezzanine debt.

Debt real estate investments are secured or unsecured, in addition to seniority. In the event of loan default, an investor with a secured debt investment has the option to withdraw on a property to recuperate the value of their loan. Senior debt investments are typically secured positions, and other debt investments may be guaranteed, but the terms vary depending on the investment.

Real estate loans are typically made in enormous amounts, limiting them to institutions and institutional investors capable of providing large sums of money over lengthy periods. Accredited investors can engage in real estate debt through a private equity fund, but most individual investors can only do so through a fund.

Some investment alternatives are primarily or solely focused on debt investments. For example, the our Dolphin Fund is predominantly devoted to debt investments chosen for their capacity to generate regular income.

Some investing strategies provide tax advantages for income-based returns. REIT investors, for example, can pay taxes only at the individual level rather than the fund level, eliminating the possibility of double taxation (as long as the fund qualifies as a REIT). Furthermore, income produced and distributed by REITs and real estate mutual funds may be eligible for up to a 20% tax deduction as of 2018, according to changes in regulations governing qualified business income under the Tax Cuts and Jobs Act.

Rental payments from equity investments can provide their income stream. Traditional or common, equity ownership offers investors the ability to rent their property to tenants to make money through rental payments. A few fundamental variations between debt and equity investments affect their respective earning possibilities.

Unlike a debt investment, which typically has a fixed rate of return over a certain period, an equity investment generates income that can fluctuate over time, increasing or decreasing in response to market demand. Income potential is also determined by occupancy rates, which might vary depending on the property. This means that equities investors take on more risk to gain money but may also earn a higher rate of return.

Furthermore, joint-equity investments typically do not have pre-defined terms of ownership and can remain indefinitely, allowing an investor to collect income until the property is sold. Real estate is a long-term investment, particularly for equity investments, that enables investors to receive large monthly payments over time.

Common equity ownership is possible for rental income, whereas preferred equity investments have cash flow more akin to debt investments. Preferred equity investments, like loan interest payments, provide a reasonable return known as “preferred return.” Due to their middle position in the capital stack, preferred equity investments accept funds until they achieve the assumed preferred return rate after all debt investments have been reimbursed and before ordinary equity investors obtain their return.

Investing for Income in Real Estate Equity Investments

Typical equity investments are less challenging to get than debt investments. Individual investors can purchase and administer investment properties on their own. Individual investors are frequently limited in quantity and types of properties that they can acquire — and manage — on their own due to the large sums of money, expertise, and time required for direct investing.

As with debt investments, pooled-fund investment choices such as mutual funds, REITs, and investment platforms allow you to spread your money across assets and their kinds. Accredited investors can also invest in private equity funds.

While investing in a single-family home or duplex is more realistic for an individual investor, a fund can provide an investor with access to assets in a diverse variety of commercial real estate in numerous places for a fraction of the dollar investment size.

How Real Estate Investments Gain Value

Real estate has the unique capacity to generate both income and appreciation. Rent payments can provide an equity investor a stable income while the property appreciates. When the property is sold, investors can profit from any increase in property value in the form of capital gains and any income produced during the investment’s holding period.

Property value, like rental revenue, fluctuates with demand. While a debt investment can be arranged to ensure a particular rate of return, an equity investment is riskier due to its dependency on the market. However, it also means that stock investment has a more significant return potential. Appreciation potential might be great or modest based on various factors, making it critical for the investor to have the knowledge required to make sound investment decisions.

Real estate is often a long-term investment that lasts at least five years. Unlike stocks, many properties’ appreciation is maximized over several years, with value rising slower. Although real estate appreciates more gradually, it is also less volatile, with lower and fewer daily variations in weight than most, if not all, stocks.

Investing in Real Estate Equity Investments for Long-Term Growth

As previously said, there are ways to engage in real estate equities, including direct investment, mutual funds, REITs, and investment platforms. The investment instrument was chosen to make an equity investment that influences how and when investors get their returns.

For example, an investor with a direct investment can directly collect capital gains from the sale of an investment. On the other hand, investors who invest through a fund may benefit from selling a property. Each alternative has its benefits and drawbacks, making one option more or less appealing to investors based on their financial needs and objectives.

Regardless of how you invest in real estate, a rigorous underwriting procedure that assesses the elements of a potential investment property is sometimes necessary. If you invest individually, you will be responsible for the underwriting process.

However, if you invest through a fund or platform like Dolphin Property Investments, a team of qualified real estate specialists will conduct the assessment on your behalf. This due diligence procedure is critical in establishing whether an investment offer is financially viable, regardless of who performs the underwriting.

Investing became more appealing when the pandemic began to spread because of the potential for quick returns. Investing money will undoubtedly help one fight inflation during these trying times.

There are numerous investments to consider. Stocks, bonds, and mutual funds are popular and extensively used assets for people just starting.

Aside from that, other assets such as real estate might provide a steady stream of wealth. Real estate has less risk and volatility than the stock market, making it an essential option for securing a secure retirement.

Because real estate is often a long-term investment, selecting the best solution that aligns with your financial objectives is critical. When properly chosen, it can be a valuable source of a steady income in your investment portfolio. Furthermore, a track record of long-term appreciation allows the collection of capital gains and income. Traditionally, individuals who have invested in real estate surpass those who have not.

Keep in mind that real estate investing necessitates a substantial initial expenditure. Avoid tinkering with your funds and support what you can stand to waste without risking your everyday needs. It is critical to review your financial commitments, such as bills and debts, as well as your approved budget for investing, to determine whether or not it is feasible to support.

A real estate agent will also evaluate an individual’s cash flow to determine whether or not they can afford to buy a home. Aside from the home’s purchase price, there will be extra costs to consider.

Remodeling, furniture, insurance, and taxes, among other fees and expenses, will significantly increase the property’s value. As a result, a reliable income source must be in place and examined before investing.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.