Introduction:

Commercial real estate investing does not have to be complicated. This guide discusses the fundamentals and investment alternatives for investors of all sizes.

The Ultimate Guide to Commercial Real Estate Investing

Commercial real estate investing as an alternative investment strategy is nothing fresh, but it’s still a surprise to many investors.

Commercial real estate (CRE) is all around us, even if many people are unaware of it. Apartments, offices, retail space, and other similar structures fall under “commercial property.”

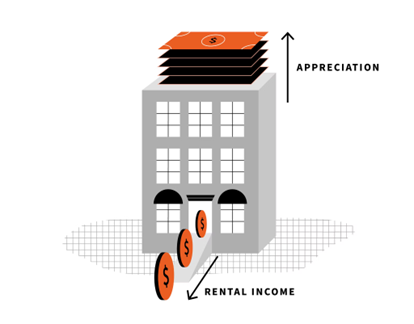

Commercial real estate investments provide revenue or appreciation. The operation of the building generates income, which is often in the form of rental payments from tenants. In contrast, appreciation is obtained through a growth in the property’s value over time.

Commercial real estate investing requires more capital, knowledge, and time than most investors have. However, there are various investment funds and platforms that allow anyone to acquire a diverse portfolio of commercial real estate investments (like Dolphin Property Investments).

Commercial real estate (CRE) is a broad phrase that refers to real estate used to earn profits for its owner. Office buildings, industrial property, medical centers, reliable hotels, malls, residential buildings, and warehouses are all examples of commercial real estate. In general, consider commercial property, which provides money, as opposed to residential real estate, which is often utilized directly by its owner for personal use and usually comprises four units or less.

Typically, investing in commercial real estate as an alternative asset has given millions of investors favorable risk-adjusted returns and portfolio diversity. However, many investors remain confused about how commercial real estate works as an investment vehicle.

In this post, we’ll go over the foundations of commercial real estate investing and how you may get started investing in this traditionally powerful asset class.

A Foundation in Commercial Real Estate Investing

The two basic types of real estate property are commercial real estate and residential real estate. Residential properties are structures only used for human dwellings and not for commercial or industrial purposes. Commercial real estate is employed in commerce, as the name implies, and multi-unit rental properties that serve as renters’ residences are considered a commercial activity for the landlord.

Commercial real estate investing has historically provided millions of investors with favorable risk-adjusted returns. It also has a long record of offering substantial portfolio diversity as an alternative asset class. Because the success of a specific commercial real estate asset is linked to the trends or behaviors of its surrounding local market, a wise commercial real estate investment can be a terrific strategy to expand your investment alongside the local and broader economies.

Commercial real estate investments differ significantly from typical investment vehicles such as equities and bonds. Unlike stocks and bonds, which have significant liquidity and can be purchased and sold quickly and easily, commercial real estate is highly illiquid and one of the few assets classified as a hard asset – a finite resource with inherent worth. Stocks are frequently purchased for their selling potential rather than their ability to generate steady revenue, resulting in the stock market’s “buy low, sell high” heuristic.

However, public market investments, such as equities, have a more considerable volatility potential due to the general market’s good efficiency, which allows for rapid and safe trading. On the other hand, private markets are less efficient and slower, but they are also less volatile since they are less connected to the movements of different needs.

Commercial Real Estate Is Classified Into Several Types

Commercial real estate property types vary greatly but can be grouped into four categories based on their function: office, multifamily, retail, and industrial properties.

Office: As the name implies, office property is real estate for office buildings. This kind comprises skyscrapers and high-rises in cities, as well as office parks and mid-rises in the suburbs. A law firm or a new business could be examples of renters. Office space can be of various kinds and sizes. Lease durations for commercial real estate are way longer, ranging from five to ten years.

Multifamily: Multifamily houses provide residential housing in exchange for rental payments. Buildings having more than four apartments are sometimes referred to as multifamily properties. Multifamily real estate includes apartment buildings or apartment communities, co-operatives, townhomes, and condominiums. These properties’ sizes might vary considerably. In general, multifamily lease arrangements are more flexible in terms of tenure. Residential leases can be short or long-term, but they are rarely longer than a year. Some leasing contracts are even month-to-month.

Industrial: Industrial property is utilized for industrial company operations. Heavy manufacturing, warehouses, assembly, and research & development facilities are examples of this. This group includes oil refineries, Amazon distribution centers, product assembly factories, and pharmaceutical research & development facilities. These properties aren’t typically placed in places that would be ideal for a residential or retail property, and their location is dictated by zoning laws that relate to their industrial company operations. Lease terms for industrial real estate are typically five years or longer.

Retail: Retail encompasses properties that provide the space for retail firms to do general business with the public. Retail real estate includes clothing stores and eateries. This type of commercial real estate can be constructed in big multi-tenant complexes such as shopping malls, strip malls, factory outlets, or other similar shopping centers. It can also be a single-tenanted independent structure. The earning potential of retail real estate for its owner can be heavily influenced by its precise geographic location, influencing which retail tenants will want to set up shop there. Retail leases are generally often mid-to-long-term, lasting 4-5 years.

Leases and types of commercial real estate

Real estate classes vary as well, ranging from Class A to Class D, and each type indicates a level of quality for commercial real estate property. Class A properties are newly constructed assets with high-quality finishing in high-demand locales, earning the highest rentals per square foot. From Class B through Class D, each consecutive class corresponds to increasingly older and less valuable assets.

Tenants vary amongst commercial real estate investment assets. Different renters require various procedures, management requirements, and lease agreements.

In a few situations, a property will use a net lease. It is an agreement in which the tenant agrees to pay some or all of the property’s operating costs and pay for the right to occupy the commercial property. Taxes, maintenance costs, and insurance fees are everyday expenses that can be included in a net lease agreement. Whether they have a single, double, or net leasing agreement, tenants may pay one or all of these categories. For various reasons, net leases can be very appealing to property owners and less attractive to tenants.

How can commercial real estate investments generate profits?

An investment plan frequently begins with purchasing a property to make money in two ways: first, by leasing the property and charging renters rent in return for the use of the property; second, by catching property appreciation over time.

Let’s look at these commercial real estate investment ideas and how they can potentially generate returns.

One approach for commercial real estate to thrive as an investment is to generate rental income from tenants or renters. Rental income creates cash for the property owner. This cash flow/revenue/rental income sometimes reaches the hands of investors through dividend distributions in commercial real estate that operates through a fund (like Dolphin Property Investments)

The ability of commercial real estate to generate cash flow is influenced by various factors, including operating expenses and debt servicing. Maintenance/repairs, loan interest payments, rent collection, evictions, finding tenants, and ensuring that the property is always in compliance with all applicable laws are all examples of property landlord obligations.

If the task becomes too demanding, or if you lack the appropriate financial, legal, and real estate understanding to manage a property and tenants, you may want to start hiring a property manager — or an entire property management firm. A property manager charges a flat fee or a percentage of earnings, which relieves you of property management tasks but decreases your monthly earning potential.

Striking a balance of vacancy and occupancy is critical to earning rental income with as little vacancy as feasible. Each empty unit means lost earning potential. Many property owners strive for a 90% occupancy rate or better. It’s critical to carefully analyze vacancy and occupancy rates in the locations where you’re thinking about investing.

The money generated by rental payments is frequently considered passive income for the owner, depending on how they have decided to manage the building’s activities. While some real estate investors want to be hands-on, others prefer to entrust operating duties to property managers. In such circumstances, the cash flow given by rent is truly passive income with the tradeoff of an added cost.

Dolphin Property Investments, on the other hand, is an entirely hands-off real estate investment solution that offers passive income potential while assuming no property-level management responsibilities and maintaining a no-fee approach.

The second option for returns and profitability from a commercial real estate investment is an increase in the property’s equity value or appreciation over the time of ownership. Because external economic influences can affect the value of a real estate investment, even the most disciplined, tried-and-true investment strategy cannot guarantee benefits. From raw ground to a site home to an extensive apartment building development, all types of property have the potential for asset value and profitability appreciation.

In general, real estate is a distinct and limited asset type. More raw land cannot simply be “produced,” and scarcity is exacerbated by demand, as many tenants in major cities have discovered. If demand for your property or the region around it rises, tenants may be prepared to pay higher rents, and prospective buyers may be willing to pay a more fantastic price than you paid to buy it from you.

Furthermore, scarcity is frequently determined by the market in the issue. A new apartment building will be valued more highly in a supply-constrained housing market in an urban center than in a rural area with a bountiful housing market. The scarcity of a complex item and the accompanying property values might differ dramatically from one zip code to the next.

Markets are frequently classified as primary, secondary, or tertiary. A primary market is the heart of a big metropolitan zone, where people are concentrated, and economic activity is substantial. Primary markets are often home to some of the most expensive real estate in the country. Secondary markets are more trim than primary markets and are frequently located around a principal market, such as a prominent city suburb. Finally, a tertiary market is much smaller than a secondary market and is positioned even more away from a large urban hub.

Appreciation due to demand isn’t the only method a property’s value rises. Many commercial real estate investors use an active “value-add” approach, modifying the property to boost its intrinsic worth and acquisition price or its capacity to provide income throughout the holding period.

One example is updating visual aspects such as flooring, worktops, or appliances in a multifamily apartment building. These updates can be costly, but they can also allow the owner to charge greater rent for finer flats. Any money invested in property renovations can potentially increase the building’s selling price in the future.

A property may be vacant during renovation and not earn rental money. It’s critical to think about any required debt service and make sure you can carry on making payments for any financing during the holding term, even if the property isn’t generating rental income.

Aside from physically renovating a structure, other ways to increase appreciation include rezoning a neighboring parcel of land (for example, from residential to multifamily) to develop more apartments. Changing the entitlements and permissions available to a piece of property can significantly impact the price of that land.

Methods for calculating the return on commercial real estate investments

Aside from understanding how rental income and appreciation work, numerous ways exist for estimating and assessing a property’s existing or predicted return potential. To correctly grasp the computation of commercial real estate investment returns, you should be aware of the following fundamental concepts:

Net operating income (NOI):

In real estate, net operating income (NOI) indicates an investment property’s annual revenue (or income) after running yearly expenses. In most cases, this is the cash flow created by rent over a specific period, less any fees or expenditures associated with holding the property.

Net operating income (NOI) is a metric used to assess the viability of income-producing real estate ventures. NOI is the sum of all property revenue less all reasonably necessary operating expenses.

NOI is a pre-tax figure that appears on a property’s income and cash flow statement and removes loan principal and interest, capital expenditures, depreciation, and amortization. In other businesses, this term is known as “EBIT,” which translates to “profits before interest and taxes.”

Capitalization rate (Cap Rate):

The capitalization rate, sometimes known as the cap rate, is the most widely used valuation approach in real estate investing. It is based on the unlevered yield of a property (rate of return).

A cap rate, in other words, quantifies a property’s natural rate of return for a single year without accounting for any debt on the asset, making it simple to compare the relative value of one property to another. A cap rate is typically represented as a percentage.

The cap rate is the most commonly used metric for evaluating real estate investments’ profitability and return potential. The cap rate shows a property’s yield over a one-year time horizon, providing the property is bought in cash and not with a loan. The capitalization rate represents the property’s inherent, natural, and unlevered rate of return.

Because cap rates depend on estimated predictions of future income, they are highly variable. It is consequently critical to comprehend what defines a solid cap rate for an investment property.

The rate also reflects how long it will take to recoup the amount invested in a property. For example, a property with a cap rate of 10% will take approximately ten years to return its investment.

Different cap rates on other assets, or different cap rates on the same property over different time horizons, imply different levels of risk. According to the calculation, the cap rate value will be higher for properties that earn higher net operating income but have a lower valuation, and vice versa.

Internal rate of return (IRR):

What is this metric? The IRR is a metric that analyzes an investment’s lifetime profitability and represents the average yearly return percentage. The IRR of an asset can be calculated both forward and backward to anticipate prospective future returns or forward and backward to measure the performance of a solid investment. The IRR is the rate of growth required for the asset’s current value to equal its expected future value.

Debt service:

The quantity of payments due under a loan is referred to as debt service. The monthly amount is determined by several criteria, including the loan-to-value (LTV) ratio. A property’s cash flow (current or prospective) ability to service debt is one crucial indicator of the investment’s inherent risk. Generally, the larger the quantity of debt (i.e., the more significant the leverage), the riskier the venture.

Other elements include risk-adjusted returns (which refers to how much an investment generates about the amount of risk it carries) and how investors usually measure the worth of a property by comparing its value against its total number of square feet. These general guidelines can help you get a good start on analyzing an investing opportunity.

For example, knowing how much you’re spending per square foot allows you to decide whether you’re getting a good bargain for the amount of space you’ve acquired based on the price per square foot of similar properties in the market.

Finally, regardless of whether the investment is passive or active, all investors have a legal obligation to comprehend the tax implications and methods for filing tax records for the total returns they make on their investment.

Strategies for Investing in Commercial Real Estate

The primary commercial real estate investing method is straightforward: discover intrinsic demand for real estate in a specific location, then buy a property while supply is still limited.

However, real estate may be a complex and costly asset class. Without due investigation, it is possible to make expensive investment blunders. When purchasing a business investment property, you must grasp the specific elements surrounding that property and the general methods that apply to that investment. Among the most common investment strategies are:

Redevelopment of industrial property: You may notice that a relatively impoverished neighborhood has the potential for an economic rebound in the coming years. You could buy an industrial building and find a business tenant in the short term. In the long run, you may seek to have the land rezoned for redevelopment into retail or residential real estate if demand in the surrounding area increases.

You could sell the property and profit from any acquired appreciation, or you could keep the property and generate revenue from monthly rental payments from tenants.

Apartment building for renovation: If you notice a region with a strong economy and constant population expansion, you can consider buying an apartment building and renovating it to boost its earning potential. Enhancing renters’ living conditions can raise rental prices, generating greater cash flow in the short term while potentially driving the asset’s overall appreciation.

Land for entitlement: There are times when you can find a location with little development primed for demographic and economic growth shortly. In such a situation, you could strive to acquire raw land and then gain all of the permissions required for construction at that location, so increasing the property’s worth. Instead of carrying out the structure yourself, you might profitably sell the entitled property to someone else who wants to develop the area.

Commercial real estate has long been exceedingly expensive, requiring investors to tie up vast amounts of money in a single property for lengthy periods, limiting the number of investors who could afford to invest.

Today, solutions such as Dolphin Property Investments have made it feasible for anybody to add commercial real estate to their portfolios with substantially less capital, far less personal risk, and more solid asset diversification. Dolphin Property Investments also provides the prospect of entirely passive income and long-term appreciation because all real estate funds and property management are handled by our own professional in-house real estate team.

Examples of commercial real estate investing in the real world

Doug’s hands-on apartment construction

To understand how this asset class performs thoroughly, let’s look at commercial real estate investors. Doug spends $5 million on 40-unit apartment development. After deducting all expenses, he obtains a rental income of $500,000 in year one (otherwise known as his net operating income).

Every year, as with any property, some renters leave. Doug renovates vacant apartments before re-leasing them to new residents at more excellent rates. Doug’s upgrades raise the property’s rental income by $50,000 per year for five years, bringing the total to $750,000 by the end of year five.

The apartment building is later sold for $16 million by Doug. The buyer was willing to pay more than Doug did five years ago for two reasons: first, Doug refurbished the units, which increased the property’s worth. As a result of these repairs, Doug could boost the rental costs for the teams, which now earn him 50% more than they did when he purchased the building.

Second, Doug’s city’s economic expansion improved property values as more renters and entertainment venues migrated into the area. Doug, excellent work!

Jason, Doug’s cousin, has heard through his relative that real estate can be a profitable asset class. Also, he’s interested in investing but doesn’t have the time, desire, skills, or resources to commit to continuing management of one or more properties. He also does not want to add the weight of another debt and mortgage to the one he already has on his family’s home.

Jason finds from his investigation that various alternative real estate investing choices allow investors to add high-quality commercial real estate holdings to their portfolios. Some streamline the process by eliminating all management responsibilities from the investors’ shoulders. In many situations, investing involves purchasing shares of an absolute estate-focused fund, such as a real estate investment trust (REIT), which provides investors immediate exposure to a diverse portfolio of properties through a single transaction.

Jason discovers Dolphin Property Investments as a method to readily access non-traded REITs. He is intrigued by the hands-off, no-fee structure and low investment minimum investment options it provides. Jason is willing to wait five years or longer for his investment to mature, which is consistent with Dolphin Property Investments investment horizons. Many of the assets in Jason’s portfolio are well-positioned to develop in the same way that Doug’s apartment complex did.

Jason’s ownership stake in those properties will reflect that potential expansion. Jason’s Dolphin Property Investments portfolio also contains properties of various types and methods.

Jason gets any distributed dividends as the properties in his portfolio generate cash flow from tenants or interest payments. Meanwhile, the values of Jason’s shares fluctuate in tandem with the properties’ values. Jason reaps several benefits from his real estate investments, while Dolphin Property Investments in-house real estate team administers the properties in his portfolio on his behalf.

Direct commercial real estate investing, as opposed to publicly traded stocks, can provide consistent cash flow in rental revenue, generally without the volatility of public assets. Adding real estate to an investment portfolio provides new income flow, long-term appreciation potential, and portfolio diversification.

Commercial real estate can be a hard asset and a finite resource. It has intrinsic worth and typically increases in value over time. This asset class has generally been limited to large institutional investors due to its high cost. Still, new investment platforms such as Dolphin Property Investments have made it easier for anybody to participate in commercial real estate.

Direct commercial real estate investing has traditionally been out of reach for the average investor and their portfolios. The reason is that institutional investors often dominate commercial real estate investments since projects demand millions in capital and a deep reservoir of experience for enhancing and operating the property. Dolphin Property Investments allows you to invest effectively in a diversified portfolio of private market commercial real estate for cheap costs, low minimums, and the possibility of high profits.

Real estate has been one of the finest performing financial assets and a staple in the portfolios of many of the most famous investors.

However, most investors have generally been unable to invest in real estate (the way institutions do) without either satisfying high net worth requirements or going through a complex and expensive procedure plagued with high fees and antiquated go-betweens.

We founded Dolphin Property Investments with a clear goal: to use technology to make high-quality real estate investments affordable to everyone, with transparency and no fees.

Partner with us! We will not let you down.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.