Reits 101: A Beginner’s Guide to Real Estate Investment Trusts

What are real estate investment trusts or REITs? For the past 50 years, investors have been underestimating this investment tool.

REITs make it easier for investors of all sizes to incorporate real estate into their investment portfolios. Because of that, as many as 87 million Americans are likely to own REIT shares at this time.

What precisely are REITs? Investments in income-producing real estate are made through a REIT (real estate investment trust). Investors who desire to invest in real estate can acquire shares in a REIT, which effectively adds the REIT’s real estate to their investment portfolios through share ownership. The REIT’s whole portfolio is represented by one investment.

What Distinguishes A REIT From Other Investment Vehicles? The Basics.

What is the purpose of REITs?

President Eisenhower introduced the Cigar Excise Tax Extension in 1960, when REITs were first created in the United States. With these funds, the public can invest in a diverse portfolio of income-producing real estate. Like mutual funds, a share-based ownership model makes it similar to how a mutual fund sells shares and aggregates many different investments into a single spot.

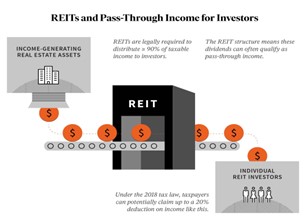

A REIT must follow a set of legal operating requirements to be recognized. At least 75% of the gross revenue and 75% of the total assets of REITs must be derived from real estate-related sources, a notable difference from other investment vehicles. At least 90% of REITs’ income from real estate investments must be distributed to investors directly by law. Measurements of FFO are often used to compare REITs and are often the most useful for this purpose.

Real estate can boost a stock-and-bond portfolio in many ways. Real estate can provide long-term growth in value and regular income in the form of dividends if appropriately managed. Investing in property is also a good idea because it can help diversify an investor’s overall portfolio of investments. Because of these operational criteria, REITs provide investors with a simple, low-cost, and low-risk way to invest in real estate. While this may be true, not all REITs are the same. A REIT’s investment strategy, or how a REIT is traded, can significantly impact many aspects of a REIT’s profitability and diversification.

What are REITs?

Once the fund has qualified, investing in a REIT fund can be done in various ways. This capital is pooled by the REIT, which uses it to fund multiple real estate investments. Direct ownership of real estate by the REIT, real estate loans, or a combination of the two are all possibilities for investment.

In order to classify REITs, there are three fundamental categories:

- By the investments they make (i.e. equity or debt, such as a mortgage REIT).

- By the way their stock is traded (i.e. exchange-traded REITs or non-listed REITs).

- The real estate industries that they specialize in (i.e. healthcare REITs or industrial REITs).

Like a mutual fund, each share of a REIT represents a portion of the fund’s assets. Therefore, any change in the value and price of a REIT’s shares reflects the overall worth of the REIT’s individual real estate holdings.

One or more fund managers are responsible for deciding and carrying out the REIT’s investment plan, just as mutual funds.

How do REITs make money?

Income

Rental payments from tenants are a common source of revenue in equity investments, which are normally paid every month. These may include:

- Paying rent

- Retail renters.

- Office renters.

Income from debt investments is generated through interest payments, which are often made on a predetermined amortization schedule as well.

Appreciation

There can be an influence on a REIT’s worth if it owns property directly (equity ownership) and the value of that property goes up. As a result, the value of the REIT’s individual shares may rise or fall as the value of the properties the REIT owns increases or decreases, respectively.

How are REIT investors able to reap the benefits of their investments?

Real estate investment trusts (REITs) and REIT investors can get the same benefits. Investors in REITs often get dividends for income-generating investments, which represent the income generated by particular real estate holdings. The REIT pays quarterly dividends to its shareholders in proportion to their percentage of the total fund’s ownership.

On the other hand, investors must sell REIT shares for appreciation-based profits. An investor receives a one-time, lump-sum payment when selling shares rather than a monthly stream of dividends and interest. When an underlying property is sold by a real estate investment trust (REIT), a capital gain dividend can be paid to investors without requiring them to sell their shares in the trust. A capital gain is typically defined as an increase in the value of stock investment, including REITs.

One of the most appealing aspects of REITs for many investors is the possibility of both appreciation and income as a return. Because real estate has a finite supply and inherent value, both types of returns can rise simultaneously. The underlying value of a property might rise along with its rental revenue potential as there is an increase in the demand for real estate. Because of this, real estate has historically been a highly profitable asset class.

Why do people like REITs?

Most individual investors wouldn’t be able to access an asset class that REITs do. Some REITs can give investors access to this asset class for less money and with less risk than other ways to invest. And most importantly, they make it easier to get into real estate.

How do REITs give you all of these benefits? For one thing, they offer regular investors access to commercial and other real estates without the high risks of direct ownership. Direct ownership requires many resources from an investor upfront and over time, including a large amount of money for a down payment. Also, a direct property investment needs much real estate knowledge, financial savvy, and ongoing property management to run smoothly and earn a net positive return.

Aside from these problems, direct ownership usually requires an investor to put a lot of money into a single asset for as long as they own it. The amount of money an investor has access to limits the number of investments most investors can make. This means that risk is concentrated in only one or a few assets. REITs, on the other hand, usually hold a portfolio of assets. This allows shareholders to spread their money across different real estate types. This lowers the risk of any one investment and increases the risk-adjusted return potential of the portfolio as a whole.

In the same way, REITs let investors buy different kinds of real estate that they might not be able to buy on their own. A property could be in one of many real estate types, such as commercial buildings, healthcare spaces, residential developments, industrial projects, and more. A REIT can offer both numbers and types of diversification.

Lastly, the shares of some REITs can be bought with just a few clicks of the mouse, which isn’t the case with most direct ownership options. But, as we’ve already talked about, it’s still important for an investor to do their research, learn as much as they can, and get good at evaluating investment opportunities before they invest.

How do REITs help you save money on taxes?

In addition to the standard tax benefits available to investors who buy REITs through traditional tax-advantaged accounts (like retirement accounts), REIT investors may also enjoy a number of other important benefits.

The first and most well-known tax benefit comes from the fact that a fund can be categorized as a REIT.

- One of the requirements for a fund to get the official REIT label is that it must give at least 90% of its taxable income back to its shareholders every year in the form of dividends.

- If a fund meets the requirements to be a REIT, then these earnings are not taxed at the company level.

- Instead, profits are given to investors and only taxed at the level of the individual investor. This eliminates the double taxation many investors have to deal with when buying regular company stocks. Since there is no tax at the company level, investors can keep more of their overall returns. Again, if a REIT’s real estate makes taxable income, investors will get 90% or more of that income within a year.

- In addition to these basic tax breaks, the Tax Cuts and Jobs Act (TCJA) of 2017 added a big tax break for REITs. Since 2018, REIT investors have been able to get more tax breaks on the taxable income they earn from REITs (that is, as dividends).

The Tax Cuts and Jobs Act (TCJA) modified the tax code to provide a 20% deduction for eligible business income paid to pass-through firm owners or investors.

Let’s look at it in more detail. Here are the main changes that the Tax Cuts and Jobs Act (TCJA) made to improve how REIT investments are taxed:

- The way the law treats pass-through businesses, which almost all REITs are, is the main reason for most of the deductions. Most REIT income is considered pass-through because, as was said above, REITs are required by law to give at least 90% of their income from real estate investments directly to investors.

- Under the law, people can now deduct up to 20% of their qualifying business income, including the income they get from REITs. Depending on the taxpayer’s total taxable income, the deduction amount could be different.

Different kinds of REITs

Let’s look more closely at what REITs have in common and what might make them different from one another. There are many ways to put REITs into groups, but there are three main ones. We go into more detail about each category and its subcategories below, but this chart shows you the big picture:

| How REITs are Categorized | |||

| By Investment Type | |||

| Equity | Debt | Hybrid (equity + debt) | |

| Advantages | High chance for growth. Strong possibilities for making money. Investing by sector is possible. | Strong possibilities for making money. Steady, fixed return. Strong safeguards against risk available. | Possible income and long-term value growth. |

| Disadvantages | Riskier than most other types of debt. Appreciation dates that are harder to predict. | No chance of growth in the long run. | Less focus on completing a single return strategy. |

| By Market Type | |||

| Public Traded | Public Non-Traded | Private | |

| Key Characteristics | Controlled by the SEC. Publicly traded on a stock exchange. High liquidity. High access. | Controlled by the SEC. Not publicly traded on a stock exchange. Low liquidity. Varying access. | Not controlled by the SEC. Not publicly traded on a stock exchange. Low liquidity. Access is limited. |

| By Sector Focus | |||

| Some REITs focus on real estate assets in a particular area of real estate or a specific industry. Some REITs specialize in almost every kind of real estate. Office REITs might focus on office buildings and skyscrapers, while health care REITs might focus on hospitals and retirement homes. On the other hand, hospitality REITs can focus on hotels, motels, and resorts. Retail REITs can focus on stores and restaurants. In contrast, residential REITs can focus on single-family homes, apartment buildings with multiple units, student housing, or housing for seniors. | |||

Types of Investments:

Based on how the financial structures of their holdings work, there are three main ways to group REITs:

- Debt

- Equity

- Hybrid (equity+debt)

Debt and equity investments have their own possible upsides, and each affects an investor’s potential return profile differently. This includes how often and how investors will get their money back.

Equity

An equity REIT takes part in the direct ownership (and often the operation and development) of the real estate assets, which can be commercial real estate and/or housing for sale. Equity REIT managers often base their investment strategies on how much physical work and money they think is needed to bring investment properties to their highest value and income-generating potential.

Some REITs focus on certain types of equity strategies within the larger category of equity REITs. For example, an opportunistic equity REIT focuses on properties that need to be renovated or developed for their value and potential rental income to go up. Other equity REITs may only buy stabilized properties that are fully occupied and bring in revenue. This is because these properties need less work and money in the long run. Equity investments can often bring in a lot of rental income, with the most potential cash flow coming from smart investments in areas that are growing quickly.

Usually, the more work that needs to be done to make a property profitable, the more money it could make, but also the more risk it comes with.

Since equity real estate investments work well for long-term goals, they are often a natural fit for an investment plan to help a person save for retirement or build a solid financial foundation.

Why equity REITs are good?

- High potential for long-term growth, such as higher relative returns and strategies that take advantage of opportunities.

- There’s limitless potential in how much money you can earn.

- The REIT could get money from rent payments from people who live in its properties.

Disadvantages of Equity REITs:

- Property management and/or improvements can add to the ongoing costs of an equity investment.

- With a higher chance of making money comes higher risk.

- There are fewer safety nets than with debt investments.

Debt

Some REITs only invest in shares of stock, while others only invest in debt. The value of debt vs. equity can often depend on how the economy is doing and, in particular, how interest rates are moving.

- Unlike equity investments in real estate, which involve owning the property, debt investments (also called mortgage investments) are loans given to equity investors in exchange for regular principal and interest payments.

- Unlike equity investments, debt investments usually have clear terms that spell out how much and when the borrower has to pay back the lender. The end of an amortization plan can be set in stone, or it can be up to the person making the plan.

- Even though the return potential of debt investments is usually not as high as that of equity investments, the relative consistency of debt and the possibility of cash flow are both good things.

What’s good about debt REITs?

- Many debt or mortgage REITs (also called mREITs) are thought to have a good chance of making a lot of money. As discussed above, these distributions are often counted as income and given to investors as dividends.

- Due to where their investments are in the capital stack, debt REITs can be relatively low risk. The capital stack is how investors are paid back in order of priority in case security goes bad. When the capital stack is set up well, investors who don’t want to take as much risk are interested in mortgage REIT assets.

Disadvantages of Debt REITs

- No room to grow indefinitely.

- How much money you can make from loans depends greatly on interest rates.

Hybrid REITs

Hybrid REITs invest in both equity and debt real estate investments, as the name suggests.

Advantages of Hybrid REITs:

- Hybrid REITs can support both long-term growth through the appreciation of their equity investments and income generation through their debt investments and rental income.

- A hybrid REIT can go after any attractive real estate investment with a mixed approach that uses debt and equity investments.

- A hybrid REIT can better deal with market forces from the outside because its portfolio of assets is made up of different types of investment structures.

Disadvantages of Hybrid REITs:

If a hybrid REIT doesn’t put a lot of focus on either equity or debt, it might not do well in terms of income or long-term growth.

Market Type

REITs can also be put into different groups based on the trade market, determining how investors can get to them. This difference is important for individual investors because a REIT’s market can affect who can invest in it and how much they can invest.

First, REITs can be roughly divided into two groups: those that are regulated by the Securities and Exchange Commission (SEC) and those whose shares are traded on an exchange.

- Like the shares of a publicly-traded company, publicly-traded REITs are registered with the SEC and listed on a public stock exchange.

- Private REITs aren’t registered with the SEC and aren’t traded on an exchange.

- The SEC registers public non-traded REITs but are not listed on a public exchange. They are also called non-listed REITs from time to time. (As we’ll talk about below, our REITs are special funds that don’t fit into any of the usual categories for REITs. But they work most like public REITs that aren’t traded on the stock market.)

Publicly Traded REITs

REITs that are traded on a public exchange are regulated by the SEC, report to the public, and can be bought and sold by anyone. Investors can readily obtain cash by trading on a stock exchange and are not required to retain the shares for a set period of time. But this daily access to money comes with a cost called the “liquidity premium,” which lowers the amount of money investment can earn.

Because liquidity is a common trait of the stock market, many investors automatically want it. But paying a “liquidity premium” isn’t always the best thing for an investor, especially if they’re looking for long-term growth where trading isn’t as important, like when they’re saving for retirement.

ETFs are another way to invest in REITs that is public and easy to sell (exchange-traded funds). Like the Vanguard REIT ETF, REIT ETF is a public fund that invests in several public REITs. REIT ETFs give people access to a number of public REITs in a single, diversified offering, similar to how an index fund holds several different securities.

One of the most significant issues with publicly-traded REITs is that their performance is closely related to the broader market. This makes the stock market volatile, and because of that, share prices tend to rise and fall with the stock market. This can happen whether or not the underlying properties that the REIT owns have changed in a significant way.

Due to this link with public markets, publicly-traded REITs don’t offer much in the way of true diversification beyond standard public market assets, which is what you would normally expect when investing in a new asset class like real estate.

Private REITs

As their name suggests, private REITs are not registered with the SEC and are not traded on an exchange. Since private REITs are not listed on a public exchange, they tend to have low liquidity. But because of this, their performance is not linked to the stock market’s performance. This means that private REITs can be an excellent way to diversify your investments across different types of assets.

Because they aren’t registered with the SEC or traded on an exchange, private REITs are only available to institutional investors and people who have been approved by the SEC. They also tend to have higher fees and higher minimum investments, which can make it hard for many investors who are eligible to invest in doing so.

Public Non-Traded REITs

Non-traded REITs (also known as non-listed REITs) have grown in popularity in recent years since the JOBS Act of 2012 made it simpler for more people to purchase them. They can be used to diversify investments, and some non-traded REITs have historically provided investors with double-digit returns.

Because the SEC regulates public non-traded REITs, they must follow the same rules as traditional public REITs. This means that they give much information to the public, such as reports. But because non-traded REITs aren’t listed on a public exchange, investors can’t sell their shares on a secondary market. This makes them less liquid.

But, like private REITs, non-traded REITs are not traded on the public market, so their performance is not linked to the performance (and volatility) of investments on the public market. Like private REITs, these traits make public non-traded REITs a good choice as an “alternative investment” or a way to add a new asset class to your portfolio and make it more diverse.

It’s crucial to understand that, like private REITs, the minimum amount you may invest in a public non-traded REIT and how easy it is to get into might vary from REIT to REIT because they aren’t listed or traded on an exchange.

Focus on Equity by Sector The type of property in which a REIT invests is another way to divide them. Here is where REIT strategies could be different. There are many different kinds of REITs to choose from. Some REITs focus on every property you can think of, from apartment buildings to data centers to self-storage facilities. There are REITs like healthcare REITs that focus on healthcare properties, residential REITs that focus on homes, retail REITs that focus on shopping, and so on.

If you want to own a specific property, there may be a REIT specializing in that type of property.

How to Invest in REITs:

Investors can buy REITs in many ways, from buying them on a public exchange to using new online investment platforms like ours.

Private Market

As was said above, institutional and accredited investors are usually the only ones who can buy private REITs. They can find the funds directly or through private networks. Private REITs are by nature limited to a small number of investors, and they usually require a much higher minimum investment than the public market or new tech-driven investment options. Because of these barriers, only wealthy, experienced, and well-connected investors with a lot of money can invest in the private market.

Public Market

On the other hand, investors can buy shares of publicly-traded REITs the same way they can buy shares of stocks, mutual funds, ETFs, index funds, or other securities on traditional public markets. Investors can easily buy shares of these funds through a broker service because they are listed on a public exchange. High liquidity is another benefit of REITs that are traded on the stock market. But because the performance of public REITs is closely linked to the performance of stocks, bonds, commodities, and other securities traded on the stock market at the market level, public REITs can’t really help investors who have a lot of traditional publicly traded assets.

Platforms for New Investment:

The emergence and rising adoption of new online real estate investment platforms that allow investors access to real estate through REITs have been one of the most interesting developments in the world of REIT investing in the last decade.

This is a significant advancement because, before the emergence of internet platforms, many REITs (including private REITs and some publicly traded non-traded REITs) imposed stringent restrictions on investors. However, regulatory breakthroughs enabled by the JOBS Act lowered the barrier to some REITs, allowing more investors to access real estate asset class.

Many of these online REITs avoid the strict exclusivity of the private market by using a direct access model. They still try to be fueled by fundamentally sound and high-opportunity real estate. Still, some real estate investment platforms only let you invest in REITs if you have a lump sum of at least five figures. Others, like ours, let non-accredited investors invest in REITs with as little as $10.

In short, real estate investment platforms give investors access to higher-quality real estate than public REITs can. They do so with a low barrier to entry, which private REITs can’t do. Consequently, online real estate could give many investors the best of both worlds. As with all investments, different platforms have different fees, details about how to get started, minimum investments, and ways to get your money out.

Our eREITs

Our platform allows anybody to invest in private market real estate for as little as $10 and receive historically reliable dividends and appreciation. Our eREIThas created a fully online real estate investment trust, called DolphineREITs, which have diversified portfolios.

As a result, DolphineREITs offer unique advantages not previously available to most investors:

- As private market investments, Dolphin eREITs offer most investors a good way to diversify their portfolios because their performance is much less tied to the volatility of public market investments than the performance of their public counterparts.

- Dolphin eREITs have no fees because they are sold directly through our online platform. This method eliminates the middlemen that many traditional investment strategies still rely on. It also cuts out the layers of costs and fees that lower the return potential of an investment.

- In contrast to other private market investments, Dolphin eREIT investments can offer limited liquidity through our redemption plans.

- eREITs are unique funds that don’t fit into any of the traditional REIT categories. However, they work most like public non-traded REITs. The SEC keeps an eye on them and makes sure they follow strict reporting rules, like annual audits and regular financial reports.

- Dolphin eREIT is open to both accredited investors and those who are not.

How It All Fits Together

As you’ve seen, there are many kinds and types of REITs. But in one crucial way, all REITs offer a big chance for many investors to add real estate to a portfolio of investments through a managed fund without the hassle and cost of owning it directly.

Real estate has been known for a long time as a historically important type of investment that could give you a more diversified portfolio, lower volatility, and better risk-adjusted returns. REITs make it easy to not only invest in real estate but also to invest in a lot of real estate assets at once by just buying the shares of one REIT. Even though not all REITs are easy to get into or cheap, many are. Because of this ease of access, a REIT is sometimes the most compelling way for a person to become a real estate investor.

In the end, it’s up to each investor to decide based on their own needs and preferences. For example, some investors won’t mind that fully private REITs have financial and regulatory limits. They might even think that the benefits of private REITs are worth it. Many other investors will choose public REITs, whether traded or not because they are easy to get to and don’t cost too much. And finally, new options like Dolphin’s eREITs may be the most appealing choice for many investors. No matter how much you know about investing, there’s a good chance you can find the right REIT.

Investing in real estate can be easy and cheap if you use REITs. Any investor who wants to invest in real estate should talk to their tax advisor about the possibility of doing so through a REIT.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.