Value Investing isn’t just for stocks. Yes! That is right. This concept can also be applied to real estate. What this does is we pick up stocks, assets, and properties for a lower price than what it is originally worth. It is a great idea especially for beginners as it is quite simple to learn, low-risk, and can have significant return. For a short-term period, this is actually shown to have great benefits, as this can also lead to the prices going down. Which is a good buying opportunity, as market prices will always go up. However, the downsides include in-depth research and patience as trends and values vary.

‘It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.’

-Warren Buffet, Value Investor Extraordinaire

Most people connect value investing with Warren Buffett studying financial data from firms and newspapers or a well-worn copy of Professor Benjamin Graham’s seminal work on “The Intelligent Investor.”

Worth investors look for firms underestimated by the rest of the industry for whatever reason and are trading at a point below their market value. They employ fundamental research, which differs from investor to investor, to discover underpriced assets. Worth investors always purchase companies for less than their inherent value and are the one constant.

The same applies to investments in commercial real estate: higher cap (cheaper) real estate will continuously offer greater risk-adjusted returns. Rather than equivalent investments in highly desired, so-called low cap-rate, more costly quality properties, and markets.

The Story of Two Investors

You could encounter two sorts of commercial real estate investors throughout your travels. The first group is obsessed with high-quality homes in high-quality markets, ready to pay exorbitant rates. The second category comprises people willing to seek beyond the quality box, to hop on a plane and hunt for lower-quality houses in secondary markets.

Markets with strong demand and excellent quality predominate in the institutional arena. Large portions of smaller American cities will be unnoticed by private equity firms, pension funds, sovereign wealth funds, including other institutional investors. These sectors get neglected since they do not meet the standards of the market’s major participants. They ignore these areas at their peril because recent research suggests that value investment assets (cheaper homes in less expensive markets) outperformed other assets in raw and risk-adjusted returns.

Commercial Real Estate Value Investment Strategies

Researchers Greg MacKinnon, Eli Beracha, and David H. Downs sought to ascertain if value-oriented commercial real estate investing offers any ROI benefits in their 2017 study, “Value Investment Strategies for Commercial Real Estate.” According to their research, investing in undervalued assets in undervalued markets consistently offers better risk/return ratios than doing the same with lower-cap, more expensive properties. In other words, the study examined whether investing in low-cap-rate (expensive) or high-cap-rate (cheaper) homes was better.

The study’s origins may be tied to Warren Buffett, arguably the most well-known investor and market-maker in history. Although he is arguably a known advocate and practitioner of value investing, he is by no means the only finance expert who worships at the altar of Good Value.

Researchers have been studying the performance of value investing since the early 1980s, and practically all available data supports the assumption that value equities outperform growth stocks. While the original study focused on equities markets, researchers eventually looked at other asset classes to see whether or not the benefits apply. They observed that value investing outperforms growth investing in almost every asset class, including currencies, commodities, and bonds.

Understanding Cap Rates Across Markets and Time

The National Council of Real Estate Investment Fiduciaries, or NCREIF, provided the property-by-property level database from which the MacKinnon research drew inspiration in significant part. They collected information on cap rates, which they calculated by classifying the income returns on US-based properties as high or low.

What is high and low, then, is a valid question. Time is the key to everything. Let’s imagine, for illustration, that you own an office building with a 7 percent cap rate. That was regarded as a high amount in 2019, given the market state. However, that would be a modest cap rate in the early 1980s. The regional market also had to be considered when assessing whether a cap rate was high or low; for example, a cap rate of 7% may be excessive in Manhattan but weak in St. Louis or Indianapolis.

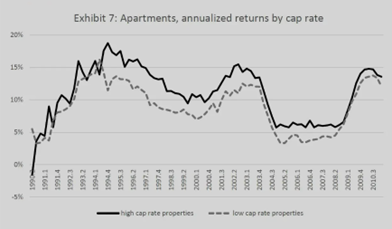

In terms of performance, the findings of the researcher’s exhaustive data analysis revealed without a reasonable question how high-cap-rate (cheaper) properties outperform low-cap-rate (more expensive) properties. It applies to all property types and over the whole economic cycle. It is also true in terms of absolute and risk-adjusted returns. Value investing concepts in real estate is not a uniform reality, but it is as close to it as historical data allows.

The absolute return differential is substantial, nothing to take lightly.

Identical positive results, as we previously noted, were observed across property kinds. From 1979 to 2010, the researchers examined all the portfolios and found that high-cap-rate office buildings outperformed low-cap-rate office assets by an average of 75 basis points annually. High-cap-rate apartments exceeded low-cap-rate in the multifamily market by 212 basis points annually or more than 2%. Industrial properties outperformed their low-cap relatives by 156 basis points annually, while high-cap-rate retail beat low-cap by 182 basis points annually.

What About the Dangers?

Even if you’re a novice investor, you understand that you can’t only look at returns—diligent investors must consider risk vs. return to acquire a picture of an investment or asset class before deploying cash. To calculate risk-adjusted returns, the study’s authors determined that if a valued asset exceeds the average by 70% or more of the time, it reflects a risk reduction. Because value-focused real estate investments beat comparable assets 70-95 percent of the time, the authors determined that these assets were less hazardous than the average property investment. Value real estate is a superior risk-adjusted asset due to its continuous greater returns over time.

In Reality, How Can Investors Benefit From Commercial Real Estate Value Investing?

If you remember one element from this study, it should be the “benefit” of focusing on smaller markets overlooked by institutional/large-scale investors. Seek attractive assets in such markets and buy them at an affordable cost using standard due diligence.

In addition to providing higher immediate cash flow returns, less costly properties regularly outperform more expensive ones concerning capital growth. According to the findings of “Value Investment Strategies for Commercial Real Estate,” you would obtain much greater total returns over the long term when compared to the identical acquisition in a growing asset or high-dollar market.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.