Many investors think they understand financial terminology like preferred equity, but they may each be thinking of something different, which can cause confusion and misunderstanding.

This article defines preferred equity and explains how to discern the difference between the various types.

Preferred Equity Definition

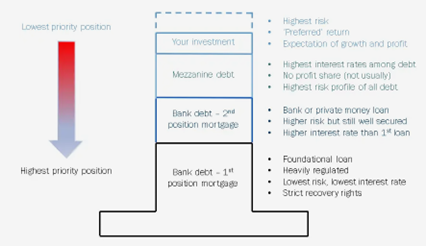

Preferred equity works similarly to preferred stock in the corporate sector in commercial real estate. Preferred stock has a position above ordinary equity as the “capital stack” but is inferior to all other types of debt. Owners of preferred shares start receiving dividends with associated payments after lenders get repaid.

When a sponsor has to fill a financing gap or when the sponsor wishes to reduce debt and boost liquidity, preferred stock used to fill the gap frequently.

Preferred equity is more expensive than ordinary equity, but on the plus side, investors often receive better returns that mature more quickly than common equity. Preferred equity holders, therefore, take on less risk than ordinary stockholders if a real estate venture underperforms.

Preferred Equity Types

Every real estate transaction uses a combination of equity and debt financing.

While the stock is payable as interest (usually referred to as a “preferred return”), a share of the profits and debt is repayable with interest. The main difference between the two sorts of capital is this.

These financial categories each have several subcategories that may be categorized further.

There are various types of debt, such as senior debt, commonly issued by banks, second-position debt, which is subordinate to senior debt, third and fourth position debt, etc. All of which are sequentially subordinate to senior debt.

Every type of debt is viewed as a loan secured by the property and is supported frequently by liens filed against it.

To provide official documentation. If the borrower fails to make payments as agreed, liens are placed on the underlying real property.

Through foreclosure, lenders can launch recovery initiatives that might ultimately lead to regaining ownership of a borrower’s property.

Mezzanine Debt

Mezzanine debt is always financed last among other forms of debt, comes before any equity, and is always subservient to any other recorded debt.

The property, however, does not serve as security for mezzanine financing.

Instead, by filing a UCC financing statement against the partnership interest, mezzanine debt establishes a claim on the deal’s equity.

Mezzanine financing is seen as a loan to the project and mezzanine investors are regarded as lenders, which grants them different recovery rights than equity holders, although their position is unprotected against an interest in the underlying real property.

The bank debt with a first position mortgage, sometimes referred to as senior debt, is at the bottom of the stack (see figure above) and is the most reliable of all the capital; it serves as the basis upon which all other funding is put.

The second layer of debt, or position debt, can be added on top of it.

Next comes the mezzanine debt, which may be divided into preferred and common stock, and the equity.

Because it carries more risk, second place debt often earns a higher interest rate than debt in the first position.

Mezzanine debt, meaning “between two distinct types of capital,” is the last tier of funding in the capital stack before the equity layer.

Preferred Equity

Banks encountered difficulties foreclosing on homes with mezzanine debt attached to them during the economic crisis of 2008–2009.

Banks now incorporate restrictions against adding additional layers of debt, including mezzanine debt, on top of the senior position in their loan papers due to mezzanine holders’ ability to have excessive influence on the ownership of the real property while acting in their capacity as lenders to projects.

Preferential equity is being employed in place of mezzanine financing to cover the void caused by its absence. Preferred equity has authority over common equity over all other debt, just like mezzanine debt does.

The investors in preferred equity are not recognized as lenders, although preferred equity does not receive a portion of the transaction’s profits. As its name implies, preferred equity is not debt.

But what are preferred equity investors if they are not considered as lenders to the project – a crucial distinction from mezzanine financing – and yet do not receive a profit-sharing agreement as ordinary equity investors might anticipate?

Preferred equity differs from mezzanine debt in that the following process allows investors to protect their interests:

In the case of default, preferred equity holders, who are members of the LLC managing the real estate, may take over management of the LLC.

In relation to preferred equity, recourse is solely a result of how the operational corporation is setted up and how the various parties are connected.

Furthermore, because preferred equity investors are only a distinct class of stockholders in the business that manages the real estate project, they do not constitute an additional layer of secured debt and hence provide fewer compliance challenges to lenders.

The only option available to mezzanine debt holders, who are not LLC members, in the event of failure is a UCC foreclosure that would allow them to seize the whole LLC.

Preferred equity and mezzanine debt investors assume control of the property owned by a partnership, as opposed to a loan lender with a lien who would acquire ownership of the real estate itself.

Although the purpose of preferred stock is to cover any gaps left by mezzanine financing, an operating agreement might contain a wide range of rights and remedies.

Therefore, knowledgeable investors should examine these rights and remedies when evaluating various preferred stock investments because no two “preferred equity” arrangements are similar and can differ.

What Sort of Debt Is Usually Secured?

When it is possible, the majority of sponsors will often use traditional funding. Traditional debt, which comprises investments made by banks, life insurance companies, pension funds, and other institutional investors, is typically supplied at the lowest cost and is thus a sponsor’s first preference when attempting to secure loans.

Typically, traditional debt will account for around 60% of the financing for real estate purchases. Depending on how the deal is structured, the sponsor may seek additional funding, such as mezzanine debt. The remaining 10-20% might be paid through mezzanine loans (sometimes more, sometimes less). The remaining 20–30% of the investment must be covered by the sponsor and its equity investors, which include preferred equity and regular equity stockholders.

Hard vs. Soft Pay

Preferred equity holdings can differ significantly in various ways, including how they are paid for—whether softly or hardly.

Hard pay operates more like a debt instrument, with harsh consequences for nonpayment.

The operating agreement will specify that the operating company must pay a specific amount on the first of each month and repay the entire debt within a set time, say three years.

Pure “hard pay” remedies, such as wiping out all subordinate stock and seizing control of the partnership interest, might be used if the business controlled by the sponsor fails to make any of those payments.

It is similar to mezzanine debt in this regard.

Banks dislike hard pay preferred equity holdings for this reason specifically.

Since the bank is providing a loan to the sponsor, it does not want subordinate positions to have the authority to seize control of the operational business to which they are providing a loan.

Soft pay conditions, which are more palatable to lenders, only call for the sponsor or operational company to make payments when there is enough cash flow so; if payments are not made, there may or may not be remedies available to the preferred stockholders.

In addition, even if preferred equity is paid before common stock, there could be “hard pay” conditions requiring the reserve for preferred interest to be set aside.

The preferred equity holders will be payed out of this reserve, even if common stockholders may get the initial income distributions from cash flow.

Risks to Novice Investors

For inexperienced investors, this mix of many interests and alternatives might increase their risks.

A sponsor may be able to present a transaction to a group of people who don’t comprehend whether the agreement is good or bad if they put together a contract that serves their best interests, such as a soft-pay preferred equity arrangement.

Essentially, it can provide the sponsor the ability to spend the preferred stock funds at their discretion.

As a result, there are significant distinctions between various forms of preferred equity.

Before investing, investors are made aware of their rights and how they may differ across different types of preferred shares. It is crucial since rights can be affected significantly.

Why Invest in Real Estate with Preferred Equity?

Preferred stock investments are made for a variety of reasons. In the first place, it’s a method of making real estate investments without assuming ownership duties directly. Second, it reduces risk if a deal goes sour by allowing investors to get their money sooner than ordinary equity owners.

Before common shareholders receive their dividends and after the debt providers have been paid back in full, preferred equity investors start to get their part of the project earnings.

And last, preferred equity frequently generates double-digit returns in the current real estate market, when values have continued to rise. For investors wishing to enter the commercial real estate market who have exhausted all other entry points, preferred stock is a very alluring prospect.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.