Yale University is one of the well-known ivy-league schools in the world. It offers courses with the top educators for its students. It is known to have the second ranked endowment fund after Harvard. It is valued 42.3 billion USD as of 2022, which covers at least 35% of the school’s expenditure.

Real estate investing has several advantages. It has no correlation with stocks and bonds and functions as a hedge against the stock market since its value rises and falls more slowly than the economy. Furthermore, well-chosen properties provide a high rate of return, attractive tax treatment, and consistent value growth.

However, how much of a portfolio should be made up of real estate?

Consider Yale University’s endowment as a valuable teaching tool. The university’s investing practices have been successful, reliable, and extensively replicated with $29.4 billion now under control. In general, real estate makes up 9–11% of Yale University’s endowment’s investment portfolio.

How does this impact the remainder of us? Not everybody should create their portfolio using the Yale approach. Incorporating real estate and other nontraditional assets into a portfolio is, ultimately, easier than it sounds.

Bulldogs Seeking High-Performance Opportunities Turn to Real Estate and Private Equity

A strong endowment is defined by Yale as the benchmark. One-third of all operational costs for the institution, including staff and scholarships, are continuously covered by its returns. According to the Yale Investment Office, the Ivy League institution “dramatically decreased the Endowment’s reliance” on equities and bonds 30 years ago. Portfolio managers aggressively shifted toward real estate, raw materials, and other alternative assets while institutional distribution methodologies like absolute return were in their infancy.

The Yale approach is unavoidably criticized for avoiding equities for years while the stock market is strong. According to the most current investment update from Yale, Cambridge Associates, endowments typically invest close to half of their assets in public shares. Yet at the end of 2017, just 3.9% of Yale’s portfolio was held in domestic stocks, with the remainder being invested in alternatives, making up 75.1% of the total. In addition to absolute return instruments, investment opportunities would include real estate, natural resources, venture capital, and leveraged buyouts.

The model is undeniably successful. Pension and other fund managers outside the ivory tower adopt a longer-term investing approach similar to Yale’s. Willis Towers Watson reports that over the past 20 years, pension fund allocations for real estate, private equity, and infrastructure have climbed from 4% to around 20%.

Savvy investors are aware that real estate is a long-term endeavor.

As market conditions change or for investors whose livelihoods depend on continuous earnings, real estate is a lengthy, illiquid investment that can be difficult to leave. It does have one benefit. The appeal of panic selling, which decimates so many investment portfolios, is shielded from investors devoted to real estate assets. The most recent endowment report states that real estate serves as a cushion against inflation in the Yale portfolio. It made up 10.9 % of Yale’s total asset allocation in 2017.

Real estate offers an opportunity for investors to profit from market inefficiencies if they have a broad portfolio and the resources to devote to long-term investment methods. These can include instances when a seller is unaware of the value of a property or value-adding opportunities where purchasers can address issues preventing appreciation. However, as any cash-strapped landlord can attest, keeping a sizable portion of your assets in real estate may be restrictive when major life events like paying for university, etc.

How Much Should You Spend on Real Estate?

Real estate may be bought by anybody, regardless of money. The returns from publicly traded real estate investment trusts (REITs) may be reliable and high. Investors have the same buying and selling options for REITs as they have for stocks, allowing them to take advantage of the growing real estate market without dealing with the management challenges associated with actually owning buildings. But much like stocks, REITs are impacted by market turbulence. They change in response to market conditions.

Alternatives to REITs and direct property ownership are available to accredited investors. The risks for private equity real estate are now within range for corporates and high-net-worth individuals thanks to new fundraising regulations. There are now affordable substitutes for REITs with money in the private equity real estate market. (Full disclosure: My firm provides this kind of investment fund.) In order to diversify the risk and lessen the possibility that the portfolio may lose value due to a single investment, these funds are invested in a number of institutional-grade properties. Considering that they do not have the same level of direct control over where to invest or how to maintain their assets as landowners have, investors in funds must become knowledgeable about the investment plan, track record, underwriting policies, personnel, and goals of a fund manager. It’s also important to be aware of the drawback of needing private real estate investments to be made over at least a 5-7 year period.

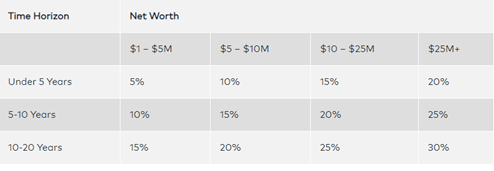

But how much of a portfolio of investments should be made in real estate utilizing either approach? According to net worth and time horizon, below is a typical formula for allocating real estate assets. The time requirements for each investor’s investing goals will vary, thus suggestions are not the only factor to be taken into account.

A portfolio with a wide range of investments might potentially generate enormous wealth while hedging against market risks. No retirement plan or family portfolio has a perfect asset allocation. Yale’s model, however, suggests a more useful approach to considering investments and their potential for better returns.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.