The Introduction

A well-diversified investment portfolio should include private real estate, yet it remains a challenging and unfamiliar asset class for many investors. This book lays out a step-by-step plan for accredited investors considering investing in private real estate. Let’s start with the basics: how personal real estate benefits portfolios, the most typical investment methods, and what percentage of an investment portfolio should be comprised of private real estate.

Investors may rely on us to guide them through spectacular property flyers to a more realistic business strategy that takes account of their risk tolerance. Private real estate investments face a wide range of risks, and the most popular forecasting measures and fees are discussed in this article.

The Advantages of Private Real Estate

To put it another way, private equity real estate investing is taking direct ownership of tangible real estate assets intending to profit from them. These assets can be anything from land to office buildings, rental homes, flats to self-storage facilities. Equity in a piece of property is what it means to be an owner. Private real estate investments can be made by direct acquisition of assets or passive investment in a private real estate investment fund (PRIF), an internet platform, and a non-traded private REIT.

Individual investors benefit from numerous aspects of private real estate, including high returns, portfolio diversification, and tax efficiency. Institutional investors have long recognized this asset class’s value and used it to temper market volatility in their portfolios. Consider Yale’s endowment, which is regarded as the gold standard for its extraordinary performance; real estate accounts for 10% of its investment portfolio. Unsurprisingly, most endowments and pension funds adhere to a similar investment strategy. On the other hand, individual investors have recently begun to recognize this technique and add private real estate to their portfolios.

The $27 billion in assets in Yale’s investment portfolio, considered the gold standard due to its extraordinary performance, is allocated 10% to real estate by Yale’s endowment.

Advantage #1: High Absolute Returns are Generated by Private Real Estate

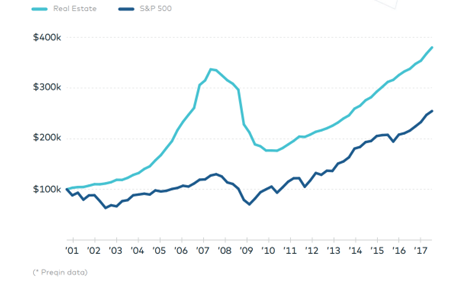

Investors in private realty can obtain substantial absolute returns. The investment earned over time is indicated as a percentage gain or loss on the initial investment and considers appreciation, depreciation, and cash flows. If we believe the research firm Preqin, which measures the performance of alternative investments, a $100,000 investment in private real estate is starting on January 1, 2001, would be worth approximately $380,000 on March 1, 2017. According to the figure below, a $100,000 investment in the S&P 500 would have risen to $255,000 on March 1, 2017.

Advantage #2: Low Correlation Between Private Real Estate and Other Asset Classes

Every portfolio’s purpose is to maximize overall return while minimizing risk. As long as the stock and bond markets are volatile, most people are okay with a diversified investment strategy. Because it is immune to the standard shocks of trade, private real estate aids investors in reducing portfolio volatility.

A private real estate fund’s worth is derived from its properties. The market forces determine the price of a share in a public REIT, which implies that it may not reflect the actual cost of the underlying real estate price of a stake in a public REIT. The share price of a REIT can be 30% higher or lower than the underlying real estate’s worth, depending on the market conditions.

As a result of the fact that private real estate values don’t change significantly daily but increase gradually over time, private investments are subject to less volatility than their public counterparts. Both vehicles have advantages and disadvantages, and the best portfolio will contain a mix of both. The public markets provide investors with liquidity; however, this comes at the cost of increased volatility. On the other hand, private investments provide investors with low volatility; however, this comes at the expense of illiquidity.

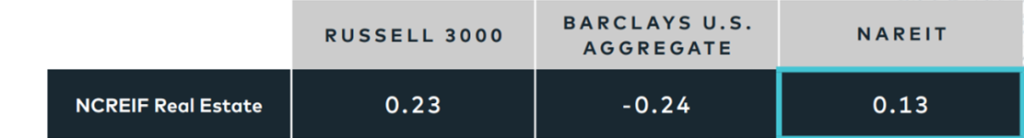

The chart below shows how the National Council of Real Estate Investment Fiduciaries (NCREIF) property index (NPI), which examines the returns of private institutional grade commercial properties, has minimal correlation to equities, bonds, and even public REITs.

Having a correlation coefficient of 0 indicates that price fluctuations are uncorrelated. Assets with a correlation coefficient of 1 move in lockstep; those with a correlation coefficient of -1 movement in the other way. When an investing portfolio includes asset classes that are not correlated to each other, it benefits substantially.

Advantage #3: Private Real Estate is Tax-friendly

Investors who are only concerned with the returns an investment generates before taxes and pay no attention to the yields it generates after taxes are missing out on a significant benefit of real estate investing. Most of the time, the income created by properties is insulated from taxation thanks to depreciation, which offers long-term benefits to investors in the form of significant cash flow with a relatively low tax burden.

Owners can take annual losses in the form of depreciation under IRS guidelines to smooth out future capital expenditures as buildings age. Depreciation solely affects the physical components of a property. Real estate value is distinct from the value of land, which cannot be depreciated. A multifamily building, for example, can be declined in a straight line over 27.5 years. If the property was purchased for $6 million and sits on land worth $1 million, it will generate $181,818 in non-cash depreciation yearly. Divide $5 million times 27.5 to get $181,818 as a result.

Hedge funds and other alternative vehicles have tax rates as high as 37% on ordinary income, while the average tax rate for individuals investing in real estate is between 20% and 25%. A property that produces $100,000 in cash flow but the depreciation of $50,000 means that only $50,000 is taxed. If an investor falls into the highest tax bracket at the federal level, the tax liability is calculated as.37 x $50,000, which equals $18,500, or an 18.5 percent tax rate on the cash flow of $100,000.

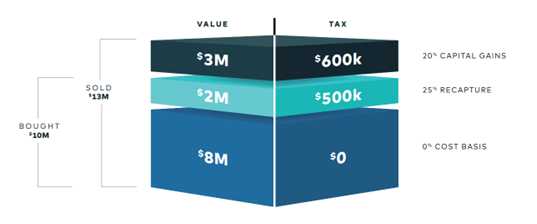

On the other hand, the property sale will result in a recapture rate of 25% for the property amount that has been depreciated. Putting it into practice looks like this: a purchased piece of property for $10 million and depreciation of $2 million was taken into account, the cost basis for taxes would be only $8 million. When an asset is sold, the difference in its cost basis and the original purchase price is subject to taxation at the rate for recapture.

In addition, if the property is held for more than a year, the long-term capital gains rate of only 20% will apply to any investment appreciation above the original purchase price. Expanding on the previous example, if the property is worth $13 million, the difference of $2 million between the IRS tax basis of $8 million and the purchase basis of $10 million would be a 25% recapture rate. The increase in value from $10 million to $13 million would be taxed at the capital gains rate of 20%. At the time of sale, the adequate total tax liability would be $500,000 + $600,000, or $1.1 million. The following graphic provides a more in-depth visual representation of the procedure.

The possibility of postponing the payment of taxes indefinitely by using a 1031 exchange is yet another advantage real estate offers in tax planning.

With the help of the 1031 exchange tax rule, real estate owners might avoid paying capital gains taxes on their profits and use the proceeds to purchase another. In principle, a real estate investor may buy and then sell properties without worrying about paying taxes on any gains. One of the most essential and valuable factors of having direct ownership of real estate is the opportunity to postpone payment of taxes to a later date.

Finally, because private equity real estate is often owned in an LLC, which the IRS considers a pass-through corporation, 100% of the profits, losses, and expenses are passed on to the owners. Because the LLC is exempt from federal taxation, LLC owners are not subject to the double taxation that applies to corporations (where the corporation pays taxes on its net revenue and the owner pays taxes on any dividend income they get). Instead, the K-1, which serves as a year-end tax document, is used to tax each member individually. In most cases, they pay a lower tax rate than a company.

To outline the many advantages of owning private real estate:

- Investors can earn significant absolute returns on their private real estate investments.

- To phrase it differently, if you had invested $100,000 in the S&P 500 on March 1, 2017, it would have been worth $255,000 on that date.

- Because it is immune to the standard shocks of trade, private real estate aids investors in reducing portfolio volatility.

- To calculate a private real estate fund’s worth, you need to know how much money the fund owns in a property.

- If you seek a precise illustration of a public REIT’s worth based solely on market factors, you may want to look at a private REIT.

- In some circumstances, the REIT’s share price can be 30 percent higher or lower than the real estate’s actual value.

- An essential benefit of real estate investing is overlooked by investors who only consider the investment’s underlying returns and neglect its post-tax yields.

- Depreciation shields property income, allowing investors to reap the long-term rewards of considerable cash flow and a low tax bill.

- Owners can take annual losses in the form of depreciation under IRS guidelines to smooth out future capital expenditures as buildings age.

- Since there is no method to write down the worth of land, the value of the land itself needs to be considered with the value of the property.

- Itself. If the property was purchased for $6 million and sits on land worth $1 million, it will earn $181,818 in annual non-cash depreciation.

Types of Investing

- Active Investing

Active investing occurs when buyers own and manage an asset outright, independently, or in collaboration with family, friends, or acquaintances. They can make quick decisions and take advantage of opportunistic endeavors because they usually make decisions alone or with a few other partners. However, given the significant resources and experience required to acquire and operate investment-grade commercial real estate, buyers face tremendous obstacles to entry.

Buying property on your own isn’t impossible, but it comes with increased responsibility. Investing in real estate involves a variety of duties, including locating suitable properties, negotiating the purchase price, securing financing, collecting rent, and managing repairs and maintenance. When many investments are required to establish a diverse portfolio of properties, these obligations are magnified, especially when more funding is needed for tenant improvements, leasing commissions, and remodeling costs.

Unfortunately, in many instances, investors do not have the required experience. As a result, they unknowingly buy real estate assets that need more time, resources, renovation, and upkeep than was initially anticipated. They may not have produced the appropriate business plan to make the investment profitable or focus on too few assets to build a varied real estate portfolio. Either of these issues could have contributed to the failure of the project. They could put them in a position where they are exposed to an unending danger due to the guarantees given for their liabilities and debts.

- Passive Investing

Passive investing is a form of real estate investing in which an investor pays a management a percentage of the profits for their services rather than managing their investments. To purchase more extensive or entire portfolios of properties, managers combine money from several investors and manage all of the day-to-day operations of these assets. Their responsibilities include acquiring properties, carrying out business strategies, and reporting to investors. Direct ownership of the underlying properties and the benefits are still available in this scenario.

Companies offering passive real estate investment options come in many forms. A non-traded private REIT, an internet crowdfunding platform, or a private equity real estate fund are all options for investors. In the event of a lawsuit or another unforeseen incident, investors are shielded from unlimited liability by owning real estate through Limited Liability Companies (LLCs).

For easier comparison, Active investment is when buyers own and manage an asset outright, either by themselves or with family, friends, or acquaintances. It can be done by active investors alone or in groups. Because they typically make decisions alone or with a few partners, they can act quickly and seize promising business opportunities. Given the significant amount of resources and skills necessary for the acquisition and management of the commercial real estate, buyers face high barriers to entry. On the other hand, Passive investing is when an investor chooses to outsource their real estate investments to a manager. Managers pool money from numerous investors to buy more extensive or whole portfolios of properties. Investors can put their money into a non-traded private REIT, an online crowdfunding platform, or a private equity real estate firm. When these alternatives are selected, the real estate is almost always held in the name of a Limited Liability Company (LLC).

In Private Real Estate, Who Can Invest?

Typically, private real estate investment is only open to accredited investors, a federal rule by the federal government. Reg A+ vehicles allow non-accredited investors to participate in private real estate investments for as little as $500.

Those individuals who satisfy at least one of the following criteria are considered accredited investors:

- A personal net worth of more than one million dollars, or joint net worth with their spouse of more than one million dollars (not including the value of their primary residence);

- An individual’s income that has exceeded $200,000 in each preceding two years, with the assumption that it will do so again this year;

- Income with their spouse has exceeded $300,000 in the last two years, with the likelihood of exceeding the same amount this year;

- On behalf of a business or investment firm with assets over $5 million and equity shareholders who are all accredited.

Strategies and Risk Levels Present in Real Estate

Before investing in a private real estate portfolio, investors must weigh their risk tolerance against the time horizon they are ready to wait before seeing a return. Long-term gains with high yields, but little or no liquidity, maybe the exclusive emphasis of confident investors, whereas regular income with more regular dividends may be the goal of others.

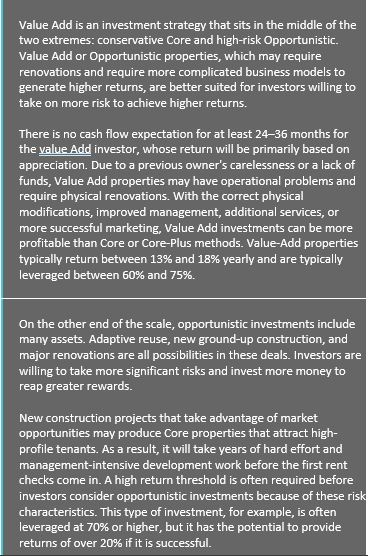

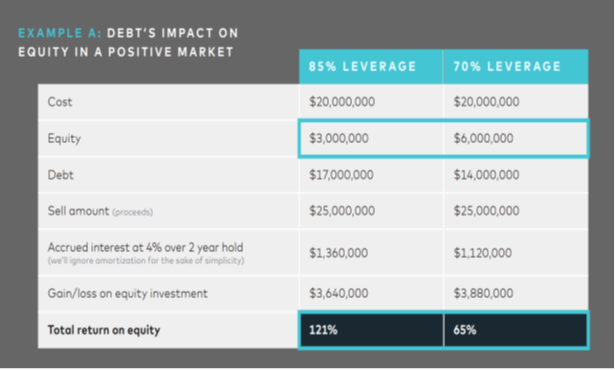

Core, Core Plus, Value Add, and Opportunistic are the four basic real estate strategies used by real estate operators to attain these investor goals. As a result, each requires a different form of leverage, as debt directly impacts the amount at which an investor is willing to take risks. The following table shows the danger and influence associated with various types of investments.

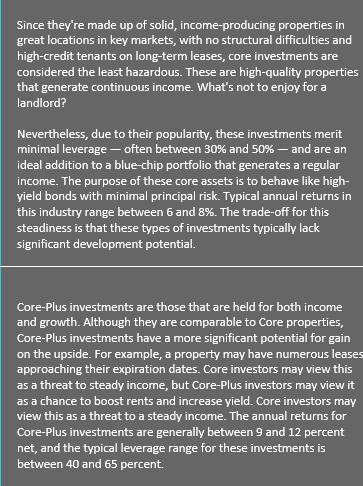

Core investments are considered the least risky because they involve stable, income-producing properties with no structural issues. The role of these core assets is to behave like a high-yield bond with little downside risk to the principal. Typical returns in this sector are around 6–8% annually. Now, Core-Plus investments are held for income and growth. Core properties may have a high proportion of leases up for renewal. Returns for Core-Plus are around net 9–12% annually.

With Value Add, it holds the middle ground between conservative Core and Opportunistic high-risk properties. Value Add investments have the potential to be more lucrative than Core or Core-Plus strategies. The targeted returns for a Value Add property average 13% to 18% annually, and they are typically leveraged between 60–75%. Finally, Opportunistic investments are on the far end of the risk spectrum and cover the broadest range of properties. These deals can involve massive turnarounds of an existing property or new ground-up development. The unifying strategy is for investors willing to take outsized risks and put in higher upfront costs to achieve excessive returns. For instance, these investments are typically leveraged 70% or more, though they can generate returns above 20%.

According to risk tolerance and time horizon, the following matrix might assist investors in choosing which types of private real estate investments are most appropriate.

Guidelines for Portfolio Allocation

Private real estate should make up a small percentage of the investor’s overall portfolio. “Don’t put all your eggs in one basket” applies to real estate and the markets. Private real estate, like equities and bonds, is cyclical but not daily.

The name “illiquid” comes from the fact that it might take months or years to release an investor’s funds, making it an impractical choice for those who require quick access to funds for things like rent or college tuition. But investors continue to pour money into this profitable asset class despite the risks. According to a Tiger 21 poll quoted by Bloomberg, high-net-worth investors with a combined portfolio value of $51 billion held an average of 33 percent of their assets in private real estate. Individuals’ net worth and time horizon play a role in determining the best allocation, but each person’s circumstance is unique.

For instance, a family office worth $300 million may feel happy having more than 50% of its investment in illiquid assets. In contrast, an accredited investor with only $1 million in investable capital may not feel comfortable having any money invested in illiquid assets. In contrast, investors may be pretty content with a powerful illiquid position in their retirement account. Still, they may not be content with such a position in their personal savings account, which they may need to access at a moment’s notice. This difference in comfort level is because an investor may need to tap into their retirement account anytime. Illiquidity is a situation that needs to have the necessary management performed on it. The question that has to be asked is how much money should be set aside for an unexpected expense?

Illiquidity isn’t always a significant hindrance to investing in private real estate, so long as an investor has a cushion of cash for unforeseen circumstances. Fear sets in when the market goes down, and many investors make unwise decisions. Investors tend to panic at the bottom of a stock market meltdown when they should remain with it.

There is strong evidence to support this claim. Co-authors Gary Belsky and Thomas Gilovich noted in “Why Smart People Make Big Money Mistakes and How to Correct Them” that “by pulling your money in the short-term stock market drops, you run the risk of missing the productive days.” It’s incredible how much you can accomplish in a day when you’re working hard. They did the math: “If you missed the 90 best-performing days of the stock market from 1963 to 2004, your average annual return would have dropped from almost 11%. to slightly more than 3%.”

It so happens to be a substantial sum of money. The co-authors estimate that “on a $1,000 investment, those different rates of return translate into the difference between having $74,000 after four decades and having about $3,200.” It reminds us of another advantage of real estate investment: illiquidity might prevent panic-driven knee-jerk decisions.

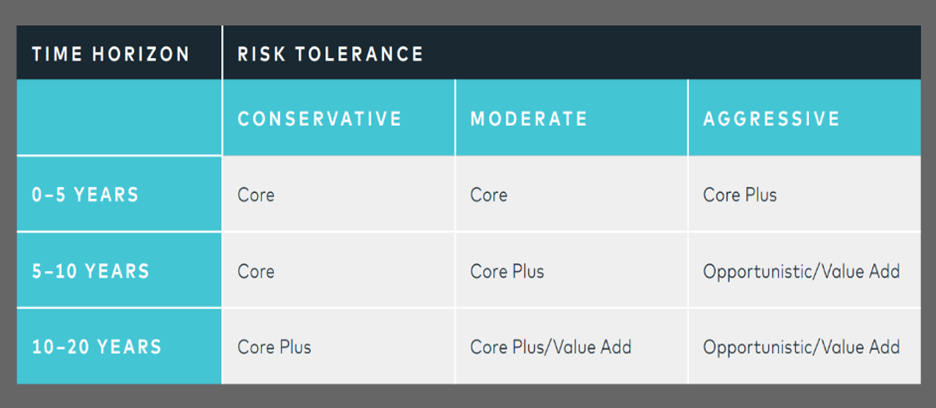

The matrix below guides a potential real estate investment distribution based on net worth and time horizon.

Funds Investing versus Deals

Investors must decide how much time and effort they are willing to commit to real estate before they begin. To establish a portfolio of real estate deals, an investor must have extensive knowledge of the market and sufficient time and resources for property acquisition. They can also invest in a real estate fund that is diversified. There are advantages and disadvantages to each method.

Real Estate Deals for Individuals

Many websites, such as RealCrowd and Crowdstreet, give users access to individual discounts. These platforms are the go-between for the investor and the real estate operator in a transaction. Rather than entrusting the process to management, many investors choose this choice because they simply like the control they have over selecting the businesses that they want to pursue rather than entrusting the process to someone else.

Private Funding for Real Estate

Multiple projects, each with its business plan, are joined in funds. Individual investors can benefit from this. Putting money into a private real estate fund that is well managed allows investors to take part in many more transactions than they would be able to on their own, and experts handle the responsibility of conducting due diligence on each property. It is true even if the investors have enough money to buy a few properties. They can be positioned in multiple cities simultaneously to take advantage of booming market conditions. If one of your properties fails, it won’t have a domino effect on the rest of your investments, allowing you to spread your risk more evenly. Individual investments in business deals do not provide the same return on investment as a portfolio. Investors lose a lot of money when a deal goes bad.

Private real estate funds can be challenging to find. When looking for a wealth manager, the most incredible way to start is by asking them for recommendations, but investors should thoroughly research every deal, fund, and manager. Later in this article, we offer advice on how to conduct due diligence.

Analyzing the Risk Present in Real Estate

We all know that the value of real estate can grow and decline at any given time. Which direction are we most likely to see, and how much? Is the predicted return on the investment worth the risk? One can expect a more significant gain when taking up a greater risk. However, the opposite is also true: a greater likelihood of failure comes with greater danger.

Thus, if one manager returns 20% but takes twice as much risk on a real estate investment, the lesser return is better on a risk-adjusted basis than the larger one, which returns 15%. A 15 percent return fund is more likely to provide downside protection and have a tighter range of expected returns because it takes on half the risk of the fund generating only 10 percent. The risk-reward profile of each real estate investment should be considered when making a decision.

Consider the following variables while analyzing any private real estate deal:

- Risk in General Market

Every investment has its highs and lows, which are directly related to the state of the economy and factors like interest rates, inflation, and other market movements. Investors cannot avoid market fluctuations, but they can lessen the impact of such volatility on their portfolios by diversifying their holdings over a wide variety of asset classes, such as equities, bonds, public REITs, and private real estate assets. Effectively diversifying across geographies and industries and effectively managing liquidity can be facilitated by maintaining a healthy mix of public and private real estate investments.

- Risk at the Asset-level

When it comes to investing in real estate, each different kind of property comes with its own unique set of dangers. Apartments, for instance, are always in demand, regardless of whether or not the economy is doing well, which is one reason why multifamily real estate is regarded as a low-risk investment. But because of this, apartment buildings typically have a lesser return on investment. Office buildings are less susceptible to consumer demand shifts than shopping malls. Still, hotel investments carry a significantly higher level of danger due to their reliance on tourist traffic and business travel. Multifamily and office investments are less volatile than hotel investments.

- Idiosyncratic Risk

Risks unique to a particular asset or business plan are distinctive. Every trade has its own fantastic set of challenges. For example, it will limit a project’s ability to collect rentals during development. In addition to construction risk, investors who build a property from the ground up take a broader range of threats.

The danger of a project not being able to move forward due to lack of permissions from government bodies having authority over it; environmental risks such as contamination of the soil or pollution; financial overruns; and other risks, such as political or human resource risks, can also be encountered.

Another distinctive risk factor is the location of the facility. For example, property values near Chicago’s version of New York’s High Line, The 606, are soaring. In contrast, property values behind Chicago’s Wrigley Field, which were utilized for private rooftop parties, moved from boom to crash investments.

Idiosyncratic risk exists even in seemingly secure and passive investments. A tenant’s creditworthiness can swiftly shift, making or breaking an investment. As brick-and-mortar establishments have been devastated by the competition of internet commerce, tenant bankruptcy examples have grown typical in retail real estate.

- Risk of Liquidity

When an investor is unable to sell a piece of property swiftly, there is a possibility that liquidity risk is to blame. In a city like Houston, regardless of the state of the market, an investor may anticipate that there will be a large number of potential purchasers present during the bidding process. On the other hand, property in Evansville, Indiana, will not have quite the same number of market participants, making it simple to enter the investment but challenging to exit. When beginning investment in real estate, it is essential to plan how you will sell any properties you acquire. Smaller markets might be fine for investors who intend to keep the property for the rest of their lives, but they shouldn’t be considered for properties with a finite business plan or for investors who might require their money at a moment’s notice.

- Risk of Credit

The length of the property’s income stream, as well as its consistency, are important drivers of value. There is never a time when there is no chance that anything will go wrong with the property’s cash stream. Compared to a multi-tenant office building with comparable rents, a property leased to Apple for the next 30 years will command a far higher price. However, even the most creditworthy renters’ landlords can lose their money if the tenant goes bankrupt. Do you remember when landlords were overjoyed to have major retailers such as Sears and J.C. Penney anchor their shopping centers?

The vast market for so-called triple-net leases, which force renters to pay taxes, insurance, and improvements and are sometimes said to be as safe as U.S. treasury bonds, might trick property investors. These leases oblige tenants to pay for taxes, insurance, and improvements. Investors are willing to pay a higher price for a piece of real estate if it has a consistent revenue stream since this makes the asset behave more like a bond with a predictable income stream. On the other hand, the landlord of a triple-net lease assumes the risk that the tenant will continue operating their business for the duration of the lease and that there will be a buyer waiting in the wings.

- Risk of Replacement Cost

Increasing demand for space in the market will lead to increased lease rates in older properties, which will eventually justify new construction and create supply risk. What if a more unique, better facility with equivalent rentals replaces the investment property? Investors may be unable to raise rents or even achieve satisfactory occupancy rates. To assess the scenario, one must know the replacement cost of a property to determine whether or not a new building can come along and grab those renters.

There are several factors that investors should take into account when trying to calculate replacement costs for a given property. For new development to be economically viable, investors need to know whether or not rents can climb to such a level. A 20-year-old apartment complex, for example, may soon face competition from newly created offerings if it can lease flats at a rate high enough to support new construction. Rents in the older building may not be able to be raised, and occupancy may have to be reduced.

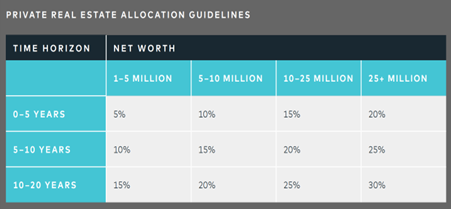

- Risk of Leverage

The riskier an investment is, the investors should expect a greater return. In good times, leverage can speed up a project’s progress and boost its profits, but in bad times, when the project’s return on assets isn’t enough to meet interest payments, investors might lose a lot of money quickly.

Generally, investments with higher debt capitalization yield higher returns on equity.

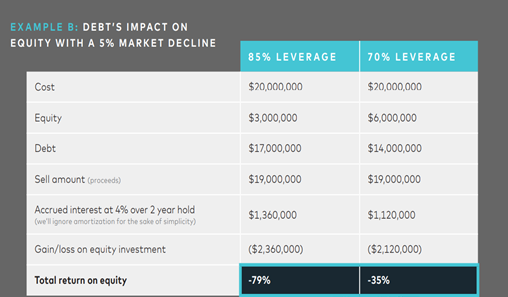

As seen in the following illustration A, there is a significant difference in return on equity when debt is 85% versus 70%. It takes $3 million to fund an 85 percent debt-financed project, while $6 million in equity is required for a 70 percent debt-financed project that yields a 65 percent return on equity.

The scenario in Example B shows how debt works both ways and how rapidly results can shift in a down market. Those with 85 percent leverage would lose 79 percent of their invested capital if the market fell by just 5 percent, whereas investors with 70 percent leverage would lose only 35 percent.

Mezzanine and preferred equity, combined, should not exceed 75% of the total debt. Rather than relying on undue leverage, returns should come from the property’s performance. Investors don’t have to steer clear of high-leverage ventures altogether; they just need to ensure they obtain a recovery that matches the risk.

Sadly, no fixed rule or scale determines the exact incremental return that one should anticipate obtaining for one greater leveraged investment over another. It makes it impossible to compare the returns of different investments. When contrasting various investment opportunities, evaluating each on an unlevered basis is helpful. This rule will level the playing field significantly.

In most cases, the option with a more significant return unlevered will yield a superior risk-adjusted return if the debt is applied; this presumes that all of the inputs are realistic.

- Structural Risk

Nothing about the building’s structure is relevant here; the focus is on the financial system of the investment and the rights it grants to individual investors. A joint venture is a type of investment property that a group of different investors owns, and this is where structural risk is concerned.

Shareholders in joint ventures must understand their legal and profit-sharing rights, which are laid out clearly in the partnership’s operating agreement. The operating agreement details how much remuneration they have to pay the LLC manager while ownership and when a property is sold; this information will be included in the contract.

Suppose an investor is a limited partner in the business. In that scenario, the overall gross profit will be lower than it would have been otherwise because of the payment made to the managers of the limited liability business. If the business transaction is successful, the operating agreement provisions will explain to the investor what share of the profits they will get if the venture is profitable.

Should the need ever arise, the operating agreement also delineates the specific parameters that must meet to fire a manager. Every successful partnership begins with positive goals and having a trustworthy companion can be invaluable. On the flip side, it is the most frustrating thing to have a terrible partner who doesn’t know what they are doing, conducts unethically, or is undercapitalized. In the agreements, the conditions for the dismissal of managers and the minimum required percentage of limited partners should be outlined. It is essential to search for a manager who is likewise strongly invested in the deal, is well-capitalized so that they are on an equal footing with the limited partners, and is well-compensated when the agreement is successful in ensuring its success.

Return on Investment Analysis

When attempting to quantify their rate of return on investment, real estate managers most frequently turn to the equity multiple and the internal rate of return as the two most valuable tools at their disposal. Equity multiples and the internal rate of return (IRR) are critical financial calculations that an intelligent real estate investor should be familiar.

Invested capital is multiplied by the equity multiple to determine how much money an investor will make at the end of the deal. A multiple of two means that an investor who invests $1 million gets back $2 million. When one knows the multiple on equity, they can understand the actual impact investment has had on their overall net worth.

IRR stands for internal rate of return and refers to the time-weighted compounded annual percentage rate each dollar gets while it is invested. It considers the value money has acquired over a specific time. Simply entering the cash flows from an investment into Microsoft Excel and using the “=IRR” function is the quickest and easiest method to determine the internal rate of return.

The internal rate of return has several built-in restrictions, which will be discussed in greater depth later on in this guide; nonetheless, the primary problem with IRR is that it does not quantify the amount of wealth created by the investment. Although an internal rate of return of 17 percent over five years may sound fantastic, it is not so terrific if it only provides a multiple invested equity of 1.3.

IRR cannot be spent in any way.

Investment Return Comparison

The total amount of money earned by investment in real estate on an annualized basis is an annualized total return. When making investment judgments, many investors make the potentially expensive mistake of comparing the internal rate of return (IRR) to the annualized return. Investors in private equity real estate can find several short-term investments that offer strong IRR. However, investors need to pay special attention to the amount of time it took to attain the internal rate of return and the amount of actual wealth produced when considering the IRR in conjunction with the multiple on invested equity.

For instance, an IRR of 30 percent over three months would only amount to a total return of 7.5 percent. On the other hand, real estate does not qualify as a liquid investment. The real opportunity and return on investment lie not in making profits in the near term but rather in keeping it for a long time. It is preferable to have the investor’s capital create an annualized return of 12 percent over three years rather than an internal rate of return of 18 percent over three months.

One of the most common errors made by investors is the pursuit of high internal rates of return (IRR) through investing for short periods. Before committing to a private real estate investment, an investor should evaluate the manager’s historical IRR track record in conjunction with the track record of the equity multiple. It will allow the investor to determine the amount of actual wealth created for investors by the manager.

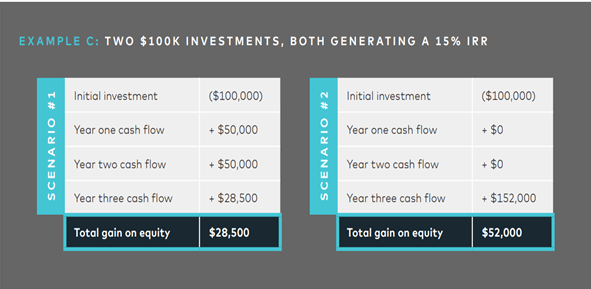

In the following example, C, we examine two ways to invest $100,000. A 15% IRR was generated for both situations. However, the second scenario’s investment gained significantly more money than the first, despite having their money tied up for three years. The first scenario yielded a gain of 28.5% on equity, but the second scenario created a total income of 52.5%. When investors received cash flow in scenario one, they would have had to invest it elsewhere quickly. One can never know what investments may be accessible in the future; therefore, reinvesting dividends takes time, effort, and self-discipline.

Improving cash flow early on can assist reduce risk following the concept of IRR. Investing in long-term cash flows has a higher risk than investing in short-term cash flows. On the other hand, cash flow is likely to be immediately invested after it is received.

- A real estate investment’s annualized total return is the average amount of money it makes yearly.

- When making investing selections, many investors make the costly error of comparing IRR to annualized return.

- Investors need to know the period it takes to obtain the IRR and the natural wealth gained by using IRR in conjunction with the multiple on invested equity.

- Private real estate investors should assess the manager’s prior IRR and equity multiple track records to see how much actual wealth the manager earned for investors before committing.

- To minimize risk, getting money back as soon as possible is beneficial.

Method for Manipulating IRR

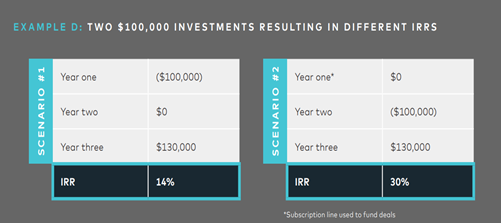

IRR is calculated utilizing the flow of money from and to investors. Generally, the IRR is higher when contributions and distributions are spaced closer together. Due to their control over the timing of cash flows, managers can easily skew the IRR. There is no straightforward method for determining the difference between managers that generate value and those that financially engineer returns.

Among fund managers, the most popular method of fabricating IRR is to use a subscription line, a credit facility given by a bank that is collateralized by the commitment of the investors. Fund managers use subscription lines to close agreements fast and maintain their cash reserves. Because the bank is confident that the fund manager will be able to raise funds from investors to pay down the line, they are ready to lend them a reasonable amount of money. Funds typically have a three-year investment horizon, and subscription lines usually expire simultaneously.

A manager can manipulate IRR by funding transactions straight through the subscription line and then keeping the deal there for as long as feasible rather than calling funds from investors. It allows the IRR to accumulate at a higher rate. With the help of a flexible subscription line, a manager can put off calling in the capital for years. It also results in a significant increase in the official IRR of the investment. Still, it comes at the investor’s expense, who must wait on their initial commitment and pay fees while the management loads up the subscription line with offers. Worse still, managers often receive enormous incentive fees for higher IRRs, which means a manager could utilize an investor’s balance sheet to their advantage to obtain inexpensive capital to generate more money from fee income.

Managers can readily manipulate IRR in example D. Each scenario involves a $100,000 investment, with all transactions taking place inside the first year. IRR of 14% is achieved by calling all of the investor’s money instead of using the subscription line. A subscription line instead of calling investors’ funds until the second-year results in an IRR of 30 percent in the second scenario.

You must also examine private real estate managers for their investment performance and capacity to provide a good IRR. A manager’s track record is the strongest predictor of how they would perform in terms of IRR. Since IRR can’t predict future returns, managers who have previously used IRR manipulations will likely do the same thing again.

Key Features of a Manager

It is impossible to accurately forecast the asset’s future value of real estate with precision. A financial model is built on hundreds of assumptions, and all are left up to the investment manager’s whim. The promise of significant returns lies at the heart of every private real estate investment. Most businesses will come short of their goals, with some even going out of business. As a result, private real estate investors face the issue of determining which possibilities will meet or surpass expectations and which ones will serve as a “learning” opportunity.

When it comes to investing in real estate, the people with whom one supports are far more critical than the properties themselves. It is up to the manager to choose what price to pay for an asset, how to generate value, the proper capital structure, how to course correct when things go wrong, and when it is time to depart the market. A skilled manager will be grounded in reality and carefully consider the presumptions. They are finding a real estate manager you can trust to act reasonably and responsibly is of the utmost importance for success in this market.

During the process of due diligence, it is essential to question a manager appropriately with the questions that need to be asked. After that, it will be easy to determine whether or not their investment plan is compatible with the personal risk profile of an investor. Imagine this meeting as a job interview, in which the investor is looking for a manager who will be a responsible custodian of their funds and a reliable business partner. Sadly, many deals are funded based only on the quality of marketing materials. In addition, the current market is filled with many financial professionals that lack the necessary qualifications yet present themselves as specialists.

To choose the best property managers, investors should ask the following ten questions and check for the answers to gain a clear image of the manager’s strategy, ethics, and future performance. Keep in mind, however, that just because a manager doesn’t fit all of the requirements on this list, it doesn’t imply they should be written off. Listening for clues in their answers that reveal their sincerity and morality is essential.

- How Have your Previous Transactions Performed?

Creating a fake track record is difficult. An excellent way of measuring how well a new chance will turn out is to look at the previous triumphs and failures of the manager in question. You should evaluate them on whether or not their deals have produced consistent results. An IRR of 15% over the past decade without losing money is vastly different from a 15% IRR over the same period, but only half of the time. Because of this, it’s doubtful for a manager to promise a 30 percent return on their new fund if they’ve never previously achieved that kind of performance.

Investors aren’t enticed by the promise of significant returns from good management. Realistic expectations are created to fulfill or exceed those standards in good and bad times. To make money in real estate, you can’t expect investors to take on many risks.

- What Percentage of Your Money are you Putting to Work?

Alignment is the most critical factor. Alongside the investors, the manager should put up a sizeable portion of their money (money that was not contributed by anybody else). In addition, most of their earnings should come not from transaction fees but from investment returns. The concept of a manager having “skin in the game” ensures that the successful outcome will drive them. Managers should be successful if their investors are successful and fail if their investors are failed.

- In What Ways is Your Team Rewarded?

From acquisition to sale, an asset requires a collaborative effort. Through performance, it is vital to ensure that the team is aligned. Asking the manager if their team is compensated based on transactions or performance is a good idea for investors. As well as find out how well they keep critical members of their staff.

Several conflicts of interest need to be minimized in this industry. For example, ensuring that the team is compensated based on results rather than transactions is one method to achieve this goal. Investors should also ensure that the current management team is the same one that has delivered the manager’s returns in the past.

- What is Your Edge in the Market, and How can you Leverage it?

It is essential to understand the manager’s perception of the strengths and weaknesses of their team in comparison to those of other competitors in the market. This edge over the competition is typically something that can quantify. For instance, if they claim that their competitive advantage lies in sourcing chances, you might inquire how many different deals they consider before settling on the finest one and the source from which they obtain their values. If their operational superiority is their competitive advantage, then they should be able to compare themselves against a standard for their industry.

- How do you Engage with Investors?

The ability to communicate effectively is critical to the health of any relationship. Because being in the dark is the worst possible situation, one of the most crucial aspects of a competent manager is the ability to provide timely and accurate reporting. Investors must ensure they receive quarterly reports by paying close attention to the dates and requesting sample reports from the most recent agreements. Note the topics covered in words and whether or not the manager keeps investors informed of both positive and negative news. Even if the performance of the investment is what ultimately matters the most, a manager who communicates poorly can be the source of many restless nights and a great deal of anger.

- Are your Financial Model’s Assumptions Realistic?

There is precisely the same number of inputs as there are outputs, and the management has the last say on every single one. The business plan assumptions of real estate management can never be 100% correct. Managers should run stress tests on all of the inputs to their financial models, determining the impact of any underperformance on those inputs on the expected return on investment. Understanding how an investment will perform if and when things don’t go as predicted is the foundation for protecting the downside and limiting losses.

How do you get a sense of an individual’s approach? By asking about assumptions, they use them in their model and see what the deal looks like when beliefs are carried to an extreme. For example, changing the growth rate or the cap rate can significantly impact returns.

The net operating income is the next thing to consider. Increased occupancy and rental rates significantly impact net operating income, which exemplary managers generate. Take a look at their projected revenue growth and occupancy rates. Every contract has a stabilizing occupancy assumption. Check to see if the property’s price is in line with, or significantly below, the market average.

Investors need to be aware of the manager’s treatment of expenditures. All costs related to implementing the business strategy will rise. Thus the management must apply a reasonable inflation rate to all of them. Ensure the manager reset property taxes based on the new purchase price and does not use old figures. It can have a substantial impact on the bottom line. In addition, make sure that the manager takes into consideration the underwriting of a growing interest rate market and a rising cap rate. Higher interest rates should be accounted for in every model.

Make sure you know the manager’s leverage in each arrangement. Power, as we’ve already established, has the potential to boost your profits if you use it wisely. Deals that use mezzanine finance and preferred equity to inflate their value artificially should be avoided. Make sure to inquire if the manager uses cross-collateralization. Asset cross-collateralization is the practice of using one asset as collateral for another. To prevent concentration risk and maximize return, assets in a fund should not be cross-collateralized.

During the financial crisis, individual real estate investors lost a great deal of money because of this strategy, which is popular in real estate debt funds. Also, determine if the manager is personally guarantying loans, as this can be disastrous for the manager and the investors if the loan is repaid early.

A key consideration is whether their business plan is practical, as most strategies fail because they were poorly thought out from the start. A Class A property can’t house low-income renters simultaneously; this is only simple logic. A company’s business strategy must be simple to comprehend and make logical sense to be successful.

- What was your Worst Business Transaction, and What did you Learn?

Every manager has had their share of terrible experiences. When investing, looking for a manager with real-world experience and a track record of success is best. Good managers are honest about their missteps, what they learned, and how those deals shaped the firm’s investment strategy. Investors must determine if these are isolated incidents or if the manager has a track record of pursuing risky ventures with faulty business models. Knowing if the manager kept shareholders informed of any adverse developments is critical. Integrity can be judged by how they treated the investment through a difficult time.

- Could you Put me in Touch with One of your Current Investors?

Investors should also try to speak with one of the company’s present investors and an investor from the company’s past. Inquire about their previous experiences and determine whether or not they would suggest the management. An investor with a lot of initiative may also use LinkedIn to get in touch with one of the company’s former workers and ask them about their impressions of the business.

- What is the Source of your Company’s Funding?

Is the company able to pay its debts on its own, or will it need to rely on its investors for further funding? Look at their balance sheet to see if they risk going out of business. Stay away from managers getting their feet wet or working with a limited budget. Consider waiting before investing in a fund until Fund II or III, when the problems have been ironed out. When investing, working with an experienced and well-funded team is critical.

- What Does your Fee Include?

The fees charged by a manager are also a significant component of the verification process. Successful real estate investing necessitates a very well staff, and transaction fees go a long way toward funding that crew. It takes someone to find the property, negotiate the price, and create marketing materials and legal documents. Also, raise equity, manage the property daily, formulate and implement a business plan and report to investors, provide K-1s, sell the asset, and distribute the proceeds of the sale. Having a great team costs money, so management pays fees to attract and keep top-notch staff.

You don’t want to make only a real estate investment decision based on fees. If you’re looking for a low-cost real estate transaction, you will pay for it in the long run. Asset managers and business plans have the most significant impact on a project’s success. The complexity of a company strategy affects fees, which should be linked to the value the manager can provide. There isn’t a definite market rate fee, but there is a reasonable range.

To avoid being surprised by hidden fees, prospective investors should thoroughly investigate the structure before investing. Marketing materials and the Private Placement Memorandum should detail fees under the Sources and Uses of Capital section, which is essential reading when considering any investment opportunity. Ask the manager about the fees they charge and how they are arranged.

Fees not driven by them should guide an investor’s decision regarding where to invest. After all, one must consider the costs, and the return on investment is the most crucial factor in determining whether or not the risk is worth the reward. In the next section, we’ll talk more about costs.

Investment Fees in Private Real Estate

The fee structure should be performance-based, so the manager benefits from the investor’s success. In private equity real estate funds, there is a difference between fees used to generate investor value and excessive fees that solely benefit the fund management.

Transaction and performance-based fees are the two most common fees in real estate investment management.

Transaction Fees in Real Estate

The fees associated with transactions are guaranteed. The management pays these fees regardless of how successfully the deal is completed. The following is a list of the most typical transactional fees.

Acquisition Fee

It is more customary for managers to charge this fee when they are syndicating individual deals. The percentage of the general agreement that constitutes the acquisition fee is often between one and two percent, and its exact amount is typically determined using a sliding scale. The cost is discounted in proportion to the size of the transaction. It is a market rate price, and its justification lies in that the management probably looked at fifty different agreements before settling on this one. The manager has already paid out using their pocket for all the expenses associated with the dead transaction and staff.

Additionally, the terms used in legal documents are quite important. Instead of being based on the amount of equity involved, acquisition fees are calculated based on the full deal size. This fee is a significant difference because an acquisition charge of one percent of a property valued at thirty million dollars amounts to three hundred thousand dollars. Therefore, the required equity may only be $10 million, which means that the $300,000 fee is equivalent to a 3 percent cost of equity invested. Since most properties are often leveraged using two-thirds debt as a standard, the equity required may only be $10 million.

Committed Capital Fee

This fee ranges from 1 percent to 2 percent of the committed equity and is often levied by real estate funds referred to as capital. This charge is paid to the manager regardless of whether or not the money is invested. They should not collect an acquisition fee if a fee for committed capital is imposed because doing so constitutes “double-dipping,” a term used in the financial services business. When dealing with individual investors, many managers make the unfortunate mistake of trying to get away with double-dipping.

Investment Management Fee

This cost, frequently referred to as the Asset Management Fee, is levied by funds and managers who sponsor individual deals and is payable to the sponsoring party. This fee takes the place of the committed capital fee for real estate funds once the capital has been invested. It ensures that investors are not charged twice on the same amount of capital for the same fund. The amount of the commitment fee is directly proportional to the amount of money invested. The cost of investment management is typically covered by this charge, ranging from 1 percent to 2 percent of the total equity capital invested. The terminology is essential; hence, this fee must be a function of the amount of stock contributed rather than the full size of the deal.

Set up and Organizational Fee

Setup expenses are incurred by both real estate funds and individual deal managers. In most cases, these costs are paid by the investing company as a whole. Legal, marketing, technology, investor relations, and other fees related to capital raising and founding the investment business are all one-time upfront costs. A percentage of the total equity is usually charged between .5 to 2%.

Regarding individual transactions, these expenses aren’t usually listed separately in the marketing materials but are bundled along with the property’s purchase price. For investors, it is essential to know what this charge is used for and ask the manager to clarify the terms in detail.

Administrative Fee

These costs include tax reporting and audits, fund administration, and third-party software. On average, they fall between 0.10 and 0.20 percent annually, calculated on the value of the equity deposited.

Other Transaction Fees to Keep an Eye Out for are:

- Debt Placement Fee

Paying a fee like this to an outside broker is common practice when setting up debt. This practice is considered a standard operating procedure in the financial business. Depending on the transaction amount, the customary charge ranges from 0.25 percent to 0.75 percent of the entire debt. A skilled broker may be able to save a project significantly more money than the price that is being requested here. However, some managers try to add their internal fee on top of a debt placement fee, and the amount can range anywhere from 0.25 percent to 0.75 percent. It significantly affects equity because the amount of debt utilized in a typical transaction is twice as tremendous as the quantity of stock used.

- Refinancing Fee

This Refinancing fee is comparable to a fee charged for the placement of debt, and certain managers’ payment for this service ranges from 0.25% to 1%.

- Wholesale Marketing Fee

This fee, typically paid to the broker-dealer for product distribution by non-traded REITs, is equivalent to around 3 percent of the equity.

- Advisor or Syndication Fee

Many real estate businesses, such as privately held REITs, use broker-dealers to distribute their goods through advisory networks. These consultants often receive compensation from an up-front, one-time charge ranging from 4 percent to 7 percent. Some sponsors will offer a lower upfront cost, but they will then tack on expenses for acquisition or transaction. These commissions are sometimes omitted from the fine print that itemizes the costs of capital expenditures.

- Joint Venture Fees

Joint ventures do not add a layer of costs alone; instead, the investor is responsible for paying two managers rather than just one. Suppose the investment manager’s only responsibility is to provide access. In that case, the fees they charge should be far lower than those set by a manager who provides value to the joint venture by carrying out the business strategy.

- Selling Fees

Bringing a project to market to maximize its potential value is always a best practice. Depending on the scale of the project, brokers typically receive compensation ranging from one percent to three percent of the final sale price. On top of that, certain managers will impose their internal fees, anywhere from 0.25 percent to 0.75 percent.

Even while this could seem like a lot of fees, an intelligent manager will limit the types of fees they charge and the amounts they charge for each. The transaction fees are intended to maintain operations but are not designed to generate a profit for the company. Although we don’t believe that costs should play a role in the decision-making process, they can provide insight into the management. It is abundantly evident that the manager does not have the investor’s best interests in mind if they make it their mission to squeeze every last penny out of the transaction by demanding guaranteed transaction fees.

Performance Fees for Real Estate

The performance fees are determined by the level of profitability achieved by the real estate investment. They are utilized to align the manager’s interests with the investor and are widespread in almost every private equity transaction, even those unrelated to real estate. The performance and incentive fee typically paid to managers allows them to pay between 20 and 30 percent of the company’s profits.

In the context of real estate investments, the term “investment waterfall” refers to a strategy for unequally dividing monetary earnings between a manager and an investor. This strategy is used to implement investment waterfalls. In the vast majority of waterfalls, the manager is given a disproportionate share of the total profits compared to the amount of money they invested. For instance, a manager may only contribute 5 percent of the total investment capital yet still be eligible for 20 percent of the profits from the investment.

Performance fees are typically subject to something that is known as a preferred return hurdle. This fee is the rate of return tier (typically defined by a specific internal rate of return or equity multiple) that needs to be achieved before the manager can begin participating in the profits. Performance fees are typically subject to this type of hurdle. These levels are what determine the different profit distributions for the business. It is possible to think of the desired return as an interest rate on investor capital, which typically falls between 7 and 10 percent annually. However, this return is not guaranteed.

European and American waterfall structures are the most prevalent versions of these arrangements, employed in real estate funds and individual deals. In a European waterfall, investors are paid back one hundred percent of all investment cash flows in direct proportion to the amount of capital they have invested. This European waterfall continues until the investors have received their preferred return in addition to one hundred percent of their initial investment. After these distributions have been made, the portion of the profits that the manager receives will increase. This waterfall is utilized in real estate fund structures most of the time.

In the American waterfall, the manager is entitled to receive a performance fee before the investors receive 100 percent of their capital back, but typically after receiving their preferred return. In other words, the performance fee is paid after the investors have received their desired return. There is usually a provision in the papers that indicates the manager is only permitted to take this fee for as long as the management reasonably expects that the fund or deal will generate a higher return than the preferred one. This provision is included to protect investors. It is not unusual for income products with more extended hold periods or transactions with hold periods that are longer than ten years to be structured with this kind of waterfall.

Investors should ensure that the management is motivated by the investment return if they use a waterfall structure because it can affect investing behavior. Investors must ensure that the administration does not take a performance fee even if the investment does not perform as expected. The secret to profitable investing is to find a framework in which everyone’s interests are aligned from the very beginning of the venture.

A technique for unequally sharing earnings between a manager and an investor is referred to as an investment waterfall in the context of real estate investments. The profit generated from an investment in real estate is used to calculate the performance fees. In the vast majority of waterfalls, the manager receives a fraction of the total earnings that is disproportionate to their level of responsibility. In a European waterfall, investors receive a return directly proportional to the amount of capital they have committed and equal to one hundred percent of all cash flows generated by the investment. Most of the time, real estate fund arrangements will use a waterfall like this one. In the American waterfall, the manager is permitted to receive a performance fee before the investors receive 100 percent of their capital back, but often after receiving their chosen return. American waterfall occurs before the investors receive the total amount of their initial investment.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.