The COVID-19 epidemic has significantly changed where we spend our time in marketplaces around the nation. We predict that the market for real estate types including offices, accommodation, and retail will continue to decline as a result of these deep transformations. However, as more professionals choose to work from home, people are placing a higher value on their houses and apartments, which is maintaining the high demand for multifamily real estate. We are seeing tenants leave expensive coastal regions to move to cheaper suburbs altogether new cities as most of us reconsider our existing living arrangements.

A Retrospective

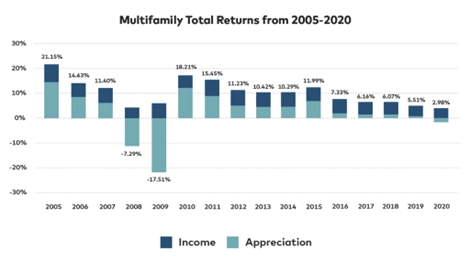

Historical framing is a useful viewpoint when things are unknown. To predict potential future developments in the real estate market, we have analyzed data from the Great Recession of 2009 as a useful framework. From 2005 to 2020, multifamily total returns are divided by revenue and appreciation in the graph below. In this context, income refers to distributable dividends from activities that boost returns and offer safety during a decline.

Multifamily property investment valuations from 2005 to 2020, which included the years of the Great Recession, averaged a 7.98% compound annual growth rate (CAGR), what is most striking is how rapidly the industry recovered from the losses of 2009 and then proceeded to post six years of double-digit gains. Even though this data serves as a helpful baseline, we would anticipate that the Great Recession had a greater impact on real estate than what our present pandemic may have on it. It is because the Great Recession was primarily driven by real estate and debts secured by it, which is not the situation today.

Data courtesy of NCREIF and Newmark Knight Frank Research. The total returns for 2020 have been annualized.

Having vs. Needing

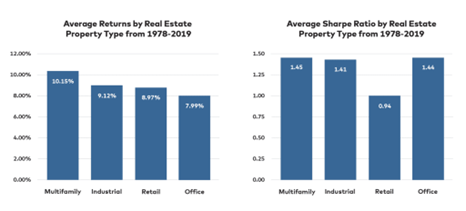

In comparison to other real estate asset classes, multifamily has for the previous 42 years produced the best average returns and returns per unit of risk (see charts below). Given the importance of housing, these findings shouldn’t come as a surprise. The last thing that consumers trim during a recession is their home costs; instead, they prioritize travel, leisure, and retail purchases.

A world where people appreciate their house or apartment’s size and quality has also emerged as a result of this year’s epidemic. Nowadays, a fair number of people work from home, making coffee shops and bars unsuitable settings for socializing or working. Nowadays, having a place to work and socialize requires multifamily real estate. During this time, multifamily property owners who can reimagine their buildings as multipurpose areas and develop novel solutions to meet residents’ increasing needs stand to gain.

This information was derived from historical returns of the NCREIF Fund Index – Open End Diversified Core Equity, which is a capitalization-weighted, gross of fee, time-weighted return index that typically indicates lower risk real estate investment strategies employing minimal leverage and is often represented by equity ownership holdings in reliable U.S. operational properties across geographies and real estate properties.

Findings from Collecting Rent Data

With such a high unemployment rate, how are renters supposed to survive? This is a typical question posed by potential investors. Rent collection records, on the other hand, suggest that renters are more resilient than previously thought. Collections increased by 91.7% between April 2020 and June 2020, as reported by statistics from the National Council of Real Estate Fiduciaries. The National Multi Housing Council estimates that 94.6% of the full rent was settled in April 2020 and 95.9% in June. In 2019, 97 to 98 percent of the unpaid rent was collected.

Strong Holdings for Occupancy and Rate Data in Non-Coastal Markets

Although collecting rent is wonderful, what occupancy and rate should you use? RealPage reports that, on average, 95.7% of multifamily units are occupied nationwide. Our multifamily portfolio has witnessed an increase in occupancy, with Dallas, Austin, and Phoenix seeing the most demand. On a national level, non-coastal towns are increasingly charging higher rent and having greater occupancy rates.

Despite a countrywide decline in rent of 1% in the second half of 2020, there is a clear distinction between coastal and non-coastal cities. Renters are increasingly choosing to move to cheaper suburbs or new cities altogether because many of the coastal cities were quite expensive.

Debt is inexpensive.

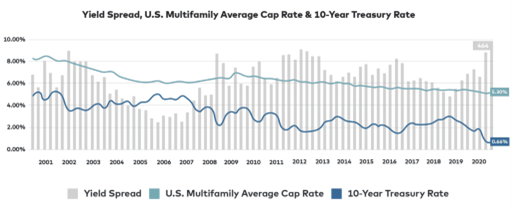

Information compiled by Newmark Knight Frank Research, the Federal Reserve Bank of St. Louis, and Real Capital Analytics.

Real estate investors today enjoy higher profits because of the historically low borrowing costs for financing real estate. Loans with variable interest rates are now more expensive than the one-month LIBOR rate, which is currently.16%. LIBOR ranged from 1.75 to 2 percent before the outbreak. The current yield on ten-year notes is.68%, and there is now a gap of more than 450 basis points between that yield and capitalization rates. The fact that Fannie Mae and Freddie Mac issued more loans in April, May, and June of 2020 than they did in 2019 is significant because it has lowered borrowing costs for multifamily real estate. Leveraging below 60% loan-to-cost, borrowing rates for stable real estate frequently fall below 3%, sometimes even as low as 2.5%.

Multifamily Appraisals

The value of the multifamily real estate hasn’t fluctuated significantly despite the epidemic. Since the start of the epidemic, we have kept track of all institutional transactions of multifamily assets in all 11 targeted cities. 90% of the transactions over the last five months have happened at prices that were either level with February 2020 (pre-COVID-19) prices or within 2% of those prices. A 4.9% drop in multifamily property investment in non-coastal cities has so far been documented by Real Capital Analytics. We anticipate that multifamily real estate valuations will stay strong as long as borrowing rates are kept low.

The market appears to still have faith in the potential of multifamily real estate as an asset class, just like us. In our perspective, the enormous demand for multifamily assets from investors and renters, along with low borrowing rates, will provide the possibility for a phenomenal performance in multifamily real estate investing during the next three to five years.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.