Those who routinely put money into private equity real estate funds will be familiar with the challenge of keeping cash on hand. Most private real estate investors put up a set amount of money at the outset of a fund and add to it as opportunities arise. It might take two to four years to invest all the money raised in the capital call. The question for most investors is how best to handle this funding burden over this period, whether by keeping the money in cash or investing it in liquid securities. Each approach has benefits and drawbacks, but one will result in significantly more money over time.

The Benefits and Drawbacks of Keeping the Cash Commitment

Although many investors “park their money” at the bank while waiting for their capital to be called, doing so offers no return on investment. Funding the capital call with cash is the safest option because we can count on having access to that money at any moment. Maximizing long-term returns is hindered by the fact that cash “drags” down portfolio performance, and that wealth can only be produced when money provides a return.

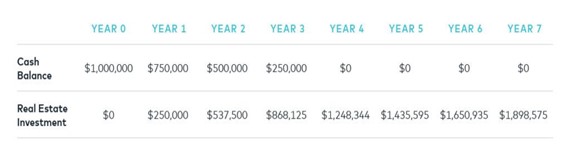

The total return generated while maintaining cash commitments is depicted in the following chart. Here, we’ll pretend someone with a $5,000,000 investment portfolio invests $1,000,000 in a real estate fund that makes equal annual withdrawals over four years. The promised amount is kept in cash, and the chart below shows how it is spent over seven years while the returns from the private equity investment are accrued. If the private real estate investment of $1 million yields a 15% return over seven years, its value will increase to about $1.9 million. It is important to note that the portfolio’s cash holdings do not contribute to the return.

A 15% return is excellent. But could it make more money if the investor had invested rather than saved?

Benefits and Drawbacks of Making the Financial Commitment

The committed capital could profit via investments but also suffer a loss. What if the investor loses money in the market and can’t afford to fulfill the obligation? Keeping a good ratio of liquid securities to private obligations is the most straightforward strategy to deal with this threat. Suppose an investor has a net worth of $5 million. In that case, they can easily commit $1 million to private investments and retain the remaining $5 million invested in public securities until the $1 million is called. Large, skilled investors employ this strategy because they know it is in their best interest to decrease cash holdings to maximize returns.

It’s essential to keep your holdings of liquid and illiquid securities in balanced proportions. If the same investor with a net worth of $5 million were to put all $5 million into private investments, they would be in trouble with holding either cash or short-term securities for the duration of their commitment. The investor’s risk tolerance is the primary consideration when determining the appropriate mix of liquid and illiquid investments. Private investments may be acceptable for confident investors at 20% of their portfolio, while others may be more at ease with a 50% allocation.

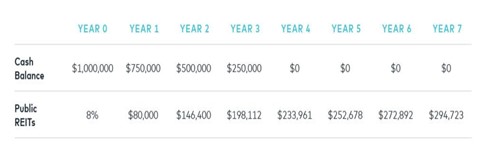

The following graphic elaborates on the abovementioned situation by estimating the additional return that could earn by investing the $1 million commitment in publicly traded real estate investment trusts (REITs) until the commitment is called. If the uncalled component of the pledge earns an average annual return of 8%, it will generate an additional $294,000 after seven years or an increase in wealth of 30%.

Implications Presented by a Falling Market

One must be aware of the most likely and worst-case scenarios to manage the risks associated with this method effectively. It’s common knowledge that the stock market doesn’t provide consistent long-term returns across every four-year cycle. Still, it is also common knowledge that markets go up considerably more often than they go down. Eighty-five percent of three-year periods and 89 percent of five-year periods show positive returns when analyzing NAREIT data from 1977 to 2017. Over those three-year periods, the best total return was 95%, while the worst was -34%. The highest five-year return was 176%, while the lowest was rough -10%.

Keeping your money in public securities increases your chances of making money, but you should be aware of the risk involved. It is where a balanced portfolio of public and private assets pays off. There is sufficient liquidity in the rest of the portfolio to meet the capital calls. Even if the market drops by 20%, as shown in the preceding scenario. With a $1 million pledge still in effect, the $5 million portfolio would fall to $4 million. It’s important to remember that selling public assets during a market downturn is a perfect opportunity for tax loss harvesting. A sluggish public market could lead to more excellent buying opportunities for private real estate.

Using Different Techniques

REIT preferred shares are a good option for conservative investors who want to maintain their capital committed to a low-risk investment. Preferred stock functions similarly to bonds in that it provides a fixed rate of return and takes precedence over ordinary shares in the event of a liquidation. It’s an investment between bonds and stocks in the capital structure and typically yields between 5% and 7%. However, unlike a stock dividend, their fixed payments are contractual and cannot be altered. High yield, lower volatility, and slightly less upside compared to public REIT shares are the costs investors must bear.

The following figure compares the equity REIT indexes with the preferred REIT index’s historical returns. Real estate investment trusts (REITs) that put out preferred stocks tend to provide investors with a more reliable and consistent return on investment than equity REITs.

Finding a better vehicle than cash to retain uncalled capital might mean considerable amounts won over a lifetime. Therefore, investors should look into it. Although it is the goal of every private fund manager to invest all of the capital that has been pledged, market conditions or a manager’s inability could sometimes prevent this from happening.

Investors can increase their returns by not overcommitting to private chances and carefully monitoring their cash flow. The abovementioned strategies can be a foundation for lasting financial success.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.