All financial assets, including commercial real estate, can be valued using discounted cash flow analysis (“DCF”). The underlying premise is simple: today’s dollar value exceeds tomorrow’s value. The total of all future cash flows discounted for risk is the worth of an asset.

The sum of money an investor is prepared to spend on a project today is heavily influenced by the timing and likelihood of future cash flows. Riskier cash flow streams are discounted at a greater rate, whereas more certain cash flows are discounted at a lower interest rate. When you invest in income streams 100% likely to happen, like coupons on government bonds, you need a lower return than in income streams that are 50% likely.

Capitalization rates are frequently used as a time-saving shortcut method for appraising real estate assets. However, these approaches have limits that are built right into them. Capitalization rates are commonly used by people considering investing in real estate. Compared to other techniques, the discounted cash flow method is superior in precision and comprehensiveness when determining the value of an asset.

This analysis considers only the value of real estate without leverage. If you’re comparing two investments, it’s advisable to evaluate them on an unlevered basis rather than relying on influence, which can distort the actual value of an asset. Investors often make frequent mistakes when focusing on a leveraged return without considering the accompanying risks. An investment that returns 15% annually using 60% leverage is better risk-adjusted than an investment that produces 20% annually using 90% leverage if all other factors are equal. Intelligently using financial power can increase the return on equity, but it doesn’t change the asset’s value.

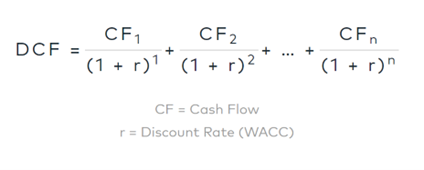

The fundamental formula for discounted cash flow analysis looks like this, and throughout the rest of the article, we’ll go deeper into this formula.

A property’s value is determined by forecasting all of the property’s future cash flows and determining how much they are worth today.

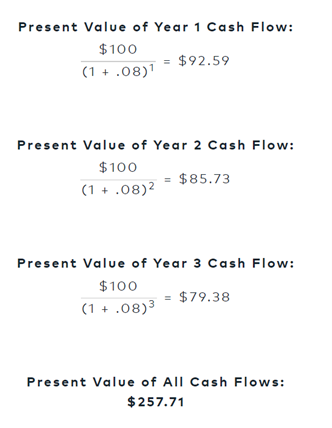

Investors can use the ‘=NPV’ method to calculate the net present value of any yearly cash flow stream by plugging in the cash flows and using the formula. For instance, suppose we were interested in calculating the three-year discounted value of a $100 cash flow stream. The procedure would be as follows:

If investors hold on to their $257.71 investment, they can expect an 8 percent return.

The discount rate is the required rate of return given the risk level being considered. Remember that more significant discount rates are applied to projects with more risk characteristics. In comparison, lower discount rates are offered to ventures with fewer risk characteristics, which is an essential factor to keep in mind.

What Factors Affect a Property’s Cash Flow?

When calculating a property’s annual cash flow and sales proceeds (sometimes referred to as “terminal” or “residual value,”) yearly cash flow and sales proceeds are both considered. The residual value is calculated by dividing the year’s net operating income by the expected capitalization rate. Several more factors must be considered when evaluating a company’s capitalization rate to select the right sale price at the end of our hold period. Also, w we compare our residual value to the cost of building a similar home today, the IRR of the next buyer, and other similar deals.

The Suitable Discount Rate

As we’ve already discussed, future cash flow estimates comprise many factors and become less precise with time. The volatility of these cash flows largely determines the appropriate discount rate. The risk of the asset, as well as the risk of the business plan, influences the discount rate for future cash flows. To put things in perspective, unleveraged discount rates in real estate typically range between 6% and 12%.

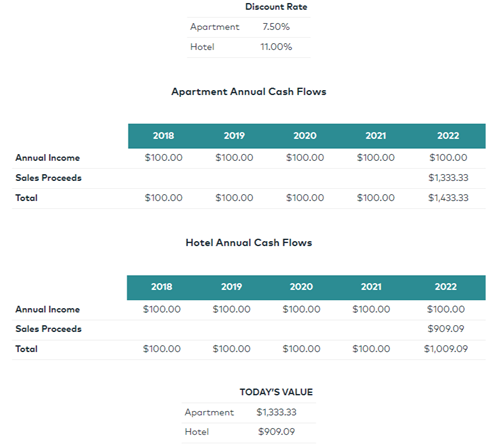

Before applying leverage, an investor’s expected rate of return, or IRR, is what we refer to as the discount rate. The risk associated with a specific type of property is known as asset risk. Because of the higher operating leverage and shorter lease terms, hotels, for example, carry a higher asset risk than flats (nightly versus annual leases for apartments). The investment strategy that underlies the project is at the heart of the business plan’s risk. How much preparation, work, and expenditure are required to create the final result, or is it for a project with an established credit tenant with at least another ten years left on their lease? Because of this, you can expect a lower discount rate or needed return.

In the illustration, the cash flows provided by a stabilized apartment complex are contrasted with the cash generated by a hotel. A residual value is calculated for each asset based on the assumption that the capitalization rate upon sale in the future will be equivalent to the discount factor. Each investment is anticipated to generate $100 in cash each year. Discount and capitalization rates are very close to being equal in a world without economic expansion.

A significant value disparity is revealed when discount rates are used in the NPV formula to compare the two assets’ future cash flows. While both assets are predicted to provide $100 in annual cash flow, the hotel’s cash flow is more volatile, resulting in a more significant discount rate. For this cash flow stream, the hotel investor is willing to pay no more than $892.50, whereas the apartment buyer is prepared to spend up to $1,333. Apartment investors can expect an unlevered return of 7.5 percent, while hotel investors can expect an annual return of 11.0 percent.

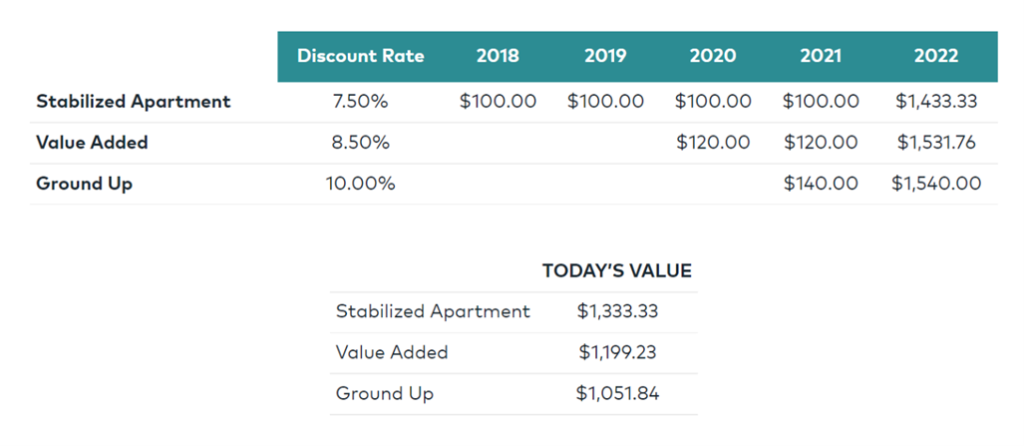

The risk associated with the company’s plan might also affect discount rates. Generally, the risk connected with a construction project starting from the ground up is greater than the risk involved with an existing asset that requires value-adding upgrades. This figure shows how different wagers in a business plan can have other effects on the same investment:

After the project is finished and leased out, there is a possibility that the cash flow generated by the ground-up development will be higher than that caused by the other alternatives. The ground-up product will probably have a more contemporary layout, physical characteristics, and facilities than stabilized and value-added properties.

Discounted cash flow forecasts are based on the probability that each cash flow occurs. Real-world results may be very different than anticipated. Accurate investment results may exceed expectations in certain circumstances, while in others, they may fall short. Flipping a coin has a 50% chance of landing on heads. Repeatedly tossing a coin has a 0% or 100% chance of landing on heads, depending on how many times it is flipped. The more a penny is reversed, the closer probability becomes to reality. Even while real estate investing is not a game of chance, the law of outstanding amounts nevertheless holds.

Forecasting is an imprecise science, and the development of financial models involves hundreds of different factors. The discounted cash flow analysis is the method that is applied that is the most complete to examine all of the risk factors that are taken into consideration in investment in real estate.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.