They developed the 60/40 portfolio because of the decades-long relationship between stock market gains and bond market losses. It functioned fine for decades, but now its having trouble keeping up. It might expect reduced returns from investing in equities and bonds due to rising interest rates and increasing inflation. One of the few asset groups that have remained stable despite the current market turbulence is multifamily real estate, which provides a means by which investors can accumulate and protect capital.

Yale University’s endowment continues to beat its institutional rivals, posting a 40.2% gain in fiscal 2021, as an example for investors who are hesitant to add real estate to their 60/40 portfolio. Yale’s late CIO David Swensen diversified the Ivy League school’s holdings with private real estate and other investments with longer time horizons. For every year Swensen was in charge, Yale’s performance exceeded that of the 60/40 portfolio by 4%.

Multifamily Investments Have Stable Returns

Multifamily housing has evolved as one of the most powerful alternative assets. Yardi Matrix research showed that in 2021, despite a decline in demand for hotels, offices, and retail space, the demand for multifamily housing remained strong and even increased. Apartment absorption of approximately 600,000 units was roughly 50 percent higher than the previous annual peak established in 2015.

Annual rent growth of 13.5 percent was more than double any prior year. As people stayed home to protect their families from the pandemic, housing became more important than ever.

The low supply of rental units and homes for sale is expected to remain for the foreseeable future, making multifamily real estate the asset class with the highest average returns for the foreseeable future (2021).

Investors are fleeing the volatile stock market for the safety of multifamily housing. Even if inflation in April 2022 was 8.2 percent annually, housing remained a great investment. Apartment complexes function like a commodity pool of lumber, steel, and other construction supplies. Values of existing structures rise because their replicas become more expensive to create.

Real Estate Doesn’t Reflect on Stock Market Fluctuations

Private multifamily real estate also offers dividends that can reduce the volatility of an otherwise all-equity investment portfolio. Similar to commodities, the value of multifamily real estate fluctuates in its way, unrelated to the ups and downs of the stock market or even publicly traded REITs. For instance, real estate investment trust (REIT) shares are bought and sold instantly when market conditions change, typically based on investor mood, even though the dividend remains the same.

It could amplify gains by using rental income from several units and leveraging existing assets. Compared to the 3% dividends paid by public stock REITs, many private investment funds pay out 5.5% to 6.5%. These basics improve the efficiency of private multifamily real estate holdings. According to modern portfolio theory, diversifying a portfolio is accomplished by looking for investments with a low correlation portfolio.

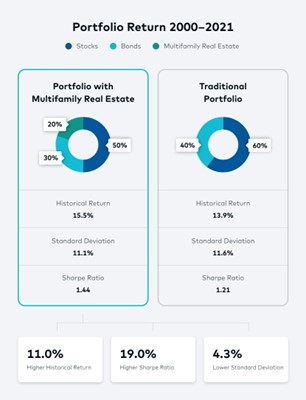

Returns Data Sources: NCREIF – Open End Diversified Core Fund Index – NFI-ODCE (Multifamily Real Estate), S&P 500 Total Return Index (Stocks), Barclays US Aggregate Total Return Bond Index (Bonds). Standard Deviation Data Source: Nuveen – Resiliency and Diversification From Uncorrelated Market Exposure Report – May 2021 (Stocks, Bonds and Private Real Estate)

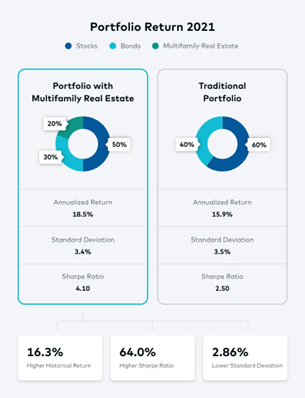

The results from 2000 to 2011 indicate that a portfolio consisting of 50% stocks, 30% bonds, and 20% multifamily properties has the potential to generate risk-adjusted returns that are superior to those generated by the traditional 60/40 allocation. Between 2000 and 2021, private multifamily assets generated an annual return of 11% and a Sharpe ratio that was 19% higher than average. The Sharpe ratio is a popular approach for calculating risk-adjusted returns. The Sharpe ratio indicated above is 1.44, which is considered excellent because it delivers excess returns compared to volatility. Sharpe ratios that are more than 1.0 are regarded as being good. The annual returns on such a portfolio increased to 18.5 percent in 2021 (below), with a Sharpe ratio of 4.10 percent.

Returns Data Sources: A private real estate Fund, S&P 500 Total Return Index (Stocks), Barclays US Aggregate Total Return Bond Index (Bonds). Standard Deviation Data Source: Nuveen – Resiliency and Diversification From Uncorrelated Market Exposure Report – May 2021 (Stocks, Bonds and Private Real Estate)

Multifamily Profits are Boosted by Demand and Cash Flow

The first quarter of 2022 saw a decline in the U.S. economy. If growth rates continue to slow, investors will have a harder time generating reliable returns and alpha from public markets alone. Home prices and mortgage payments have risen due to low supply and high demand, making homeownership less accessible in many parts of the country.

Because of this, apartment living has become a necessity for many, ensuring a steady demand for multifamily housing over the coming years. The typical one-bedroom apartment’s rent rose by 26.5%. On the other hand, rent for a two-bedroom apartment has increased by 25.7%, according to rent.com. The cost of housing has increased by more than 5 percent annually and now constitutes a third of the CPI. Rising wages will mitigate tenants’ aversion to future rent hikes.

Property values for apartment complexes continue to rise at a higher rate than the price of new buildings, even as construction expenses continue to rise along with the price of materials. Even today, ground-up development may be lucrative, sometimes even more than a value-add. A 50/30/20 portfolio with a 20% real estate allocation provides diversification opportunities in private equity or private debt, with distinct risk profiles, holding durations, and tax treatments than real estate.

Recently, Nuveen has recommended private asset investments as a hedge against market volatility, and real estate has been named a long-term inflation hedge. Investments in private real estate funds offer a secure, tax-advantaged alternative to the traditional 60/40 stock/bond split, which can help mitigate the negative effects of market fluctuations in stocks and bonds. Allocating some of your savings to real estate will continue to be a smart defensive decision that can help you earn passive income and has long-term upside potential.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.