There is no doubt that the pandemic has already made serious economic and social problems around the world much worse. The daily loss of employment and revenue continues, and there is no telling when things will return to normal. Small island states strongly dependent on tourism can see their hotels empty and their beaches deserted. We have witnessed how it has affected every living thing on Earth.

Without a shield, your investment is vulnerable to this worldwide epidemic. You may have had a similar first-hand experience that leaves you with more questions than answers. Discover all you need to know about the risks associated with investing in today’s unpredictable market.

Complete worldwide economic collapse and nationwide lockdowns occurred in under 15 days. Despite the lack of a significant economic release, the stock market has dropped more than 30% in the past month, wiping off trillions of dollars in wealth. We’re going to try to restart the engine and get back to work as soon as possible because the U.S. economy wasn’t designed to be shut down for a day, let alone a month. It’s one thing to put money away that you might never need to use again. However, you may want to reconsider your portfolio allocation if you invest money that you may need in the next two, three, or even ten years.

The capacity to quantify a likely range of outcomes is essential for assessing the risk involved in an investment. The spectrum of possible possibilities has grown tremendously, making it much more difficult to assign a monetary value to something now than it was even a month ago. A typical sales prediction could range from 2% to 4%. This spectrum now covers such extremes as bankruptcy and a return to business as usual in the current market. It explains the current market uncertainty; only time will tell whose prediction was correct.

While a miracle medicine may theoretically end the COVID-19 epidemic by tomorrow, putting workers back to work could give fuel to the virus and lead to yet another shutdown. It would help if you also considered that the government is out of options after spending $2 trillion on bailouts. The stock market has responded positively to the news, increasing by 15 percent in days, suggesting that this may be sufficient to resolve the issue. Keep in mind that while federal aid may help millions of Americans cope, it won’t stop the spread of the virus or eliminate the associated anxiety.

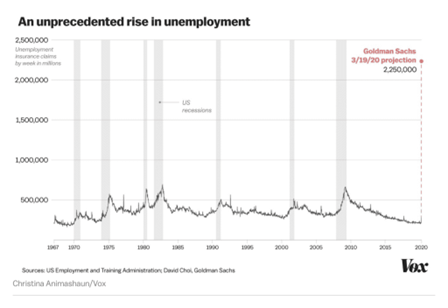

In the following months, we anticipate seeing some of the worst economic data ever reported by the United States. We are about to see the unemployment rate increase and consumer confidence plummet, and 37 million jobs are at stake. Current estimates from Goldman Sachs and Morgan Stanley pointed to a 24 percent drop in global GDP for the second quarter. President of the Federal Reserve Bank of St. Louis, James Bullard, agrees that growth might fall by half and that unemployment could rise to 30 percent.

The administration is currently weighing the potential for complete economic destruction against the potential public health consequences of allowing the virus to spread more freely. So far, efforts have slowed the spread of infection and readied the hospital system for what is ahead. The government plans to let workers return to their jobs in April, knowing that doing so will spread the infection further. We’ve all read that the goal of flattening the curve is to slow the virus transmission at a rate manageable by our healthcare system. Hospitals throughout the country are scrambling to improve their capacity as healthcare providers, including General Motors, Ford, and 3M, ramp up production of new respirators.

Isolation will eventually become the norm, but those most at risk, such as the elderly, will have to continue to observe it until treatment is discovered. We are unaware of the long-term consequences of removing people from the physical economy would be, let alone if they would cooperate. There are approximately 50 million Americans who are over the age of 65. It’s possible that we’re in for a roller coaster ride as the number of verified virus cases fluctuates up and down. In 1918, three separate instances of the Spanish flu occurred.

Nobody who is still living today has ever experienced what we are going through, and waiting to make any financial decisions until the pandemic has been contained could be the wisest course of action until then. Whatever you choose, we strongly advise you to proceed with caution in these times because no one is definite about the future. Continuing one’s current path is successful for some people, but not all. We are confident that the United States of America can weather this storm. There is light at the end of the tunnel, but the question that needs an answer is how long the tunnel is.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.