Alternative investments have seen a meteoric rise in popularity over the past few decades, and this trend is only anticipated to accelerate. By 2023, the market for alternatives is expected to be worth $14 trillion, according to research from Prequin. This sum is larger than the total market capitalization of the NASDAQ and close to half of the entire NYSE. Portfolio exposure is also on the rise. One-third or more of the portfolios of the most prosperous university endowments are typically invested in alternatives.

Let’s start with a definition of “alternatives” before we get into the advantages driving this rising desire. Alternative investments can be anything from the tried-and-true (hedge funds, private equity, real estate, managed futures, and commodities) to the novel (art, cryptocurrency, lumber, storage facilities, and peer-to-peer lending). Companies like Origin Investments have been lowering the entry hurdle to the alternative investment market in response to rising demand from retail investors.

What advantages have garnered so much interest, and how might they assist your clients in reaching their financial objectives? The capacity to create substantial profits, protection from risk, and a low correlation to stocks and bonds are three of the main advantages of many alternatives. Let’s take a closer look at each of these separately.

Advantage #1: Leading to Substantial Profits

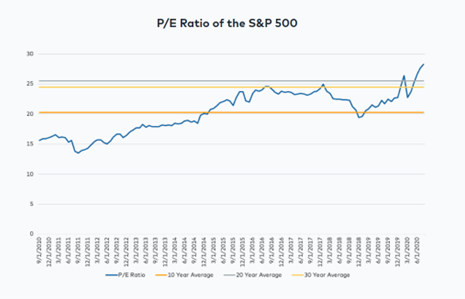

Alternative assets that have not experienced such a run-up in a market where major asset classes trade at high prices can provide superior value. If more expensive asset classes have a valuation correction, this investment could yield larger returns over the long term. The S&P 500 index of major U.S. stocks is near record highs. Below is a graphic depicting the price-to-earnings ratio (value) of the S&P 500 over the past century. As of 8/17/2020, the index’s price-to-earnings ratio is just above 29, above its 5-, 10-, 15-, and 20-year averages.

Bonds have also enjoyed a long and successful run as interest rates have declined. The value of bonds declines as interest rates rise. The benchmark 10-year Treasury rate fell by another 70% this year, from January 1st to July 31st. It makes getting started in fixed income somewhat costly, which can affect the asset class’s long-term returns and the returns of any portfolio that relies heavily on a fixed income.

The potential for high profits is an allure of some alternative investments. Some of the choices use less efficient markets with fewer players. It can lead to more favorable evaluations of some assets, leading to more favorable relative returns over time than other investments.

The specialty at Origin Investments is direct private real estate investments. They place a premium on multifamily dwellings in areas where they expect the greatest increase in population and employment. The projected rate of return is a primary criterion they use when underwriting investments. Will this purchase help them give the alpha they’ve been hoping to find? They have found about 60% of their bargains through non-public channels. They can gain access to unique prospects at what they believe to be highly attractive pricing points because they are even less followed than the broader commercial real estate market. The long-term returns of their customers benefit from better entry points.

Advantage #2: Risk Reduction

The second reason why financial advisers should consider alternatives is because they reduce volatility. There are alternative asset classes that may not prioritize growth but rather portfolio risk reduction. The goal of long-term investing should not be limited to maximizing the return at the expense of minimizing loss. The key to a profitable investment portfolio is to maximize profits while minimizing risk.

Volatility, or the degree to which the security value or basket of securities moves up and down over a certain period, is one way to quantify risk. Less volatile investments tend to perform more consistently than their more volatile counterparts. This investment will reduce the investor’s stress and may increase returns in the long run.

It takes substantial gains after a deep decline to compensate for lost ground. For instance, from October 2007 through March 2009, the S&P 500 fell by around 53% during the Great Recession of 2008. About a 110 percent cumulative return is needed to return to where it was. It took the S&P 500 until March 2013, or around four years from its low point, to achieve this. Investments with smaller losses would require a smaller gain to break even.

At Origin, they base their investment strategy on hedging against potential losses. They do this through various risk management techniques, such as cautious modeling to account for all possible sources of uncertainty and strategic capital structuring. As a result, they can reduce losses during downturns and gain less ground during recovery. This outlook has also ensured that the monthly dividend from the Origin IncomePlus Fund has never been skipped or reduced.

Advantage #3: Low Stock-Bond Correlation

In addition to the risk associated with individual security or asset class, financial advisors should consider how a possible investment might complement the risks associated with the other asset classes to which their clients are exposed. As was mentioned, reducing the amount of risk that investment involves can result in large additional advantages over time. It is also true on a more general level when looking at the portfolio as a whole. When the stock market or the bond market experiences major pullbacks, it can be quite beneficial for your clients to have more diversification in their portfolios. It is helpful to have exposure to different asset classes that will suffer less, or even better, do well while one asset class is having difficulty.

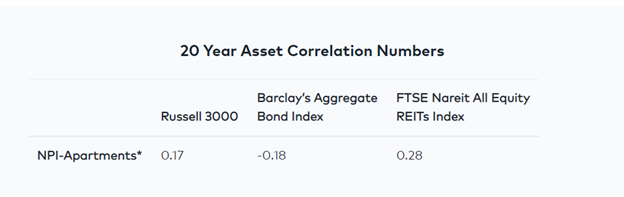

One essential method for determining the value of variety is through correlation, which examines the extent to which the prices of two different assets move in connection with one another. If two assets correlate 1.0, it indicates that they are perfectly correlated to one another; hence, investing in both would not result in diversification benefits. A correlation of 0 indicates no association between the two variables. A negative correlation between the two variables indicates that they have an inverse relationship and move in the opposite direction. They can obtain the most effective kind of diversification from stocks or asset classes that exhibit low or negative correlations to one another; yet, in the current market environment, this might be challenging to do. Even though stocks and bonds are often considered to have an inverse connection, it is not uncommon for these two asset types to move in tandem from time to time. Because of their low correlation to traditional asset classes like stocks and bonds, alternatives can help mitigate this risk.

They find that the low correlation of multifamily housing to stocks, fixed income, and even public real estate securities are one of its most appealing features at Origin. The accompanying matrix displays the multifamily housing (NPI- Apartments) correlation numbers for the 20 years ending this June 30th. For example, the FTSE Nareit All Equity REITs Index shows a negative correlation with bonds (Barclay’s Aggregate Bond Index) and a weak correlation (0.17) with the overall stock market (Russell 3000).

Advantages Beyond That

In addition to the advantages outlined previously, there may be others that are unique to alternative investments. Inflation has been low for a while, but some worry it will spike due to the stimulus measures taken by Congress and the Federal Reserve. To protect against inflation, real estate and other tangible assets might be advantageous due to their valuations tracking price increases. Bonds and cash also lose value since their purchasing power decreases during these periods.

Alternatives also have major tax benefits. The Origin Income Plus Fund’s 6.4% distribution for depreciation and other expenses is completely nullified by write-offs. The end investor receives a K1 that reflects the positive tax effects. Capital gains (and transaction expenses) can be a huge drag on performance, but we’ve mitigated this risk by adhering to a buy-and-hold strategy for the fund. Over time, these advantages can amount to substantial gains.

Last but not least, one less measurable advantage that alternatives can offer customers is the chance to participate in a novel and engaging opportunity. Investment conditions are dynamic and constantly shifting. Every once in a while, a novel concept may take off, and with its success comes a need for initial and ongoing financial support. Your customers can take part in the market with the help of alternative investments.

Conclusion

Since the turn of the century, there has been considerable growth in the market for products that offer alternatives. As was previously mentioned, they contribute a plethora of advantages to an investment portfolio, yet, they are available in a wide variety of forms, each of which has its complexity. When acting as an adviser or an investor, it is essential to carry out the necessary research to keep track of the benefits you are hoping to include and the alternative asset classes that will deliver those benefits.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.