Fair market value, tax basis, and unreturned capital balance are the three primary metrics private real estate managers use to report on their holdings’ health. The true worth of a financial asset is reflected by its fair market value. It can’t reconcile contributions and distributions appropriately without knowing the taxpayer’s tax base. Ownership and distribution rights are established by the amount of capital not repaid. What every individual investor needs to know about these three private real estate reporting methods is discussed in this article.

What is Fair Market Value?

The current value of an investment can be calculated using its Fair Market Value (FMV). The fair market value of an investment is the amount of money an investor would get if it sold the investment today. Each investor receives a quarterly FMV calculation from investment firms to help them keep track of the value of their investment and its performance. If the reported fair market value is to be of any use, it must be presented on a Net basis, accounting for the manager’s fees and expenses deducted from the sale proceeds.

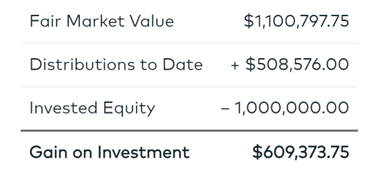

For example, here is the performance of a $1 million investment in a fund using fair market value as the metric:

The Basics of Tax Basis

Investors can find their tax basis on a K-1, a document issued annually by the investment manager or general partner. An asset’s tax basis is its value to the taxpayer in income tax. When an asset is sold, this metric is the most important—the bigger the tax base, the lower the taxable gain on the sale. For instance, if the tax basis of a piece of property is $10 million and it sells for $10 million, no capital gains taxes will be due. However, a $9 million gain will be subject to taxation if a property sells for $10 million with a tax basis of only $1 million.

The initial investment into a property serves as its tax basis. This number goes up when more money is put in or when the property generates taxable income. Distributions made to investors, and the deduction of operational expenses and depreciation by the partnership bring it down. The investor can compare their records with the information provided on the K-1 about partnership contributions and dividends.

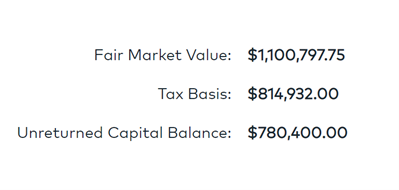

The accountants have a lot of work to do all year long to arrive at the tax basis number. If you’re an investor, all you’ve got is a tax basis, which doesn’t tell you anything about performance. Appreciation, the rise in the value of an asset over time, or an investment’s fair market value are not included in the K-1. On December 31, 2017, an investor who put $1,000,000 into the fund would have an $814,932.00 tax basis. However, the investor can get a rough estimate of the possible tax liability if the remaining assets were sold by subtracting this amount from the fair market value of $1,100,797.50.

The Unreturned Capital Balance

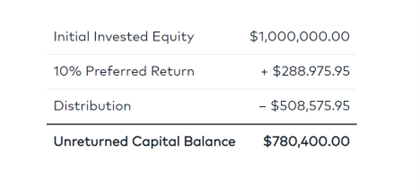

Similarly, the unreturned capital balance is disclosed to investors by some private real estate managers in their financial accounts. The unreturned capital balance is calculated by adding the investor’s equity investment to the preferred return. It can be considered an interest rate on invested money but is not guaranteed. Unreturned capital rises when new equity is invested and falls when cash is distributed.

Typically, the manager only utilizes the unreturned capital balance to determine when they will begin to get a higher portion of payouts. Until the whole capital account amount is paid off, all private real estate investment distributions will go directly to the investors. Once an investor’s capital account has been depleted, the manager is entitled from 10% to 50% of further payments made to that investor. As of December 31, 2017, the unreturned capital balance of a $1 million investment in Fund II yielding a 9 percent preferred return was $780,400.

How that number is arrived at is as follows:

Like a tax basis, the unreturned capital balance says nothing about the actual value of the investment or the investor’s profit or loss. The only information provided is the amount of money the management must pay the client before that investor starts to share in the gains from the waterfall. The fair market value is used to predict whether or not the investor will get the next $600,000. The unreturned capital balance is $600,000, but the fair market value might be either zero or two million.

The distribution part of a private placement memorandum often contains information on capital balance accounting. Learning the formula beforehand will allow you to verify your investment manager’s calculations when you get your incentive fee.

Reconciling the Pieces

Fair Market Value, tax basis, and unreturned capital balance are the three distinct reporting approaches utilized in the private real estate industry. Each of these approaches is utilized to analyze an investment in the fund valued at $1 million dollars. The following table presents, as of December 31, 2017, the actual valuations reported by the various private real estate reporting systems for an investor who contributed $1 million the fund.

The value of the investment as of December 31, 2017, is depicted on the fair market value line. When investors revise their balance sheet or net worth, they often refer to this. Schedule K-1 is where you can find the tax basis provided to investors for use by their accountants. In addition, the investor will receive at least $780,400 before the fund receives an incentive fee, as indicated by the unreturned capital balance. A sizeable chunk of the original $1 million investment has been repaid is also explained. Any remaining principal balance will earn the preferred rate of return.

Various people will place different amounts of importance on concepts like fair market value, tax basis, and the unreturned capital account balance. Together, they can be informative, but only if you know how to decipher the intricacies.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.