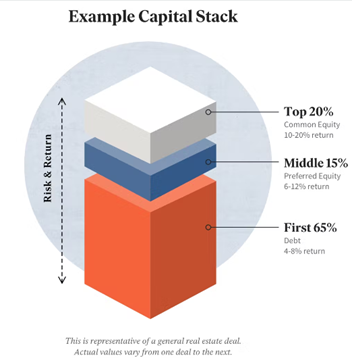

When describing the financial framework of a real estate transaction, the term “capital stack” is commonly used (frequently depicted as a bar graph or pyramid). The capital stack defines the many forms of capital invested in a real estate asset and their respective relationships.

There are traditionally two primary categories of capital:

- Equity, which reflects a stake in the asset’s ownership.

- Debt is a loan granted to the equity owner and often secured by the asset or other assets of the equity owner.

Experience and Risk

The capital stack illustrates the connection between stock and debt. The lower the position on the stack, the lesser the risk associated with that money, and vice versa as you progress up the stack. This reduced risk results in a more secondary return. As you advance up the accumulation, the potential risk and reward grow proportionally. This is also referred to as seniority.

Debt

On the capital structure, debt is always subordinate to equity, meaning it is paid back first. The vast majority of real estate debt is given by conventional lenders, such as banks, with a senior secured position. Because the senior debt has the highest level of security, the return (or interest rate) levied is the lowest and is sometimes limited. In addition, debt has a specified duration, at the end of which the debtor must return the complete principle interest payments or risk losing possession of the asset.

Equity

Equity keepers are at the top of the capital stack and in the most vulnerable position; they are the last to be reimbursed. As a result, equity investors often demand the highest returns to offset this risk. Unlike debt investors, equity investors participate in the success of the investment, meaning that their potential returns are not limited but may rise or decrease based on the investment’s performance. Because equity investors are the asset’s owners, there is no fixed time for the acquisition; complete payment happens only when the asset is sold or when an individual investor sells his or her ownership stake.

In almost all real estate transactions, a sponsor (often a manager or developer) provides a modest amount of stock and is responsible for the management and performance of the actual investment. The sponsor will raise additional equity capital from investors who assume a senior position inside the stock, often obtaining a preferential return and early repayment rights.

Preferential Equity

As the complexity of real estate transaction financing has increased, other kinds of capital that often function as a hybrid of equity and debt have been introduced to the capital stack. This group is typically referred to as preferred equity or mezzanine debt. As a hybrid structure, this investment is subservient to debt but superior to conventional equity investments. Often, the return structure is also a mix between accurate equity and debt, with mezzanine/preferred equity investors receiving a predetermined yearly payback over a defined investment period but also having the possibility to share in the investment’s upside or sustained performance.

Each real estate transaction is unique, and the variables influencing the potential risks and profits differ. Therefore, the structure of the capital stack will change from marketing to transaction. Understanding the potential dangers at each pile level and being fully aware of the rewards you are entitled to are crucial for investors. Not all investment structures are suited for all investors since complexity increases risk and the possibility of total investment loss.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.