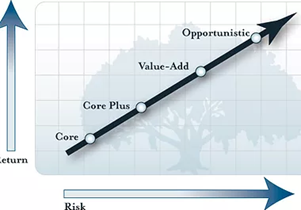

Core and core plus are the foundation of a diversified portfolio and services to mitigate risk. Understanding the four real estate investment methods is vital since it is the only way to comprehend your risks and build a diversified, secure portfolio.

These are the four methods:

Core: 7 to 11% historical returns with little to no risk

Core+: 8 to 12% in terms of historical returns; low to moderate risk

Value-added: 10 to 15% in terms of historical returns, medium to high risk

Opportunistic: high risk (historical returns of 12 percent to ??? percent)

As you may have seen, as your rewards improve, your risk also increases. Therefore, adequately diversifying across strategies (at the appropriate moment) is essential for portfolio protection.

Here is a breakdown of each kind.

Core

Historical rates of return range between 7 and 11 percent.

- Leverage: around 25%

- Risk: low

Real estate is the cornerstone of a varied investment strategy. It is a real estate situated in high-demand urban cores of large metropolitan regions (New York, Los Angeles, Washington, D.C., etc.) and leased to renters with excellent credit.

Due to the tremendous demand for tenants, core investments are almost as secure as bonds but provide much larger yields. Typically, tenants (such as a Starbucks franchise) are backed by a rent guarantee from the parent business (Starbucks Inc.), protecting the investment should the tenant vacate.

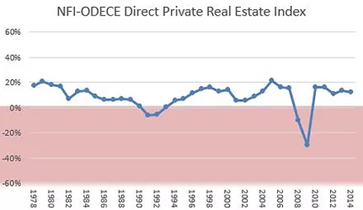

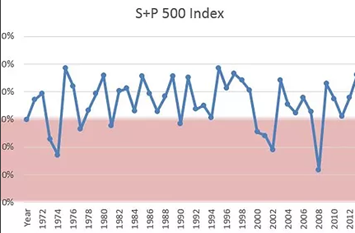

Unlike the stock market, essential assets do very well during economic downturns. Here is a contrast between core real estate and stocks. Observe how stock prices fall with every business cycle slump (every 3 to 5 years). But core investments remain favorable and only become negative during the most severe financial crises (which occur about every 20 years)

Historical Returns on Core Real Estate

Historical Returns on the Stock Market

The most minor risky assets are chosen for core investments, which utilize the most conservative leverage (0 to 40%). (The Big 4: office, retail, apartments, industrial). Their return is mainly derived from revenue (at least 70 percent) and has traditionally ranged from 7 to 11 percent.

Synchronization

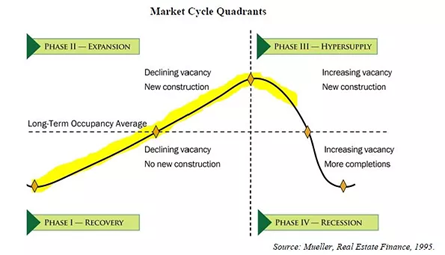

The core investing techniques are the most “all-weather” and offer the largest timing window.

However, towards the conclusion of a cycle, returns are at their lowest, so this is an excellent time to hold off on making new fundamental investments. This is particularly true near the conclusion of the 18-year super cycle when returns tend to become negative.

The optimal purchasing windows are shown in yellow below. The sooner the cycle, the greater the availability of excellent properties and the smaller the risk. As the process progresses, the reverse becomes true.

If you are seeking core investments, I have investigated several choices. Here you can find the top Core investments. (This is an exclusive investor club article. Membership is free, but verification is required.)

Core +

Historical rates of return range between 8 and 12 percent.

- Leverage: 40-50 percent

- Low to moderate danger

Core plus real estate is comparable to the core but of lower quality. The property might be located in the suburbs or a secondary city: The renter may not be of the same caliber or lack a rent guarantee from a reputable national firm. Or it might entail a riskier property type than one of the primary four, such as self-storage, entertainment, medical offices, or student housing.

Investments in the core plus category have a low to moderate risk and somewhat higher return. The time is comparable to that of the core, except for a somewhat earlier taper down near the conclusion of the cycle/super cycle since it will incur losses before the body.

If you’re seeking core plus investments, I’ve investigated several possibilities. Here you can find the top Core Plus investments. (This is an exclusive investor club article. Membership is free, but verification is required.)

Following up next

Part two will examine value-added and opportunistic investments that provide better core and core+ returns. We will also investigate the optimal allocation of the four methods within your portfolio.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.