How Do We Create a Well-Balanced Robust Investment Portfolio to Include Real Estate?

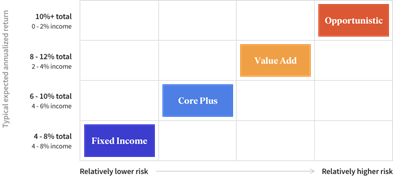

Using various techniques, we want to construct well-balanced, robust portfolios designed to generate consistently good returns depending on our customers’ objectives and risk tolerance. There are four types of commercial real estate investments – Fixed Income, Core Plus, Value Add and Opportunistic. Let’s go through each one briefly.

Fixed Income Earnings

Our Fixed Income strategy is to create above-market returns by offering innovative and all-encompassing financing options backed by high-quality real estate. We want to invest with a safety margin to product categories with high demand endurance (such as housing) and actual supply constraints, hence boosting property prices. A typical total return on a Fixed Income investment is around 6% to 8%.

Core Plus

Our Core Plus investment strategy comprises stable real estate with a long investment horizon and modest leverage, where we can unlock extra value via concentrated asset management. Our objective is to acquire high-quality residential and industrial properties at competitive prices in expanding areas. A typical total return on a Core Plus investment is around 8% to 10%.

Value-Add

Our Value-Add approach emphasizes purchasing existing assets below replacement cost and investing money to enhance their competitiveness. We concentrate on purchasing competitively priced residential developments in expanding areas where affordable rental housing is in short supply. A typical total return on a Value-Add investment is around 10% to 12%.

Opportunistic

Our Opportunistic approach is to buy underused, well-located assets in the most active real estate areas. Our in-house development team and best-in-class partners frequently collaborate to rethink iconic investments from the bottom up. These company concepts are the most difficult and have the most extended timelines, but they also have the highest potential for payoff. A typical total return on an Opportunistic investment is around 12% to 15%.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.