Did You Know That Real Estate Earns More Than Stocks and Bonds? With Less Volatility?

A portfolio with some allocation to private real estate has historically demonstrated the ability to generate greater returns, with typically higher annual income and lower volatility, compared to a standard portfolio consisting of 60 percent large-cap stocks and 40 percent bonds over the past two decades. Learn how a 20-30 percent allocation to private real estate may affect your portfolio.

The Advantages of Real Estate Investment

- Earnings

Year after year, real estate has shown its capacity to provide investors with excellent revenue streams.

- Security

In contrast to other sorts of investments, real estate has a reputation for being stable.

- Risk-adjusted gain

Control of the risk of your portfolio does not require surrendering return possibilities.

Steady Historic Earnings Production

Real estate has gained its reputation as a dependable source of passive income. In fact, the income component of the NPI (the index that measures the performance of private real estate (National Council of Real Estate Investment Fiduciaries Property Index)) has averaged a greater rate than the yields of the following mainasset classes.

Resilience through an Earlier Economic Collapse

Historically, private real estate has had a poor connection with publicly listed equities and REITs. When public market sectors have shown higher volatility and sensitivity to investor opinion, real estate has been very stable, notably throughout the three most recent severe economic crises.

A Balance between Safety and Profit Potential

Among the four primary asset classes now accessible to internet investors, private real estate is the most risk-averse and return-oriented, as seen below.

How Investing in Real Estate Will Affect Your Investment Portfolio

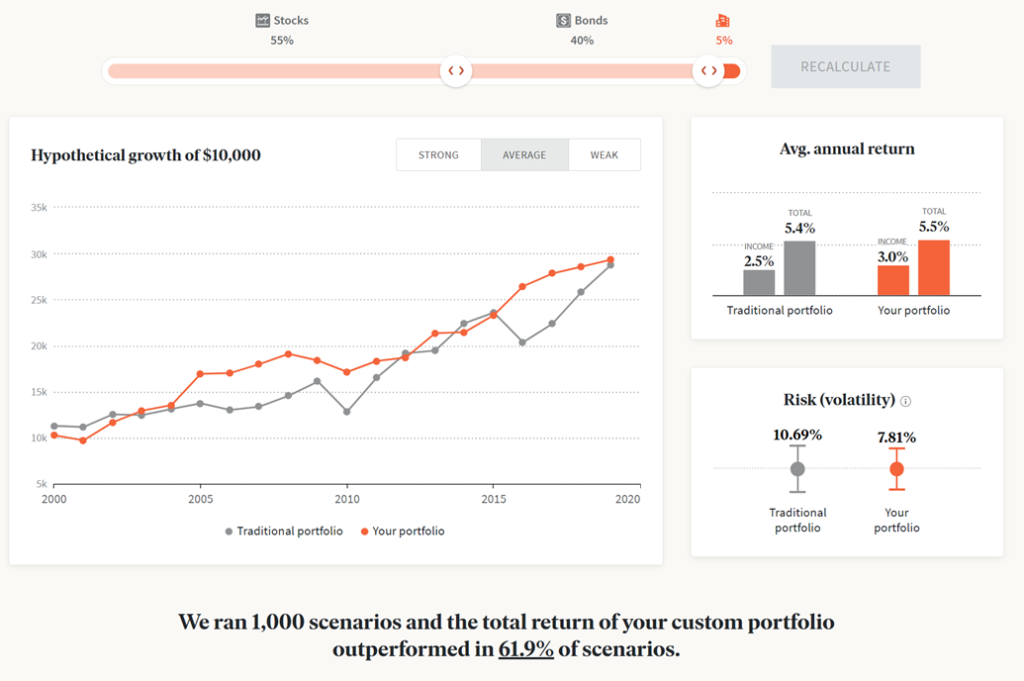

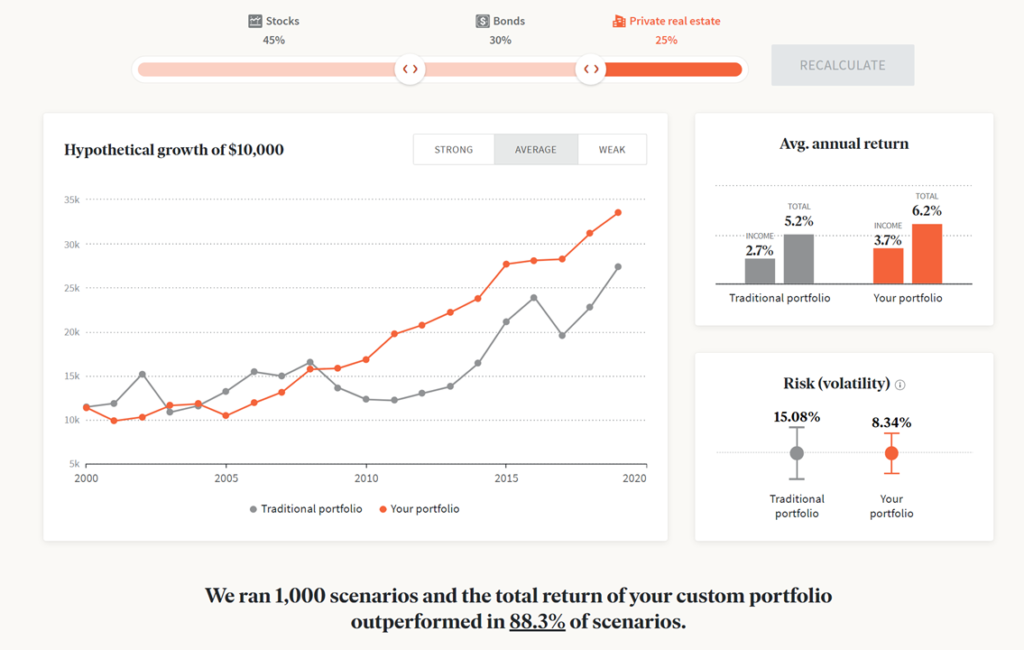

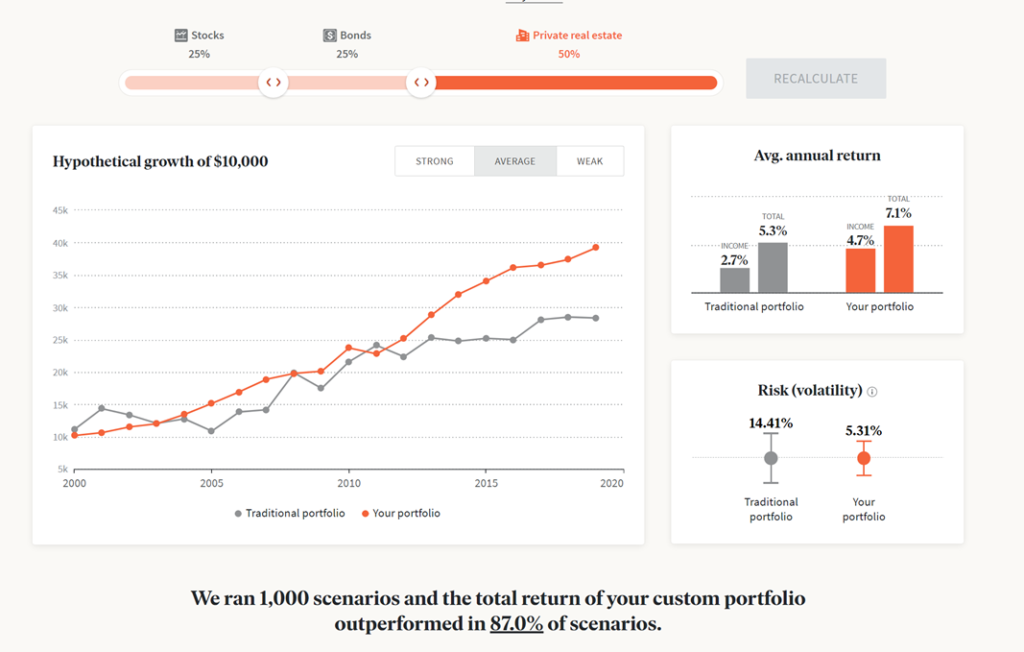

We give you three scenarios vs a typical portfolio of 70% stocks and 30% bonds and how it would have potentially performed over the previous 20 years:

- 55% stocks, 40% bonds, 10% real estate – We ran 1,000 scenarios and the total return of your custom portfolio outperformed in 61.9% of scenarios

- 50% stocks, 25% bonds, 25% real estate – We ran 1,000 scenarios and the total return of your custom portfolio outperformed in 88.3% of scenarios.

- 25% stocks, 25% bonds, 50% real estate – We ran 1,000 scenarios and the total return of your custom portfolio outperformed in 87% of scenarios.

Definitions

The Bloomberg Barclays U.S. The Aggregate Bond Index represents bonds. It is a broad-based benchmark that tracks the market for investment-grade, U.S. dollar-denominated, fixed-rate, taxable bonds. This index consists of Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through), ABS, and CMBS (agency and non-agency).

Public REITs: Represented by the National Association of Real Estate Investment Trusts (NAREIT) All REITs index, a market capitalization-weighted index that includes all tax-qualified real estate investment trusts (REITs) listed on the New York Stock Exchange, American Stock Exchange, or NASDAQ National Market List.

Private real estate is represented by the National Property Index of the National Council of Real Estate Investment Fiduciaries (NCREIF) (NPI). This database dates back to 1978 and contains approximately 8,300 properties with a total market value of about $658 billion. It aims to give a historical assessment of property-level returns to enhance the understanding of real estate as an institutional investment asset class and to add legitimacy to it.

500 firms are included in the S&P 500 index, among other factors such as market size, liquidity, and industry categorization. The S&P 500 is intended to be a leading indicator of U.S. stocks and to represent the risk/return characteristics of the universe of big-size companies (Investopedia).

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.