Introduction:

Do you want to know more about Multifamily investing? Read on to know more.

Those afraid of the stock market’s turbulence may find solace in real estate. Additionally, it is preferable for individuals who prefer to take a more hands-on approach to build wealth rather than relying on an investment fund to do so. Real estate investing can allow investors to choose from various strategies.

For example, investors Donald Bren and Zhang Xin made their billion-dollar fortunes by building various residential and commercial properties. On the other hand, Residential equity founder Sam Zell amassed his fortune over time by accumulating a diverse portfolio of rental properties that provided him with a steady income.

Some real estate investors have made millions of dollars from house flipping to purchasing buildings in ruin for pennies on the dollar. This is just one method of making money in real estate.

Investing in rental properties is an excellent option for investors looking for an additional source of income and a continuous increase in their portfolio’s value. Single-family and multi-family properties are the two most common types of investments in residential real estate.

Multi-family properties, often known as apartment complexes, are residential structures with more than one rentable unit. As their name implies, single-family properties are residential buildings with only one available unit. Investing in large residential complexes has several advantages over creating a portfolio of tiny residences. Investing in multi-family real estate rather than single-unit rental homes has three advantages.

Investing in an apartment complex is almost always more expensive than buying a single-family home, even though that isn’t always the case. An investor could spend as little as $30,000 on a single rental unit, while the price of a multi-family structure can easily reach millions of dollars.

Getting a loan for a single-family home may seem easier than attempting to get funds for a million-dollar apartment building, but this is not always the case. Banks are more likely to accept loans for multi-family buildings.

Multi-family real estate has a strong cash flow every month because of this. Even if a property has a few vacancies or a few tenants who are behind on their rent, this is still true. For example, the property will be empty if a tenant vacates a single-family home.

Only 10% of a vacant property with ten units is 10% of an uninhabited property. Apartment buildings are less likely to be foreclosed on than single-family homes. A less hazardous investment for the lender and a more competitive interest rate for the property owner are the results of all of this.

Building a Portfolio Is Faster

In addition, multi-family real estate is an excellent choice for investors who want to accumulate many rental properties. More time and money can be saved by purchasing a 20-unit apartment building instead of 20 separate single-family homes.

Choosing the second option would necessitate dealing with twenty different sellers and inspecting twenty homes throughout the country.

To avoid obtaining 20 different loans for each property, an investor may have to go this path in some circumstances. Buying a single property with 20 units would alleviate all of this stress.

Property management makes financial sense.

Some real estate investors prefer to outsource the day-to-day management of their rental properties to a professional property management firm. According to the landlord and property management terms, they are customarily compensated each month.

As a result of their limited holdings, many investors with just one or two single-family houses cannot afford to hire an outside manager. Owners of multi-family properties can benefit from property management services without considerably reducing their profit margins because of the amount of money they generate each month.

Investing in real estate, like the stock market, can be approached in various ways for different levels of success. Rental homes are one of the most common ways to invest in real estate. Single-family homes and apartment complexes with more than one rental unit are referred to as “multi-family properties” instead of “single-family homes.”

According to Milton Friedman, it was always a monetary phenomenon that caused inflation.” In other words, he believed that when central banks produced money, all roads led to inflation. Nobel laureate economists once contrasted inflation and drunkenness. Friedman suggested that, like drinking alcohol, the initial feeling of euphoria when these institutions began printing money. In his opinion, the temptation to overindulge exists. Also, the consequences of printing too much money or consuming too much push are inevitable.

Friedman made this comparison in 1980, and a lot has changed. Since inflation was rising, Paul Volker was named Federal Reserve chairman. As a result of Volker’s aggressive interest rate increases, inflation was brought under control. When Volker took over at the Fed, it peaked at slightly over 14%. Ultimately, he prevailed against rising prices even though his rate hikes plunged the country into recession. By 1989, inflation had fallen to less than 5% and ushered in a decade of economic growth.

Inflation can take various forms, and not all result in negative consequences. As commercial real estate investors, we see this as exceptionally trustworthy. Inflationary conditions can hurt our investment returns, but the degree of inflation also plays a role. Because of this, we use a more sophisticated definition of inflation. Demand- and cost-pull inflation are concepts that help explain our views on inflation and its effect on real estate returns.

The Federal Reserve Faces a Different Challenge

According to Jerome Powell, the current chairman of the Federal Reserve, the problem is precisely the opposite of Friedman and Volker’s: he can’t seem to get inflation going. In August 2020, the Federal Reserve declared that it was rethinking its approach to inflation under the leadership of Powell. A new policy of “average inflation targeting” has been ratified by the central bank. The Federal Reserve had previously set a target of 2% annual inflation. The Fed will be able to allow inflation to rise above 2% under this new approach. Put another way, the Fed will be less likely to raise interest rates as unemployment declines.

According to Powell, “Many find it strange that the Federal Reserve would seek to push up inflation.” On the other hand, low inflation can put the economy at considerable peril.” Investors and academics have heard many opinions following the Federal Reserve’s decision to adjust its inflation policy. Some believe inflation will remain low in the long and near term because of technological advancements and the pandemic. A middle ground exists between these extreme views. In other words, what does the data tell us?

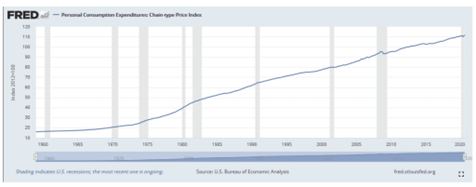

The Federal Reserve measures inflation by the Personal Consumption Expenditures Index (PCE) which measures prices for goods and services. Also, the Personal Consumption Expenditures Index is well-known for capturing pricing patterns over various costs. Since 1959, the PCE Index has been shown in the following graph.

Using the famous Will Rogers adage, “Invest in inflation,” the chart is nostalgic. This is the only thing that’s rising.” The accompanying graph captures Rogers’ sentiments, and his comment might even be wise. Charts like this don’t do justice to inflation during the past 60 years, notably the 1970s rise and recent decade pause.

On the other hand, the following graph shows the year-to-year change of that same data set. Volker’s countermeasures took hold in the 1980s, and what some at the Fed dub “stubbornly low inflation” since the financial crisis in 2009 can all be seen on this chart. The 1970s price increase caused cheap money policies and increased oil costs.

Despite a brief jump in the PCE to roughly 2.5%, inflation has averaged around 1.8% over that period instead. As a result of the reduction in crude oil prices in 2015, inflation even went negative during the 2009 financial crisis. The COVID-19 epidemic produced a new slump on the far right of the chart in early 2020.

Is it worth it to fight the Fed?

Knowing the history of inflation and the current direction of Fed policy, the phrase “don’t fight the Fed” is an excellent place to start. This premise holds if the Fed is trying to raise or cut interest rates while making investment decisions. Investors are rewarded for aligning with the Fed and investing when the Fed is cutting interest rates and not investing when the Fed is raising interest rates. However, history is not definitive.

This proverb becomes even more difficult to decipher when inflation is factored in. Is it a good idea to ignore the Fed’s claims about their current fight against low inflation?

We believe investing in multi-family real estate and not fighting the Federal Reserve is the best way to beat inflation and safeguard your purchasing power.

How to Protect Yourself from Inflation

Commercial real estate is an excellent inflation hedge because it has intrinsic value, is scarce, and is a yielding asset.

Regarding commercial real estate, we believe that multi-family offers one of the best inflation protection because the lease structures in this asset class are better positioned than other asset classes to profit from an increase in inflation rates. Compared to other commercial real estate assets, multi-family leases can have terms as little as six months and as long as a year. Resetting these leases offers us the chance to raise rents in response to rising costs.

As a general rule, the annual turnover of a multi-family property is roughly 100%. Investors can immediately respond, raise rental rates, and hedge against increasing inflation if the Fed’s successful plans. As a result of this strategy, we can provide even more flexibility in our multi-family buildings by staggered lease expirations during the prime spring and summer rental periods.

Keeping in mind that multi-family real estate is an asset based on need is critical. It’s an asset, but its primary function is to give a place to live, and there’s a lot of effort (money, effort, and time) involved in people moving. We hope to put a damper on residents’ eagerness to uproot and look for greener pastures elsewhere by working hard to foster relationships between our residents and those who maintain their properties. So the principal substitute for one of our multi-family communities is a home purchase, but rising rental prices owing to inflation cause extra friction via rises in property values.

Single-family homes as a substitute for multi-family units should be reexamined in light of recent demographic and consumer demand developments. Baby boomers are selling their homes to free up cash and avoid taking on additional mortgage debt at this point in their life.

Millennials start families later than their parent’s generation, the Baby Boomers, and still feel the effects of the Great Recession. Gen Z’s savings rate is at an all-time low, making it difficult for them to save enough money for a down payment on a property.

For multi-family, these trends are an enormous boon regardless of inflation. Apart from the high level of interest among potential tenants, there are numerous other advantages to owning this type of property that is sometimes overlooked.

As the last line of shield against inflation, we’re strategically placing our multi-family real estate assets in different parts of the country.

The Suburbs are basking in the Sun.

Targeting suburban areas in high-growth economies, particularly the Sun Belt, is one approach. Massive numbers of millennials are moving to the suburbs, and here’s why:

Schools in the suburbs tend to be good than those in the cities because suburban residents tend to be more closely knit. The standard of living, as measured by factors such as crime, traffic, personal space, and proximity to nature, is often higher in this area. In cities, the cost of living is higher than in the suburbs. Smaller villages allow you to have a more significant impact on local government than larger cities.

The COVID-19 pandemic has only served to hasten the tendency of people to return to the suburbs. Even if inflation and interest rates remain low, these visible trends in demand will undoubtedly provide high investor returns.

When it comes to shielding the wealth of our investors from inflation, we are taking a proactive approach. As with most things, moderation is the solution to the parallel between inflation and alcoholism that Milton Friedman made. If you have multi-family real estate investments, you have nothing to fear from a bit of inflation. Investing in the multi-family industry may benefit from a slight rise in inflation.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.