Banks are withdrawing due to increasing interest rates, skyrocketing real estate costs, and slowing rents. Instead, sponsors are approaching crowdfunding/syndication investors. Is it worth the risk to be included?

The Economy is on Their Minds

Nobody knows when or how severe the next recession will be. But we know that it is a matter of when not if. And these days, some people wonder if it will be sooner rather than later. During January, the stock market has been in decline. Oil prices are rapidly rising (and oil price shocks are a major cause of past recessions). Significant tariffs are looming on the horizon (which could be like a bullet-in-the-foot, reducing business profitability, GDP, and employment). And the synchronized global growth that appears promising at the start of the year is unraveling in the Eurozone, China, and elsewhere.

Bankers have observed three unsettling trends in US real estate, causing them to reject sponsors with more leveraged deals. (See “Multifamily Investors Face Loan Size Cutback,” National Real Estate Investor.)

Rent Prices Are Spiraling Out Of Control

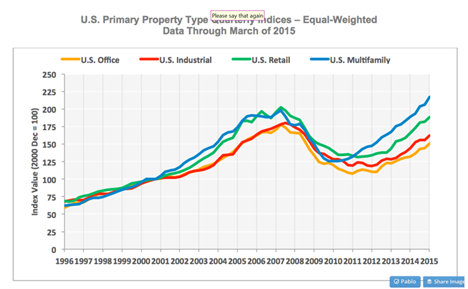

To begin with, the cost of purchasing new properties is rapidly increasing (or, to put it another way, cap rates are going down). It is a long-standing trend. But there is one significant difference now.

The justification for higher prices is high rents. For example, if an apartment earns more rent than it did yesterday, paying more for it today makes sense.

In 2018, multifamily rent increases slowed significantly in many parts of the country. Most popular markets (such as New York and Los Angeles) got hit the hardest, requiring owners to make concessions such as free rent to fill buildings. Austin, Texas, a once-hot market, became the first larger market to see year-on-year rental drops. (See “Multifamily Rent Growth Stalls in Top Markets,” National Real Estate Investor.)

These two trends have caused prices to rise more quickly than rent in these markets. As a result, the risk of overpaying increases significantly. Furthermore, suppose there is a sharp downturn. In that case, this increases the risk of being unable to pay the mortgage and possibly going risky with the results.

The third point is that interest rates are now rising due to the Federal Reserve’s sixth rate hike. The average loan now has a 0.55 percentage point higher interest rate than just six months ago. (Check on National Real Estate Investor, “Multifamily Investors Face Loan Size Cutback.”) That doesn’t sound like much, and it wouldn’t be if the price and rent fundamentals were better. However, where many deals’ finances are sometimes stressed, it takes away a significant portion of the potential profits in the current environment. And if the interest rates rise, it will become increasingly difficult.

Big Loans, Farewell

To lower their risk, banks have decreased lending due to these three factors.

It was relatively easy to obtain a permanent loan from an agency lender. It covers 75 percent to 80 percent of the value of an apartment property two or three years ago (75-80 percent LTV). Not any longer. “Today, we can get to 65-70 percent—hard it’s to get to 80 percent with a 1.25x debt service coverage ratio. The cap rates at which deals are currently trading,” says Dustin Doolin, managing director of real estate services firm JLL.

Options for Sponsorship

So, what can a sponsor do if a bank shoots him down? They could raise additional equity in the transaction to lower their LTV to a conservative 65%. However, this also reduces the investors’ return. A lower return is the ideal solution to this problem for extremely cautious investors for whom it is not a problem. In practice, few sponsors take this approach.

Part of the issue stems from their compensation. The secret of the real estate industry is that most sponsors are paid significantly more for taking on more risk than less. Therefore, many people will choose to maintain a high level of debt (75%–80%) and turn to crowdfund/syndication investors for the funding that the bank refused. Every day, more of these offers are being made available.

Alternatively, the sponsor may take 65%–70% from the bank and ask crowdfunding/syndication investors to make the difference with mezzanine (or second lien) debt. It might initially seem like a fantastic deal because it gives the investor a significantly higher return (perhaps 5 to 10 percentage points higher than primary debt). If everything goes well, it can be fantastic.

A disadvantage is that if anything goes wrong and the property must foreclose on, it has a lower priority for repayment. If the property’s value falls, the mezzanine debt is gone, and the investors lose everything. As a result, the investor is willing to take on significantly more capital stack risk in exchange for that return. Again, these deals are becoming more common.

Naturally, investors can also choose to invest in the equity component of either of the earlier types of deals. The return is typically higher to encourage investors to try these deals because there is generally more risk involved.

Is any of this appealing to an investor? It depends on the investor’s comfort level with risk and financial situation.

It’s Sale

Typically, deals like the one described above come with a pitch about how safe it is because “apartments are recession-proof” and “apartments shrugged off the last downturn with only a minor hiccup.” Or they may admit that this isn’t true for all apartments but will tell a story about how this strategy, usually class B workforce housing, isn’t affected by this. Is any of this appealing to an investor? It depends on the investor’s comfort level with risk and financial situation.

Is the data useful for marketing?

How to Fail at Financial Loss without Trying

If apartments are truly recession-resistant, there ought to be a ton of sponsors who have experienced at least one entire real estate cycle. In reality, sponsors like this are as scarce as a purple cow. (See the 2018 Top Full-Cycle Sponsors.) It is the first indication that some pitches may not fully disclose the risk.

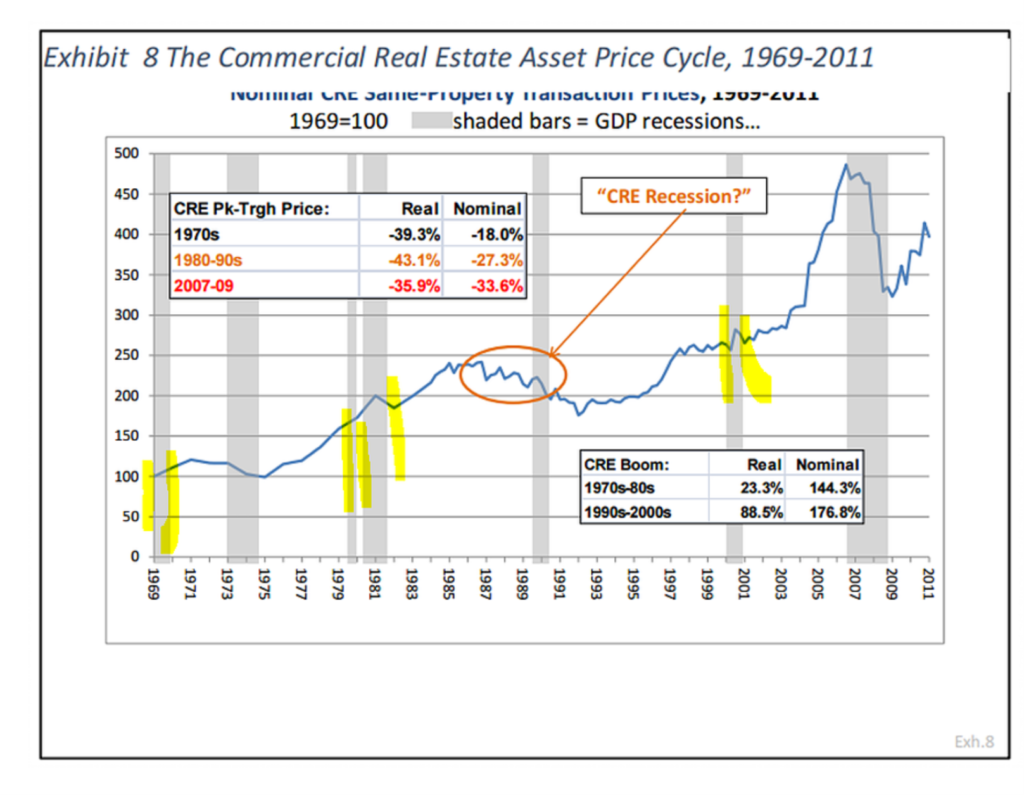

What do the numbers show? The average apartment lost 37.5 percent of its value. And it took seven long and agonizing years to recover.

I’ve heard more than one sponsor assert that their region performed better, only to have the data show otherwise. Personally, always double-check and don’t take anything at face value. Some local markets performed better, while others performed worse.

What is the significance of this? Price drops are problematic because they make it difficult to exit. (This is particularly true for investments in value-added and opportunistic strategies, which depend much more on price appreciation than the core and core-plus investments.) As a result, it needs to keep investor funds for longer than anticipated. For instance, a 3–5 year value-added flip could unintentionally lock up the investor for 11–15 years.

Even so, it is not the end of the bad news. The renewal of short-term debt financing for the property is a must to avoid loss of income. It can result in a double whammy and a challenging problem.

First, during the previous recession, many banks completely halted lending. So any investment based on that would have been doomed.

Those deals that were lucky enough to get financing but charges with high LTV loans encountered a second issue. Because prices had dropped drastically, the loan offers were much smaller than requested. They had to return to investors and ask for additional funding to prevent an implosion.

That was a challenging request to make during a recession. Most investors were hoarding their meager cash because they were themselves experiencing severe financial hardship. Furthermore, sponsors asked for a decade or more of their hard-earned money — to break even. That is a risky situation for a fund.

Playbook of Silver Linings

All of the previous are depressing. However, there is one possible very significant bright spot. Prices for commercial real estate (including apartments) do not fall in every recession. In three of the previous six recessions, prices remained stable or rose slightly. So it’s a 50/50 chance.

Therefore, there’s a chance the upcoming recession won’t happen. Be a problem, and price decreases won’t be an issue. No one can predict what will occur until it does.

How Do You Plan?

Therefore, if you’re a risk-taking investor, you might be okay with taking on the risk associated with these deals. If everything ends well, you shall receive rewards much better than if you had kept the cash.

Since I’m a cautious investor, I don’t think the risk is worthwhile. I limit myself to equity transactions with long-term debt (7 to 10 years). Doing this decreases the likelihood of having to refinance at the wrong time. In addition, I limit myself to deals with a maximum LTV of 65% to avoid a situation in which the fund forcefully raises a large sum of money from investors to avoid losing everything. (I also go with no debt on my direct-owned residential rentals to prevent these issues entirely.)

Your financial situation, goals, and risk tolerance will affect what is sensible for you.

Regarding Income

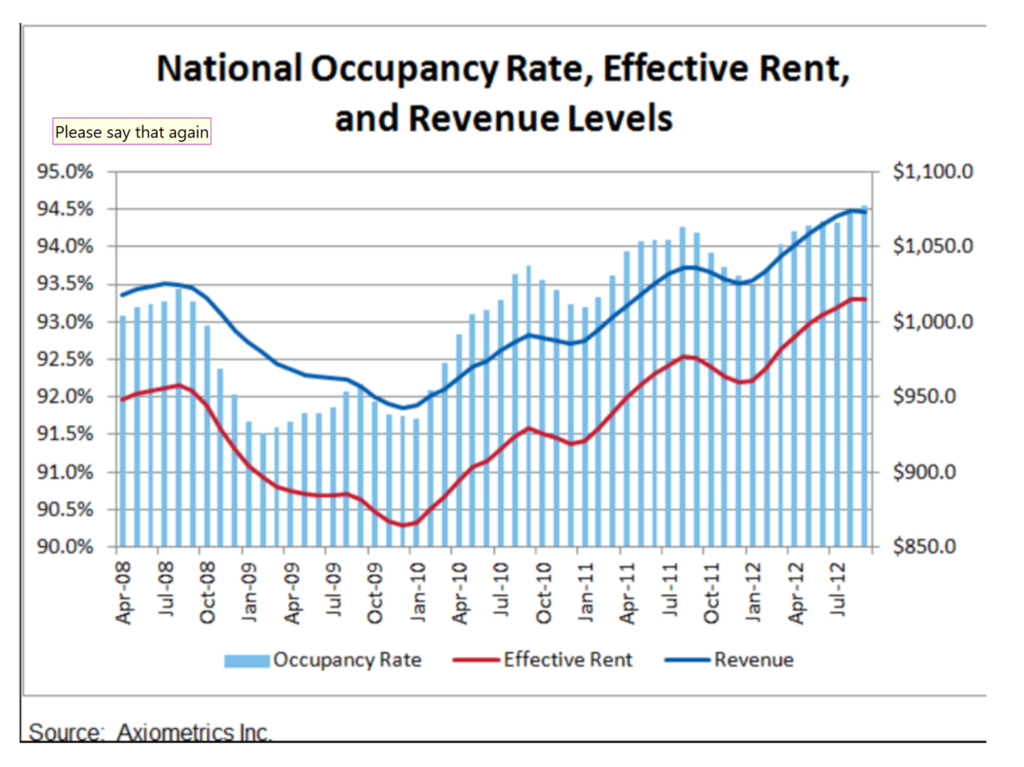

While the abovementioned issues are serious, these transactions have other concerns. Rents and occupancy, unlike prices, always fall during recessions. That could be an issue.

The average rent fell, and it took three years to recover. The openings were all the same.

If a property is barely profitable or is undergoing costly renovations, it may be impossible to repay the debt. If this occurs, the investment will fail.

As a result, it’s critical for investors to always check local statistics for worst-case scenarios before stress testing the investment to see what happens. One recession isn’t enough for conservative investors. Most of the United States was affected by the S&L crisis (also known as the “apartment recession”) in the 1990s. So, going back in time or adding more to recession stress tests is a good idea.

Class B Should Work Just Fine, Right?

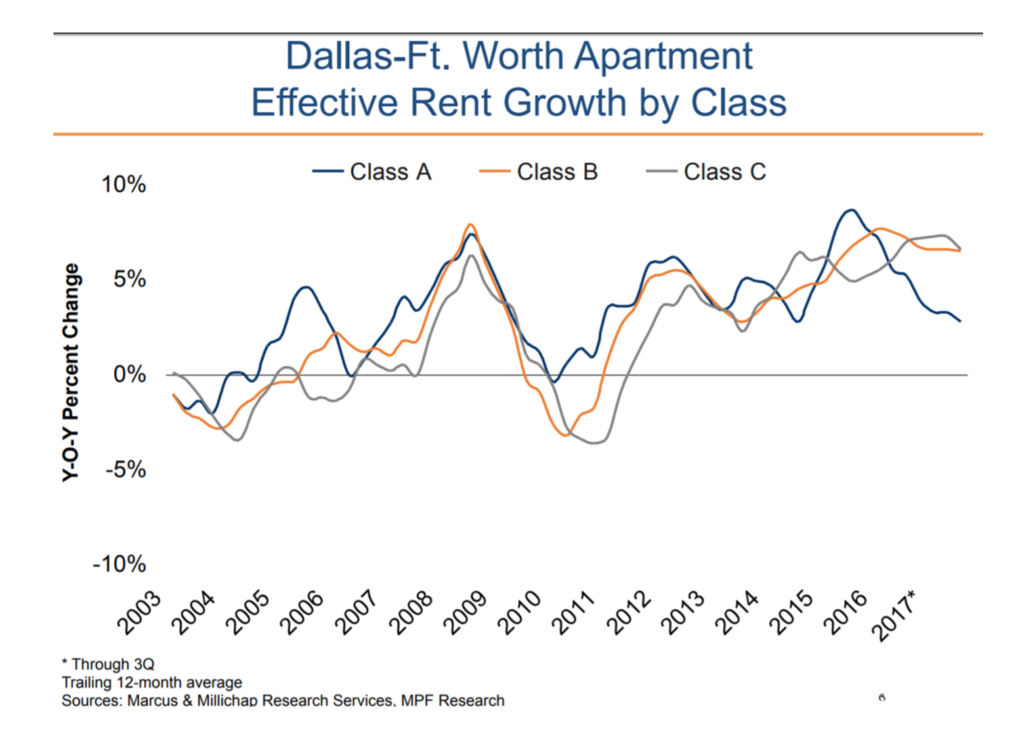

I will briefly discuss this pitch because it has gained so much traction. The sponsor declares that their apartment deal is extraordinarily recession-proof because it is in a Class B or Class C building ten or fifteen times a week. (Class A represents newer/luxury housing, Class B represents older/workforce housing, and Class C represents even more senior/”affordable housing”). They make the very valid point that there isn’t much supply because replacing such housing is too expensive. Therefore, they assert even during a recession. There will always be a high demand from those looking to rent. And this keeps them from falling.

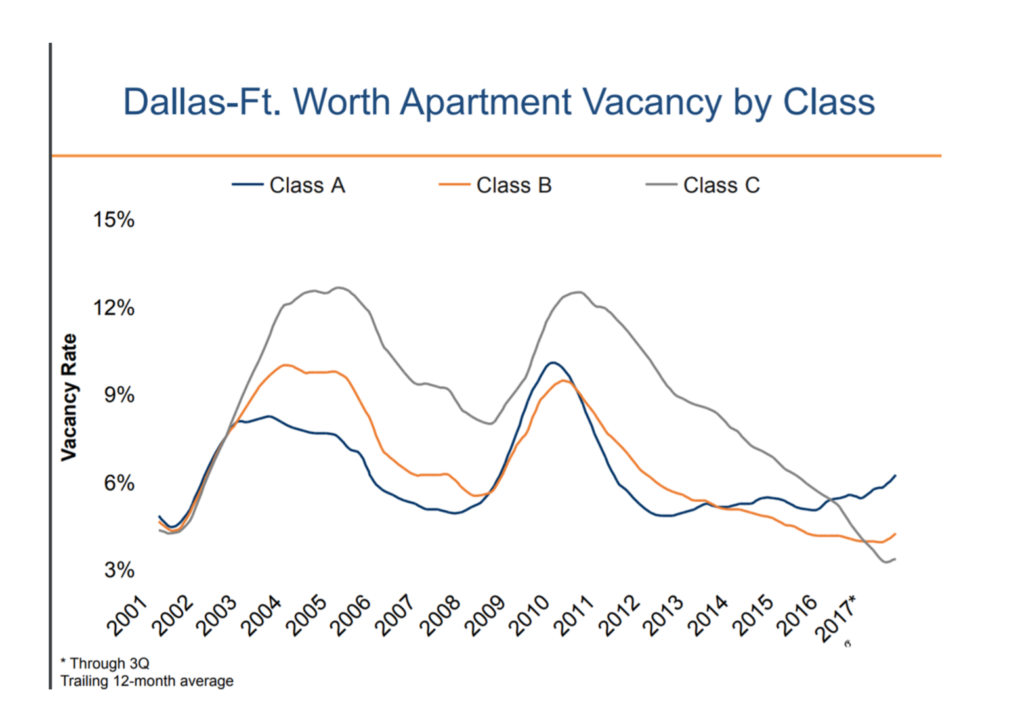

But does the evidence support this? Here’s a look at the performance of class B properties in one ostensibly recession-proof market: Dallas-Fort Worth.

An investor hoping for a recession-proof investment would have been in for a rude awakening. You can see that for three years. Class B rents suffered significantly more than class A rents (which barely went negative). Class C fared even worse. The story just wasn’t true in this case.

A Few Openings as Shown Below:

At least, in this case, class B may have outperformed class A. However, vacancies increased from 6% to over 9%. That is not recession-proof. Class C fared the worst, with an incredibly painful 12 to 13%.

To ensure that sponsor claims are accurate, I always check the actual performance in the city.

All Systems Go?

These deals might be a good fit if you’re a more daring investor. If this is the case, not all sales are created equal, and some involve more risk than others. So here are some questions to ask the sponsor pro forma to see if it’s a good fit for you. (I refer to this as “pro forma popping.”)

- Is the sponsor predicting a steady increase in rent?

Since rent increases have already begun to fall, consider putting in lower rental growth or even a decrease at some point. Is there a significant issue, or can you live with the outcome?

- Are they counting on price increases to meet projections?

What happens if prices remain stable or fall if that’s the case? Is this a significant issue, or are you okay with it?

- What action should you take if there is a downturn they can’t refinance? Can they withstand rising interest rates?

What choices do they have if they don’t owe anything for a long time? And how would you react if this happened?

A recession stress test is also something I recommend. It can be a good double-check to ensure you are comfortable with the worst-case scenario. If you don’t know how to do any of the above, joining a good investor club is a great way to learn.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.