You can buy a Real estate with an IRA. It’s simple and even offers tax benefits. But what if you don’t have enough funds in your IRA to invest? A “non-recourse loan to the IRA,” also known as non-recourse debt, is an intriguing real estate investment strategy that investors can use to fund their deals. It is a popular strategy among IRA investors.

What exactly is a non-recourse loan? A non-recourse loan is made to an IRA in which the account holder is not personally liable for loan repayment. It’s also known as “non-recourse debt” at times. It means that if the borrower does not repay the loan as agreed, the lender cannot seek repayment from the IRA account holder. They cannot, for example, garnish the account holder’s wages to repay the loan. Instead, the lender has the option to seize the asset that served as collateral for the loan. You can see why this would be appealing to IRA investors.

Because of the uniqueness of this funding, not every IRA provider, bank, lender, or real estate professional may be familiar with it. We’ve seen it all in our over 25 years of working with IRA investors and non-recourse lenders. It is how it works:

Begin your research once you’ve included a non-recourse loan in your investment strategy. If you do not have a self-directed IRA, you must look into a lender and a custodian.

Doing your research is critical when getting started because you will want to become acquainted with the process, loan-to-value (LTV) requirements, rates, terms, timing, restrictions, fees, knowledge of the area, how to calculate cash flow, and so on. But don’t worry, we’ll get to that later.

STEP ONE:

Set up and fund your SDIRA.

To qualify for a non-recourse loan, you must first have a self-directed IRA. If you do not already have a self-directed IRA, you can open one through our website. You can add retirement savings to your self-directed IRA account once it is opened.

You can add funds by transferring funds from an existing IRA or rolling over an old 401(k) (k). Please see Transfers and Rollovers in Chapter 6. To transfer other investments from your IRA, you may have to liquidate assets to make a real estate purchase. It would help you if you considered doing so before transferring the account to your self-directed IRA. A cash transfer is far more convenient.

STEP TWO:

Determine Your Strategy

You are not limited to doing only one IRA investing strategy at a time, as with all other IRA investing strategies. You can bring in a partner to make the investment if necessary. See our previous chapter on collaboration.

Assume you wanted to form an LLC to hold your self-directed IRA investment. You are capable of doing so. The LLC may have partners. Take advantage of the opportunity to structure your transactions in novel ways. Make sure you do this before applying for the loan.

STEP THREE:

Applying for the Loan

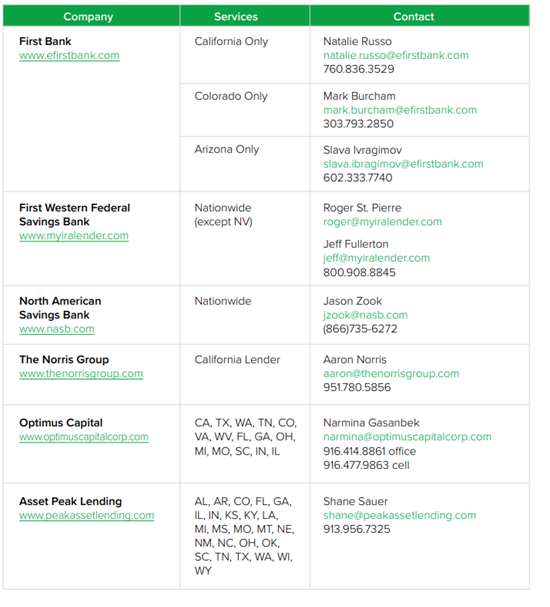

Most banks do not provide these loans, and large national banks will not even allow a real estate IRA transaction. IRA has a list of non-recourse lenders with whom we have previously worked, which you can find on our website’s non-recourse loan lenders page.

Qualifying for a non-recourse loan is not the same as qualifying for a loan to purchase a home. Non-recourse lenders do not consider your income, employment, tax returns, or other financial information. Non-recourse lenders, like commercial real estate loans, are concerned with the property, leases, cash flow, and whether or not the IRA has sufficient funds.

When you apply for the loan, you will be asked to provide IRA statements. The lender will use these statements to confirm that the IRA has sufficient funds for purchasing, closing costs, and reserves. The IRA reserve requirements vary by lender but can be up to 20% of the loan amount. These reserves are necessary if the borrower defaults and there is insufficient cash flow to cover operating expenses and mortgage payments.

Loan Terms

Loan terms can range from a three-, five-, or a ten-year adjustable-rate mortgage (ARM) to a ten-, fifteen-, twenty-, or thirty-year fixed rate loan, or even a 25-year fully amortizing loan with no prepayment penalty. Depending on the individual situation and investment, loan terms and interest rates will differ from lender to lender. These loans have higher interest rates and down payments than mortgage loans.

Requirements and Limitations

Though each lender has different requirements, some are similar. Here are some things to keep in mind regardless of which lender you choose:

• Some properties may not be eligible for a non-recourse loan, depending on the lender. It varies by lender, so check with the individual loan provider before applying.

• Not all lenders provide loans across the country. Before proceeding, ensure that your lender meets your specific requirements.

• Beyond the property price, your IRA must have enough funds to cover closing costs and reserves. The amount you must keep on hand varies depending on the lender.

• The property must have the name of the IRA, not the owner of the IRA.

• Although your credit score is not used in a non-recourse loan, you may be asked to provide personal information for yourself and your spouse.

• The property must be a profitable investment. The debt service coverage ratio, which is net operating income divided by annual debt service, must be met by properties. The property must generate a positive cash flow after “discounting” the rent for vacancies, utilities,

etc.

• The lender will request an appraisal. The appraisal must be paid for with IRA funds rather than personal funds. The IRA is responsible for all income and expenses (including inspections) during the purchase process and beyond.

• You must provide contact information for an insurance agent for the proposed property when purchasing hazard insurance, and the insurance has a title in the name of the IRA. Lenders will not accept insurance in your name.

• The lender may require that the hazard insurance “loss payee” clause be in the lender’s name.

STEP FOUR:

Closing Costs Closing costs are associated with any real estate purchase. Pay the expenses from the IRA, not your funds, so ensure you have enough cash in the IRA. You can request a cost estimate from your lender ahead of time. If you don’t have enough money in your IRA, you can contribute (if you haven’t already maxed out your contributions for the year) or transfer funds from another IRA if available.

Fees you may encounter during this process include:

• Lender Origination Fee

• Lender Underwriting Fee

• Lender Processing Fee

• Fee for Flood Certification

• Appraisal Charge

• Escrow/Settlement Fee

• Title Protection

• Fees for Recording

• Mortgage Registration Fees and Other State Fees (if applicable)

• Interest and taxes paid in advance

• The first hazard insurance premium

• If applicable, an attorney review fee

Duration of a Non-Recourse Loan

Non-recourse transactions for IRAR Trust clients are typically completed within 30 to 45 days of the lender receiving your loan application. This procedure and timetable do not apply to all IRA providers. Experience is crucial in completing your transaction on time.

Other factors to consider are the structure of your deal, the length of the negotiation period, and the experience of the IRA provider’s staff. Any of these factors can significantly speed up or slow down the transaction, and a mistake during this process can cause the purchase to be significantly delayed.

Taxes Related to Non-Recourse Loans

When using a non-recourse loan to fund your transaction, you may be subject to Unrelated Debt-Financed Income (UDFI). The UDFI tax levies any income derived from “acquisition indebtedness” in self-directed IRA investments. “Acquisition Indebtedness” refers to income from a property where debt incurs during the acquisition of the property.

COMPARISON OF SELF-DIRECTED IRA FEES AND SERVICES

IRA SELF-DIRECTED NON-RECOURSE LENDERS

The Conclusion

If you have less money to invest in real estate, you can get a non-recourse loan through your IRA. The loan is not personally liable to you. Each non-recourse lender has its lending requirements and criteria, so do your research and compare lenders.

******************************

Come join us! Email me at mark@dolphinpi.us to find out more about our next real estate investment.